Spain's record wind prices fail to curb the rise of solar

Spain secured Europe’s lowest wind prices in its latest power auction but solar developers claimed all technology-neutral capacity, pushing Spain off its course towards a balanced renewables mix.

Related Articles

Spain's latest power auction - its first since 2017 - has revealed the sharp cost reductions in renewable energy in recent years and the shifting cost dynamics between wind and solar.

Wind developers secured 1 GW of projects at an average price of 25.31 euros/MWh ($30.5/MWh), Spain’s government announced in January. Enerfin secured two 10 MW projects at a price of 20 euros/MWh, the lowest wind price ever recorded in Europe, industry group WindEurope said.

Wind power costs are estimated to have fallen by 10 to 20% since the 2017 auction, Heikki Willstedt, Climate Change and Energy Policy Director at Spanish wind energy association AEE, told Reuters Events. Spain has improved its auction terms, making like-for-like price comparisons difficult.

“Turbine prices have fallen and OPEX costs have been reduced on the technological side," Willstedt said. "On the financial side, capital costs have also come down and capital is more readily available."

The auction also revealed the competitive threat from solar power. Solar developers claimed all of the 1 GW of capacity available in a technology-neutral pot, on top of 1 GW set aside for solar projects. Solar capacity was allocated at an average 25.31 euros/MWh but the lowest price was 14.89 euros/MWh, far lower than wind.

Solar costs are falling faster than wind costs and while improvements to wind turbines have opened up new opportunities, land availability is a growing challenge.

Spain's best wind sites have already been claimed but "solar is still underdeveloped and with good resource in almost all of Spain,” Alenjandro Labanda, Regulation and Studies Director at PV industry body UNEF, said.

Wind savings

Under its latest National Energy and Climate Plan (NECP), Spain plans to build 28 GW of new wind capacity and around 30 GW of PV by 2030, through annual auctions held over the next five years.

Spain's power generation mix in 2020

(Total volume: 250.4 TWh in 2020, 260.8 TWh in 2019)

Source: Spanish grid operator Red Electrica

The global rollout of competitive auctions and the gradual removal of subsidies have spurred cost reductions along the wind value chain.

Wind developers have used rising turbine capacities and economies of scale to drive down capex costs. Operational learnings and data analytics have lowered operations and maintenance (O&M) costs. The cost of capital has also fallen as demand for renewables rises and investor confidence grows.

Renewables developer Capital Energy secured the most capacity in Spain's auction, snapping up 620 MW through 12 projects. The large portfolio gave Capital Energy some "flexibility" when structuring its risk coverage, a company spokesperson told Reuters Events.

Spain's switch to a contract for difference (CfD) auction model also boosted investor confidence.

"CfD auctions deliver the lowest prices for renewables because they minimise the financing costs,” Giles Dickson, CEO of WindEurope, said in a statement.

Spain's switch to CfDs made it easier for developers to build a business case for their projects, Willstedt said. The 12-year CfD duration is shorter than in many other CfD mechanisms, which makes the price assumptions of potential commercial power purchase agreements (PPAs) and merchant income critical to the bid price.

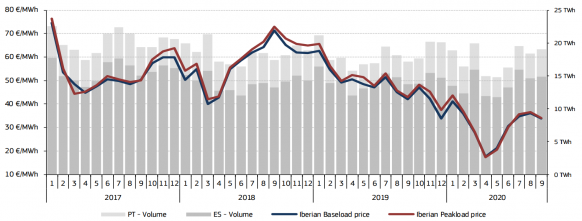

Wholesale power prices in Spain, Portugal

(Click image to enlarge)

Source: European Commission's quarterly electricity market report.

Data source Platts, OMEL.

The CfD price applies for 26.4 GWh per year per installed MW and developers can build more capacity than awarded. Some developers have indicated they will do this, Willstedt said.

An oversized project can be split into a CfD section and a commercial section tied to commercial PPAs, or be used to fulfil CfD volume requirements and exit the system before the 12-year period ends, Willstedt said.

Solar surge

Following years of improvements and savings, the reduction in wind costs is slowing and developers face increasing competition in countries with strong solar resources.

US solar costs fell by 9% last year while wind costs fell 2%, Lazard consultancy said in its latest annual levelised cost of energy (LCOE) report. US corporate demand for solar is expected to far exceed demand for wind this decade and the Energy Information Administration (EIA) predicts solar power will account for 80% of the growth in US renewable energy generation between 2024 and 2050.

Vestas, the world's leading turbine supplier, recently acquired 25% of renewables investor Copenhagen Infrastructure Partners (CIP) in a move which widens its role in offshore wind and solar and expands its long-term income potential.

Spain plans to repeat the three pot auction system for wind, solar and competing technologies in the next annual auctions. If solar continues to beat wind to technology-neutral capacity, solar will expand far faster than wind and AEE and WindEurope have called for solar and wind projects to compete separately.

It is virtually impossible to design an auction that does not favour one technology, due to different production profiles, Willstedt said. For example, wind operators can supply power during high demand periods after sundown.

"It would be better for the power system and the economy in general if both technologies are developed in accordance with the objectives of the NECP, as both technologies are needed in a certain proportion," he said. “Thus the auctions should be separated.”

Reporting by Neil Ford

Editing by Robin Sayles