Giant turbines position onshore wind at UK grid parity

Larger turbine dimensions are driving down costs and outweighing rising cost pressures from the UK energy transition, experts told Reuters Events.

Related Articles

Last month, developer Energiekontor signed a 50 MW turbine contract with Siemens Gamesa that brings its latest giant turbines into the UK onshore wind market.

The eight turbines destined for the Longhill Burn project in central Scotland will each have a capacity of up to 6.6 MW and a rotor diameter of 155 metres. Siemens Gamesa has signed similar deals for its large-scale model in Finland, Sweden and Brazil, for a global capacity of over 2 GW.

The UK contract comes as onshore wind developers prepare to bid for contract for different (CFD) subsidies for the first time since 2015. The UK's Round 4 auction later this year will see developers compete against solar projects for 15 years of guaranteed revenue at an agreed strike price.

Wind power costs have plummeted since 2015 as developers use growing turbine capacities and operations and maintenance (O&M) gains to lower costs. These savings look set to outweigh rising regulatory costs for UK developers as the grid accommodates rising wind and solar capacity.

The Longhill Burn project has already secured long-term power purchase agreements (PPAs) and will operate without subsidies, Siemens Gamesa said, highlighting the impact of technology gains.

In the upcoming auction, onshore wind prices are "expected to be low and on a par with the market energy price," Graham Rice, Head of Onshore Sales UK at Siemens Gamesa, said.

Big wins

Larger wind turbines are driving down the levelised cost of energy (LCOE) by maximising the use of wind resources and reducing installation and maintenance costs per unit of output.

Wind experts predict the global average capacity of onshore turbines will rise from 2.5 MW in 2019 to 5.5 MW in 2035 and project costs will fall by around a quarter.

The latest turbines are also expected to operate for longer than earlier models and include a number of control and monitoring features that minimise energy losses and downtime.

"Through small optimisations and innovations over a large number of areas, Siemens Gamesa aims to apply further downward pressure on the LCOE,” Rice said.

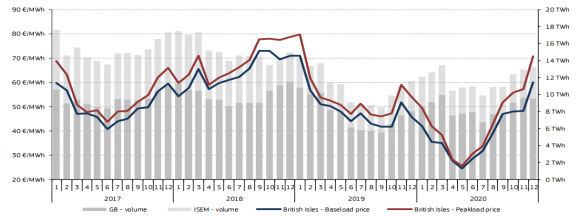

UK monthly average day-ahead power prices

(Click image to enlarge)

Source: European Commission's Quarterly Electricity Market Report

Large-scale turbines give developers a competitive edge when competing in subsidy auctions and for corporate offtake contracts.

In the UK, tip heights of 180m-250m and capacity around 6 MW and above are typically required for projects to be viable, Rice said.

“Most new planning applications for wind farms are targeting this range,” he said.

Price risks

Some costs have increased since 2015 and onshore wind developers will need to absorb these in their bids.

Supply chain uncertainty due to COVID-19 has increased steel and transport costs, Rice noted.

“We expect these costs to fall again when supply and demand are re-balanced as we emerge from the effects of the pandemic”, he said.

Larger turbine dimensions increase transportation challenges, and the prospect of local opposition, limiting the number of sites available to developers.

Rising transmission charges are also an issue, particularly in Northern Scotland, an area with strong wind resources and low population density.

Annual transmission network use of system (TNUoS) costs for a typical 40 MW onshore wind site in Northern Scotland will rise from 460,000 pounds ($642,467) in 2016-17 to 1.28 million pounds by 2025-26, analysts at Cornwall Insight said in a research note.

The Round 4 auction terms provide greater flexibility on construction and delivery than in previous rounds, but developers must accommodate more stringent payment terms that reduce income during times of negative wholesale prices, James Brabben, Wholesale Manager at Cornwall Insight, told Reuters Events.

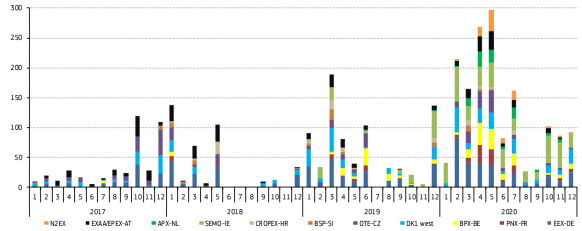

Negative pricing is a growing concern across Europe as more wind and solar capacity comes online and consumption patterns change.

Number of negative hourly power prices on selected platforms in Europe

(Click image to enlarge)

Source: European Commission's Quarterly Electricity Market Report

“These [Round 4 auction] terms could impact total CFD payments over the lifetime of the projects if negative prices become a more common occurrence in the 2020s," Brabben said.

Reporting by Neil Ford

Editing by Robin Sayles