Solving obsolescence a key part of the puzzle for nuclear life extensions

An increasing number of aging nuclear power plants are being cleared for long-term operations (LTOs) and original equipment manufacturers (OEMs) say solving obsolescence will be key to keeping the fleet operating.

Related Articles

Operators must be able to swap out old parts for new to keep a reactor running, but when like-for-like is unavailable, OEMs are faced with the challenge of finding an alternative while avoiding making any major changes.

“There’s a rule of thumb that if a plant has to do a design change, it’ll cost anywhere from $300,000-$500,000 just in engineering, licensing changes, drawing changes, and that doesn’t include the cost of the required equipment … so we try, wherever possible, to keep our clients from doing a design change,” says Vice President of Westinghouse Parts Business in its Operating Plant Services unit Craig Irish.

However, design changes and other innovative solutions such as additive manufacturing will be needed as an increasing number of nuclear power plant operators extend their plants’ lives from the original 40 years to 60 years or further.

Life extensions

Many of the world’s nuclear power plants having been built in the latter part of the last century and applications for long-term operations (LTOs) are becoming increasingly common.

As of the end of 2020, over 100 nuclear reactors worldwide were operating beyond their initial 40-year licensed periods, with more than 30% of the nuclear fleet operating under LTO conditions, the OECD-NEA says.

In the United States, where nuclear power has supplied 20% of electricity and is currently running 93 reactors with two new units under construction, the average age of the fleet is 41 years including three reactors that started operation 52 years ago, according to the Department of Energy (DOE).

Nine U.S. reactors have active applications with the Nuclear Regulatory Commission (NRC) to extend their lives and 10 reactors have publicly announced plans to extend their licenses to 80 years.

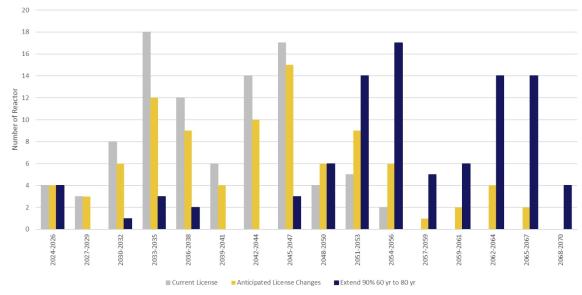

“Under current license basis 92 percent of operating reactors would shut down by 2050 and 74 percent would shut down by 2050 with anticipated license renewals. However, if 54 reactors extended operation to 80 years, only 20 percent of operating reactors would shut down by 2050,” the DOE said in its 2022 report on nuclear energy supply chains.

U.S. Nuclear Power Reactor License Expirations by Year

(Click to enlarge)

Source: U.S. Department of Energy

Obsolescence challenge

The challenge, say OEMs, is keeping a supply chain running and up to date for complex, always-on machines that were built with Reagan-era (or earlier) technology.

According to Westinghouse, a leading global parts manufacturer for power stations, approximately 35% of installed equipment in the nuclear industry is obsolete.

In fact, with construction times for some plants approaching ten years, many of the parts can be obsolete before the plant has even started generating power, according to Westinghouse’s Irish.

The high cost of design changes means that many operators, working with a plant that went online in the 1970’s, would work hard to keep it looking the same by the time it is set for decommissioning in 2030, he says.

This was especially challenging when dealing with instrumentation and control (I&C) parts which may have worked with dials and levers when the plant was built but now in many cases can be digitalized.

“They try like hell to keep plants exactly the same, with the same technology, the same parts, though obviously that’s not realistic, so operators have to introduce digital products where it makes sense,” he says.

Internationally, part of the challenge is many of the parts produced for the nuclear industry face varying specifications depending on the regulator they are working under, restricting an already tight market to national boundaries.

Such differences will become even more pronounced with the introduction of a new generation of reactors expected to begin commercial operations within the next decade, with more than 70 SMR designs under development in 18 countries.

A common approach

To meet the challenge, the nuclear industry must work along similar, if not identical, international guidelines.

The International Atomic Energy Agency (IAEA) and the OECD-NEA Nuclear Harmonization and Standardization Initiative (NHSI) was launched in 2022 to bring together policymakers, regulators, designers, vendors, and operators to develop common regulatory and industrial approaches that view nuclear as a global fleet.

“Imagine if you’re a valve supplier trying to supply a valve in the United States. It’s a different code to supplying the same valve in France,” said Chief Nuclear officer for the Electric Power Research Institute (EPRI) Neil Wilmshurst.

Wilmshurst, speaking during a Reuters Events Nuclear webinar, ‘New to the Game – A Global Growth Perspective of SMR Deployment Progress,’ noted the models in the valve example were very similar and the goal was to find some convergence on country- or region-specific codes to unlock the capabilities in the power and supply chain.

“It’s a big dream but even if a small amount of progress is made, it could be a game changer,” he said.

Finding parts

When seeking the right part for an operator, OEMs use many options including commercially available equivalent replacements, alternative supply, and reverse engineering when replacing electronics and instrumentation, says Irish.

“The biggest problem is a lot of these discrete components, resistors, diodes, transistors, capacitors, etc are either substantially changed from the 70s and 80s when we built these instruments or they’re not available or they got bought and sold by another company,” he says.

The pandemic was especially hard on nuclear supply chains, with circuit board delivery times going from a typical 10-week delivery to over a 100-week delivery in some cases.

Fortunately, Westinghouse’s boasts about $50 million worth of inventory in a facility outside Pittsburgh and, failing that, the industry’s experience of changing out obsolescent parts means it has learned to work together, even across competing power generators, to share parts and inventories.

“That’s why the capacity factors in the nuclear industry are so high, because years ago they realized that yes, they may be a competitor, but the only way the industry is going to survive is if they band together,” says Irish.

By Paul Day