Cancelled NuScale contract weighs heavy on new nuclear

The failure of a high profile small modular reactor (SMR) contract in the United States has prompted concerns that Gen IV nuclear may be further off than expected.

Related Articles

NuScale, the first new nuclear company to receive a design certificate from the Nuclear Regulatory Commission (NRC) for its 77 MW Power Module SMR, said in November it was terminating its Carbon Free Power Project (CFPP) with the Utah Associated Municipal Power Systems (UAMPS).

UAMPS serves 50 community-owned power utilities in the Western United States and the CFPP, for which the Department of Energy approved $1.35 billion over 10 years subject to appropriations, was abandoned after the project failed to attract enough subscriptions.

NuScale shares tumbled 37% to less than $2 on the day of the news, Nov. 8, though that had largely been recovered by the end of the month. The early December share price of $3.1, however, is a long way from highs of nearly $15 in August 2022 just three months after going public.

The CFPP had aimed to build NuScale SMR units at a site near Idaho Falls to be operable by 2029 though concerns arose that some at UAMPS members may be unwilling to pay for power from the project after NuScale raised the target price to $89/MWh from a previous estimate of $58 MW/h in January.

The cancellation came shortly after another advanced reactor developer, X-Energy and special purpose acquisition company Ares Acquisition Corporation, called off a $1.8-billion deal to go public citing “challenging market conditions (and) peer company trading performance.”

The work with UAMPS had helped advance NuSCale's technology to the stage of commercial deployment, President and CEO John Hopkins said.

However, the failure of the much-anticipated proof case for advanced nuclear alongside the X-Energy market retreat left many questioning whether next generation nuclear could live up to its promises.

“Almost all these kinds of MoUs and contracts, as we saw with the NuScale contract, are just not worth the paper they're written on. There are so many off ramps and outs for both sides and no one's willing to expose themselves to the downside risk of projects that go way over budget cost and take too long,” says Founder and Executive Director of The Breakthrough Institute Ted Nordhaus.

Nordhaus co-wrote a piece for The Breakthrough Institute, ‘Advanced Nuclear Energy is in Trouble’, a scathing criticism of policy efforts to commercialize advanced nuclear which, it says, to date have been entirely insufficient.

The nuclear industry was keen to ‘whistle past the graveyard’ of recent developments and efforts to commercialize the new generation of reactors ‘are simply not on track’, the Breakthrough piece said.

Mounting challenges

There are five areas that pose mounting challenges for the industry, according to Breakthrough; high interest rates and commodity prices, constrained supply chains, a regulatory regime that penalizes innovation, project costs versus system costs, and fuel production.

High interest rate and commodity costs in the last couple of years have hit the industry especially hard due to long project lead times. Nuclear supply chains struggle to rebuild as tight regulation forces many materials to be tracked from certified mine to certified manufacturer.

The regulatory regime, meanwhile, continues to cut and paste large nuclear reactor regulations on to the small reactor designs, whether it makes sense to do so or not, Nordhaus wrote.

Project costs, which are low for small nuclear due to the relatively small volumes of steel and mortar needed, don’t reflect system costs, since nuclear must prove their products are safe - more so, they argue, than any other energy project - while competing with fossil fuels and renewables, which pay little to no cost for polluting or intermittency, the Institute says.

Advanced nuclear fuel production, meanwhile, had been outsourced to the Russians for decades and is only now being hastily reassembled in the United States for the new reactors, with developers such as Terrapower forced to push delay their commercialization timelines due to a lack of fuel.

“Taken together, these developments suggest that current efforts are unlikely to be sufficient to deliver on the promise of advanced nuclear energy,” The Breakthrough Institute said.

Investor case

Over recent years, nuclear power has been recognized as an environmental, social, and governance (ESG) investible asset, taking its place alongside renewables in the European taxonomy and successfully raising cash through green bonds in Canada.

Such classifications allow nuclear companies to attract funds from investors looking to build increasingly popular clean energy portfolios.

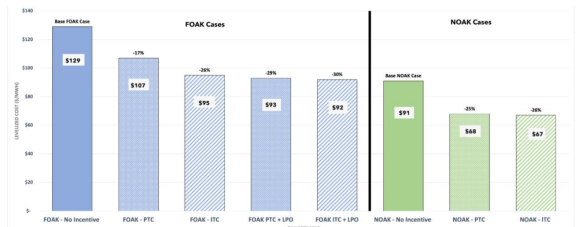

Nuclear will also benefit from government schemes such as the U.S. Inflation Reduction Act (IRA), which alone is expected subsidize new nuclear through Production Tax Credits (PTC) and Investment Tax Credits (ITC) on first-of-a-kind (FOAK) and nth-of-a-kind (NOAK) builds.

Summary of PTC and ITC effects on New Nuclear Cost

(Click to enlarge)

Source: Nuclear Innovation Alliance 'Implications of Inflation Reduction Act Tax Credits for Advanced Nuclear Energy'.

With billions of dollars earmarked for clean technologies and mounting concerns over missing emission targets, certain aspects of the nuclear industry have attracted new investors; Uranium spot prices have nearly doubled in the last year as bets are made on rising demand.

However, with all this tailwind, new nuclear has not been attracting the cash it needs. That’s partly due to developers’ lack of focus on development activities, according to Fiona Reilly, CEO of energy consultancy FiRe Energy.

“They're so focused on the technology that they're often not focusing on the commercial aspect. How to be more efficient, how to be more effective. What's your risk register look like; corporate risks as well as technical risks? What's your legal structure? Where is the money coming from?” says Reilly.

“They seem to think that if they have this great technology, then the market will finance the projects. How the project will reach financial close and make a return for investors does not always appear to be a key feature."

The NuScale failure with UAMPS and X-Energy’s cancelled offering are just further bad signs for the market, especially when, at the same time these projects are announcing problems, the international nuclear community is in Dubai during COP28 saying they need to triple capacity by 2050.

“We've got to start building a mix of large and small reactors for different applications and, once we can start proving projects can be built in a commercial and efficient way, then you can start talking about targets,” says Reilly.

“You can't set targets like these when we're not even building the first reactors in many countries.”

By Paul Day