Hydrogen investments seen ramping up after slow start

Investments in the hydrogen industry are seen accelerating before the end of the decade, but only once challenges are addressed.

Related Articles

The need to decarbonize and increase energy security are driving the industry’s creation, however several unknowns will continue to weigh heavily on wide adoption of clean hydrogen in the short- and medium-term.

If all announced projects are realized, clean hydrogen production could reach 38 million tons (Mt) a year by 2030, according to the International Energy Agency’s (IEA’s) Global Hydrogen Review 2023, a forecast rised 50% higher than a year earlier.

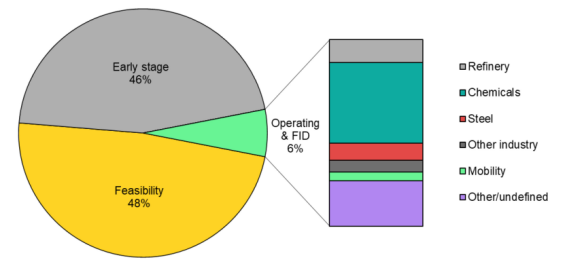

However, uncertainties at every level of the new industry mean only 4% of this potential production has reached FID, says the IEA.

Low-emission hydrogen production by status and by sector based on announced projects, 2030

Notes: FID = Final investment decision. “Operating & FID” includes projects that are operating and that have reached at least FID, therefore projects under construction are also included; “Feasibility” includes projects undergoing a feasibility study; “Early stage” includes projects at very early stages, such as those in which only a co-operation agreement among stakeholders has been announced. “Other/undefined” includes projects for which the use has not been specified, and other hydrogen uses.

Source: International Energy Agency (IEA) Global Hydrogen Review 2023

Imbalances and unclear definitions

Some of those uncertainties include imbalances between electrolyzer capacity and off taker needs, size and allocation of government subsidies, confusion over globally-recognized definitions of what is clean and what is not clean hydrogen, overall price instability, technological development, and China’s outsized role worldwide.

Supply chains must be created and reinforced, storage facilities need to be established, and electricity and water infrastructure must be strengthened or built from scratch.

Until these matters are addressed, clean hydrogen will remain a niche fuel with little to no impact on the energy transition, say analysts and consultants.

“Over the next couple of years, we will see a lot of things shake out – it won’t suddenly turn into a fully mature market with trading, long distance shipping, and all of the other stabilizing factors you need to get a really global industry,” says David Hart, Global Hydrogen Lead at sustainability consultancy ERM.

“I think during that period, some of the froth will come out.”

Several opportunistic project developers with no funding pathways are likely to fall away as, Hart says, we are currently in “the Darwinian market evolution phase,” where only the fittest survive.

The change in expectations from the hype and barrage of strategies from companies and countries just a couple of years ago to the more sober realization that the whole process may take a while has been reflected in electrolyzer manufacturers’ share prices.

Leading electrolyzer producers have been hammered on the markets over the last few months as expectations for the industry change; Bloom Energy has seen its share price slide to $9.97 as of April 16 from a high of $41.48 in February 2021, while Norway’s Nel dropped to 5.05 Krona ($0.46) from a high of 426.63 Krona in January 2000.

Similar patterns can be seen for Plug Power, Enapter, and ITM Power.

Supply and Demand

In many countries, there has been a focus on building out the production side of the clean hydrogen equation, with promised subsidies for clean hydrogen hubs and tax credits that increase in line with how little CO2 is emitted in the process.

Establishing this base, even with all the good will and government subsidies in the world, will take time amid the rapidly evolving clean hydrogen landscape.

Hart sees lead times between ordering an electrolyzer for a project and installing it at around 18 months to two years (half that when the technology is from China), and a lot can happen within an industry as new as clean hydrogen in that time.

Projects may be scrapped, electricity prices can change, and/or the funding mechanism could have shifted.

As final investment decisions (FIDs) for large-scale projects lag, the electrolyzer market is experiencing rapid expansion, potentially leading to another growth concern – electrolyzer overcapacity.

While not everyone believes this is a bad thing, they do accept that more support needs to be given to boosting demand to meet up with supply.

“Should this happen, it could result in lower prices, which in turn might encourage positive FID decisions, thereby stimulating project development and balancing the market,” says Brett Ryan, Head of Policy and Analysis for Hydrogen UK.

Hydrogen UK is calling on the government to implement specific measures to increase the viability of demand-side uses, such as industrial fuel switching, indicating that balancing supply and demand will need solutions that employ both a carrot (subsidies) and a stick (carbon penalties and fuel mandates.)

Getting it right

It is essential that the new industry is regulated well and in a globally coordinated manner from the outset to avoid dead ends and the expansion of production methods that are as polluting as practices that came before.

However, no one knows where profits are to be made until regulatory certainty lands, whether that be over the U.S.’s Inflation Reduction Act, the European Renewable Energy Directive (RED III), the European Hydrogen Bank auctions, or the effects of the Carbon Border Adjustment Mechanism (CBAM) on steel manufacturers.

“Once these guidelines are in place, we can expect a wave of FIDs to commence,” says Hydrogen UK’s Ryan.

Brendan Murphy, head of hydrogen with LCP’s Energy Analytics team, says projects such as the UK’s Hydrogen Allocation Fund (HAR) which ran its first round in December followed by applications for the second round in April, have helped to give the industry a market to aim for.

They have also helped differentiate between projects that can run now and others that have chosen to sit out until the market matures.

“There's a vast difference between the order books for the whole industry versus the announced capacity. At the moment, we see only about 12% of projects have got a confirmed electrolyzer manufacturer lined up in Europe,” says Murphy.

LCP tracks announcements through to 2030, and Murphy notes that there is currently 73 GW of unaccounted for electrolyzer capacity.

“Electrolyzer manufacturers are keen to invest in, or have already invested in, giga-factories, but don't necessarily have the cushion in their order books, placing those investments at risk,” he says.

All of these factors point to a slow build-up of activity over the next few years.

“We feel that the next two years will still be quite inactive. If you think about how long it takes to build a project like this, it's about three years once you get going. So, we think in around 2027 you'll see a big spike in activity because you start to butt up against the 2030 targets,” he says.

By Paul Day