Made in America tax credits allow for some imports; France to offer 40% tax credit

The solar news you need to know.

Related Articles

US domestic content bonus allows for component imports

Solar developers in the United States will be eligible for domestic content tax credits under the 2022 Inflation Reduction Act even if some component parts are made entirely with Chinese materials, under guidelines set out by the Treasury Department on May 12.

The inflation act offers solar and wind developers a 30% tax credit and a bonus of 10% for using American-made content. The Biden administration wants to expand domestic manufacturing capacity to reduce the country's reliance on imports from Asia. The U.S. had only 8 GW/year of module production capacity at the end of 2022 and must install over 60 GW/year of solar from the middle of the decade to achieve President’s Biden’s climate goals.

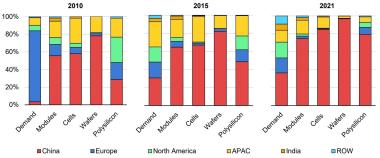

Solar manufacturing capacity by country, region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

The inflation act has spurred flurry of announcements in new U.S. module manufacturing facilities, but upstream activities including wafer, ingot and cell manufacturing, will take time to build out and companies will depend on imports from Asia.

To gain the bonus, 40% of components in modules, trackers and inverters must be made in America, allowing companies to import some component parts, the Treasury's guidelines show.

The inflation act has spurred developers to invest in U.S. module factories for the first time, highlighting the thirst for domestic content. Developers are looking to reduce delivery and cost risks, worsened by recent customs delays and uncertainty over import tariffs.

In a key move, U.S. developer Invenergy has partnered with China's Longi to build the U.S.' largest solar panel factory. Invenergy will be the majority owner and anchor customer of the facility, purchasing 40% of all output, a company spokesperson told Reuters Events last month.

France to offer solar, wind tax credit up to 40%

France will offer a tax credit of 25 to 40% to solar and wind projects, batteries and heat pumps, under a new green industry bill designed to compete with the U.S. Inflation Reduction Act, President Emmanuel Macron said on May 11.

The government plans to budget 500 million euros ($543 million) annually for the new tax credit, which will be included in the 2024 budget law, Finance Minister Bruno Le Maire said on May 16.

The new tax credits are expected to generate 23 billion euros of private sector investment by 2030 and directly create 40,000 jobs, Le Maire's ministry said. The green industry bill also includes measures to halve the approval time for new factories to nine months and make 2,000 hectares (4,900 acres) available for new industrial sites.

Macron's announcement follows a loosening of European Union state aid rules that will enable companies to receive as much funding as U.S. green subsidies. Until the end of 2025, EU member states will be able to provide funding to companies that matches the level offered in other locations, or sufficient funding to persuade the company to invest in Europe, the European Commission (EC) said. National governments will also be allowed to provide more types of support to renewable energy projects.

President Biden's 2022 Inflation Reduction Act provides $369 billion of green subsidies, including a 30% tax credit for solar and wind facilities that can be increased by 10% by using domestic content.

The EC has also proposed a new Net Zero Industry Act that sets a target of 40% of renewable energy components from EU factories by 2030 and domestic content rules in renewable energy tenders that favour EU products.

The rules form part of the EC's Green Deal Industrial Plan to mobilise state aid and EU funding for clean technology companies and accelerate the construction of new manufacturing facilities.

The EU has also agreed emergency regulations that speed up solar and wind permitting and laid out draft market reforms that aim to protect consumers against volatile wholesale prices and make it easier for all business customers to sign long-term power purchase agreements (PPAs) with generators.

Texas set to hit record power demand, drawing on renewables

Texas power demand is forecast to peak at 82.7 GW during hot weather this summer, exceeding last year's record and requiring renewable energy supplies to minimise disruption, the Electric Reliability Council of Texas (ERCOT) said.

Texas is the fastest growing solar market in the U.S. and operates the largest wind power fleet, accounting for 26% of total U.S. wind generation last year. Battery storage is also on the rise, spurred by a growing need for dispatchable power and new tax credits in the 2022 Inflation Reduction Act.

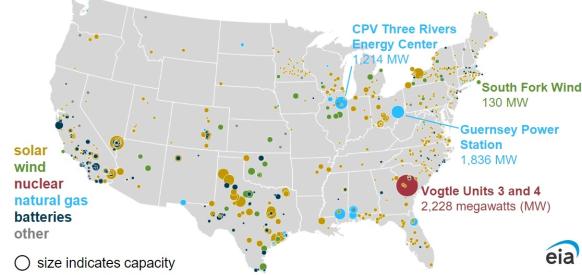

Planned U.S. power plant installations in 2023

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA), February 2023

ERCOT estimates there will be 97 GW of power capacity available in Texas this summer but some of this will be intermittent solar and wind capacity. This total also includes 688 MW of planned thermal resources and 372 MW of planned solar resources that are forecast to be connected by July.

ERCOT adjusted its peak load forecast this year to incorporate new solar rooftop systems representing 432 MW, as well as increased power demand from large consumers, such as crypto-mining facilities, which could demand 1.1 GW of additional energy.

Reuters Events