6 Trends: 2020 will travel, but will travel differently

Nobody is suggesting that a sugarcoated pill will deliver the travel and hospitality industries from pain but trends are emerging and with them opportunities

As lockdown restrictions lift, leisure travellers are tentatively looking to book, according to recent consumer surveys, but they are looking to book differently.

For example, a survey by IPSOS, on behalf of the Europ Assistance Group, asked 11,000 travellers from 11 countries around the world about their post-Covid-19 travel plans and preferences for the rest of this year. An overwhelming 81% said they would be taking a holiday this year. However, while consumers will travel in 2020, they are looking to travel differently.

1. Staycations are on the rise

Airbnb’s vision of a world where you can ‘belong anywhere’ to one where ‘you don’t have to go far to find what matters’ sums up the status quo and is backed by its own data. On July 8 Airbnb booked a million future stays globally for the first time since March 3rd and of those 50% were to places within 300 miles.

The point is echoed by IPSOS, which finds that 60% of travellers are planning domestic travel this summer but for 2021 that falls to 39%.

However, international travel is a write-off for most people this summer with just 6% of those surveyed looking to travel abroad, if indeed their governments allow it. However, that more than doubles to 14% by the autumn and winter. Some travellers are more intrepid than others; for example 35% of UK visitors are considering an EU break and 15% are looking further afield. Increasingly, this becoming easier as borders open. In Europe in mid-July, for example, the European Council announced further easing of restrictions on non-essential travel.

2. Cities and airports suffer as travellers choose remote retreats and roadtrips

Globally, a report from the UK Hospitality, the leading trade association for the hospitality sector, and CGA, an international data and insight consultancy, find that 75% of UK hospitality leaders expect consumers to be reluctant to visit city and town centres, and this seems to be borne out by where people are venturing.

In the UK, for example, online booked local staycations in cottages, camps and parks are up 127% on pre-pandemic levels, according to real-time personalisation and optimisation platform Fresh Relevance, which counts Cottages.com, Contiki, Hoseasons and Hays Travel as customers.

Meanwhile, in the US, visits to national parks are climbing and two-thirds are visitors from out of town, with over half journeying from over 200 miles way, according to a new tracker from the US Travel Association.

Globally it is a similar story with Airbnb reporting that two in three bookers are choosing rural (which have risen by 25% on the previous year) over urban breaks.

When it comes to transportation, the IPSOS survey finds that 74% of people are planning to drive versus just 20% who said they would fly. Cementing this point is data from the US Transportation Security Administration (TSA) which screened just 441,255 passengers at US airports on June 7, 2020 compared with over 2.5-million a year ago.

3. Hotels and holiday homes battle it out

In the early stages of the pandemic there was a view that hotels may have the edge on vacation rentals with hygiene and social distancing policies. In the UK, hotels remain the number one choice for 40% of travellers, followed by 31% who said they would choose a holiday home.

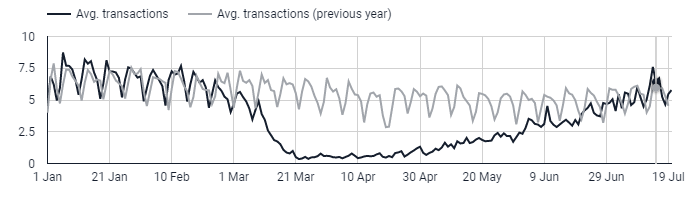

In Europe, there are hopeful signs. While year-to-date hotel bookings are down by 36.7% on the previous year, according to a live COVID tracker from Hotel Benchmark, a community of 500 hotels in 50 countries across Europe, things are improving. In the past 30 days transactions are down just 5.6% on the comparable period, and in the past week they are actually up by 7%!

In the US, STR data shows that US hotel transactions are still down 43.2% on the year. But at the end of May hotel occupancy was 36.6%, and this marked the seventh consecutive week of higher demand since April. However, there is a hard slog ahead with the latest forecast revision from STR and Tourism Economics suggesting that US hotel demand will not return completely to pre-pandemic levels until 2023. This glum view is echoed by how investors are responding to hotel company prospects and the under performance, in particular, of US lodging real estate investment trusts (REITs).

While battle continues, there is more hopeful news, although probably not what hotels want to hear, in the vacation rentals space. Airbnb’s US bookings have been particularly robust, according to Bloomberg which reports that between May 17 and June 3 more nights were booked for US listings than the same period in 2019. Expedia’s Vrbo and Booking Holdings are also seeing domestic vacation-rental reservations rise.

However, for medium to longer-term bookings, hotels may still have an edge by offering full refunds on everything but the lowest rates. In the two-sided market place of vacation rentals, where the intermediary must keep both host and renters happy, it is a little more complicated.

4. Health and hygiene is a prerequisite but brands must go further

For a majority of people looking to travel, the expectation is that brands prioritize their customers’ health and maintain high levels of hygiene. Outlining the challenge UK Hospitality and CGA, finds that 23% of UK consumers will return to hospitality venues with caution, and a third will only do so if there are added precautions are in place.

An indicator of the value people attach to their health is demand for travel insurance, according to IPSOS. In the UK, 74% of travellers plan to purchase travel insurance in the future while 97% want to be covered for emergency medical & hospital expenses.

Another impact of the pandemic is that people are placing greater value on healthy options, be this food or lifestyle. In China, 40% of travellers are factoring this in when they choose a place to visit versus just 29% pre-lock down. Similarly, in the UK, CGA’s BrandTrack survey of 5,000 consumers found that 70% are proactively trying to lead a healthier lifestyle, which “will have long-term implications for businesses right across the hospitality sector”.

However, consultants McKinsey warn that a focus on health and hygiene only scratches the surface of the changes that are necessary. It suggest that “brands might differentiate themselves and re-engage their travelers with visible, communications-based cues—such as notifications about the health status of the destination city and personalized notes about the importance of testing and other safety measures.”

A reminder from Laura Lo Mascolo, the CEO Interlude Hotels, a small Italian chain, who was recently interviewed by Reuters Events Travel, and says: “Every guest will request a security and clean protocol, but nobody on holiday wants to feel like they are living in a hospital.”

5. Economy rules

In 2020, the only certainty is uncertainty, and travellers are taking it day by day. As the world faces a global recession, its citizens are looking to converse cash. An indication of this is that at Airbnb, over half of the million bookings made on July 8 were for less than $100 a night.

Meanwhile, in the hotel space, according to McKinsey, data shows that in early May occupancy was under 15% for luxury versus 40% for economy, a trend that is expected to continue. Pointing to how this is influencing the moves of international hotel companies, negotiations are currently underway with the leading ownership group of Travelodge, a UK-based economy chain.As part of a rent reduction deal with landlords negotiated by an owners action group, hotels now have an opportunity to fly a different flag and IHG, Magnuson Hotels, Marriott, and Oyo are among the brands said to be lining up.

6. Customer experience remains the true differentiator

Even before the pandemic, the customer experience had emerged as the most important competitive differentiator for travel and hospitality brands.

And as McKinsey notes, the shift to a more digital and personalized journey, and an increased emphasis on wellness and sustainability—have not gone away. If anything they have accelerated, and brands that wish to emerge stronger from this pandemic should do the same. There will be opportunities on the other side – as the Europ Assistance