US turbine output drops 3.6% at PTC expiry as owners revalue repairs

US wind operators are cutting back on maintenance spending after production tax credits expire, underlining a growing confidence in component reliability.

Related Articles

A new study of the US wind fleet has shown how federal production tax credits (PTCs) have driven different maintenance strategies to Europe.

Lawrence Berkeley National laboratory (Berkeley lab) analyzed generation records from 917 US wind farms and published their findings in the journal Joule.

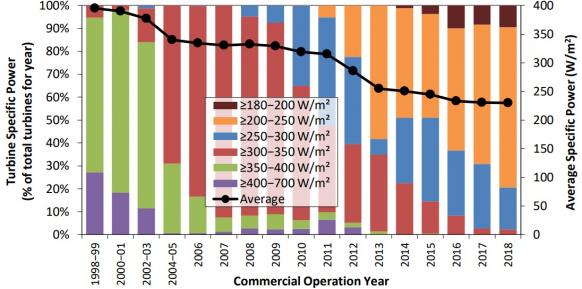

For the first 10 years of operations, turbine performance fell by 0.53% per year for older turbines, and by 0.17%/yr for newer turbines. This decline was at the lower end of the range found in Europe and highlights how turbine advancements and improving maintenance practices have boosted performance and extended lifespans.

However, the study also found a sudden drop-off in US turbine performance after 10 years, when PTCs expire. Turbine performance drops by 3.6% between years 10 and 11, reducing average capacity factors by 1.5 percentage points to 30%, it said.

For a 100 MW windfarm with a $50/MWh power purchase agreement (PPA), this equates to a drop in revenue of $500,000/year.

US turbine performance by age (indexed)

Source: Lawrence Berkeley National Laboratory (2020)

"The reason the capacity factor declines is to save on maintenance costs,” Ryan Wiser, Senior Scientist at Berkeley Lab and co-author of the report, told New Energy Update.

“Operators are making cost trade-offs, and presumably the cost savings outweigh these revenue reductions," he said.

The drop in US maintenance spending around year 10 highlights a growing confidence in turbine management and component reliability.

Key components often require repairs or replacements around this time and many operators plan to extend lifespans beyond manufacturer specifications.

Spending shift

The $23/MWh PTC has been steadily phased out since 2016 and ends this year. Projects starting construction in 2020 will be eligible for 40% of the credit.

The drop in performance at year 10 may be due to operators deferring preventative maintenance just ahead of PTC expiry, Wiser said. Operators are also more likely to seek lower costs for specific maintenance activities, for example hiring cranes during lower cost periods or seeking spare parts and logistics savings.

These decisions can have short and long-term implications. Preventative maintenance helps operators control costs and avoid critical component failure.

Importantly, key drivetrain components such as gearboxes must be refurbished or replaced around this time. A quarter of turbine gearboxes and generators need replacement within ten years of operation, IHS Markit said in a 2018 report.

Some blade replacement or repair may also be needed, particularly for older turbines, Wiser said.

Wear and tear of gearbox and generator components is likely the main driver behind lower performance in the 10 to 15 year period, Will Hayes, Senior Asset Manager at German wind operator BayWa r.e, said.

BayWa r.e operates 300 MW of wind capacity in the US and its oldest turbines have been operating for nine years.

BayWa r.e. does not plan a major change in maintenance practices for ageing turbines, but it will review whether more cost-effective methods are available, Hayes said.

O&M offers

O&M market competition has soared as operators seek new ways to lower costs in increasingly competitive power markets. Turbine suppliers, independent service providers (ISPs) and larger operators are offering an increasing range of O&M products to gain a share in this growing market. U.S. annual wind O&M spending is set to rise by 50% by 2030, to $7.5 billion, following a surge in installations in the next few years to meet tax credit deadlines, IHS Markit said last year.

“As the [wind farm] gets later in life and post PTC, lower cost alternative maintenance providers, whether ISP or OEMs determine a way to reduce their pricing to ensure that the cost of energy goes down relative to the revenue," Hayes said.

As operators seek greater value, turbine service availability contracts have shifted from time-based arrangements to production-based contracts.

Going forward, increasing exposure to wholesale price risks will lead to more market revenue-based terms.

Larger turbines

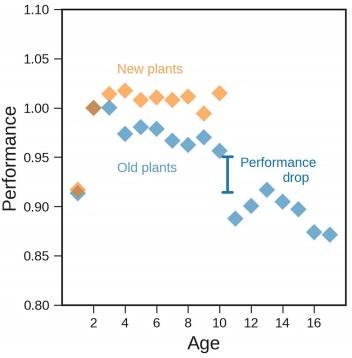

Growing turbine capacities have been a key driver of lower wind power costs, boosting output and reducing O&M costs. Some operators are choosing to repower turbines at around 10 years to benefit from the latest advances.

Larger units reduce the required number of turbines, but reliability has also improved.

Developers are installing larger rotor turbines relative to nameplate capacity to achieve higher capacity factors. Combined with improved components, this has slowed performance declines, Wiser said.

"A wind turbine running at rated capacity does not experience aerodynamic losses because, by definition, it is running max out. So this too has the effect of reducing the influence of degradation over time,” he said.

US turbine specific power by installation year

(Click image to enlarge)

Source: US Department of Energy's 2018 Wind Technologies Market Report

At the same time, larger turbines have placed greater loads on other components, such as those in the drivetrain.

A growing understanding of loads and improvements in modelling accuracy are helping component manufacturers keep up with growing turbine capacities.

Longer lifespans

Intense price competition is increasing the importance of asset performance and component degradation.

Many operators are securing low PPA prices and assuming longer turbine lifespans to claw back revenues after long-term contracts expire. Any shift in maintenance strategy will require careful cost analysis to avoid long term issues that impact life expectations.

When the PTC system ends, US turbine performance is likely to decline at a smoother rate around the 10-year period, Wiser said.

“Without the PTC the annual operating profit of most projects would not change as abruptly post year 10...So we would expect some performance reduction, but likely a smoother pattern,” he said.

Reporting by Neil Ford

Editing by Robin Sayles