US efforts to restore offshore wind pipeline spur factory investments

Much-needed investments in U.S. offshore wind factories are on the rise on the back of action by East Coast states and expectations of rate cuts.

Related Articles

US Forged Rings, a new company created by piping group Canadoil, announced plans last week to invest $700 million in a tower fabrication facility and a steel forging plant on the East Coast to supply components to the offshore wind industry.

The factories could produce up to 100 towers per year – enough for two large wind farms – and start operations in the first quarter of 2026. The announcement will be a welcome signal for developers seeking to wean projects off imports from Europe in the next wave of development. The U.S. supply chain outlook remains patchy as many suppliers are waiting for multiple orders and a clearer growth outlook before they commit to building local factories.

Forged Rings has yet to identify the exact location for the facilities.

“This substantial investment serving U.S. offshore wind was spurred by our confidence in the medium and long-term prospects of the U.S. market,” the company said in a statement.

East Coast states have accelerated offshore wind auctions this year to re-establish investor confidence in offshore wind and provide a much-needed pipeline of projects. A number of projects were delayed or cancelled in 2023 due to rising costs and supply chain delays.

Inflation has trended downwards since its peak in 2022 and expectations of interest rate cuts this year should help to attract more investments in the supply chain.

Jeremy McDiarmid, Managing Director and General Counsel at clean energy trade group Advance Energy United, is “cautiously optimistic” that more manufacturing plants will be announced this year.

But he warned developers will need to source materials from a "blend” of domestic and foreign suppliers for some time.

The use of foreign components and installation vessels exposes projects to global supply markets and the risk of higher prices. Demand for offshore wind components in Europe is set to soar and U.S. offshore wind projects could miss out on a 10% tax credit bonus if they miss a domestic content threshold.

The buildup of a U.S. supply chain is "going to be a slow transition that could be speeded up by more coordination between states and consistent, long-term signals that demand for offshore will continue in the future,” McDiarmid said.

Wind farms wanted

New York, New Jersey, Massachusetts, Connecticut, and Rhode Island all plan to allocate new offshore wind contracts this year under new price mechanisms which aim to avoid the cancellation of contracts seen last year following cost hikes.

In a promising sign, New York's latest auction attracted revamped bids from developers of advanced projects.

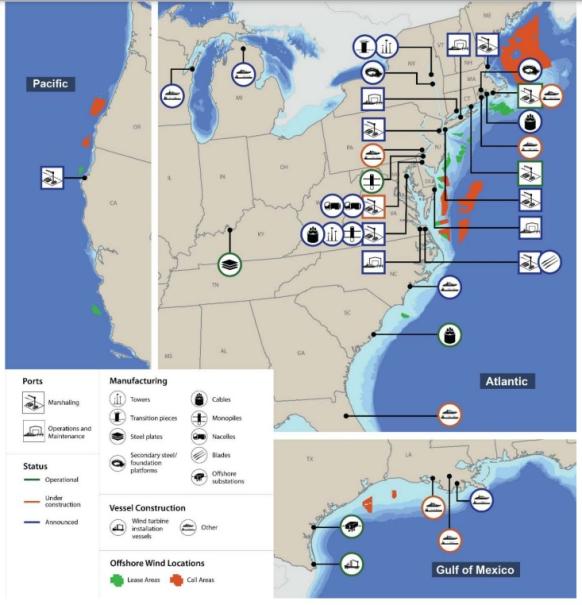

US offshore wind supply chain activity (2023)

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

A clear pipeline of projects is crucial to attract investors in a US supply chain. In one example, GE Vernova and its subsidiary LM Wind Power have pledged to build blade and nacelle factories in New York State but only if the group “wins a sufficient volume of orders from customers.” The companies are evaluating potential locations for the facilities, the New York State Energy Research and Development Authority (NYSERDA) said.

In late 2023, Siemens Gamesa scrapped plans to build a facility to manufacture offshore wind blades in Virginia and Orsted cancelled two projects in New Jersey, dealing a blow to the state’s plans to build a major supply hub on the New Jersey Wind Port.

New Jersey state authorities responded by securing 3.7 GW of capacity in a new auction in January and auction winners Leading Light Wind and Attentive Energy pledged investments of $164 million to expand EEW’s monopile facility at the Port of Paulsboro. The state plans another offshore wind tender later this year.

A New Jersey Wind Port marshalling area is 90% complete and sections that can house factories for blades, nacelles, and towers will be developed according to demand, a spokesperson for New Jersey Economic Development Authority (NJEDA) said. These sections would have direct access to the Atlantic Ocean, which could provide efficiencies and facilitate logistics.

New York will announce the winners of its latest auction this month and the state plans another solicitation later this year. By the end of last year, the state had committed $700 million of investments in supply chain projects that would be built by private investors, it said.

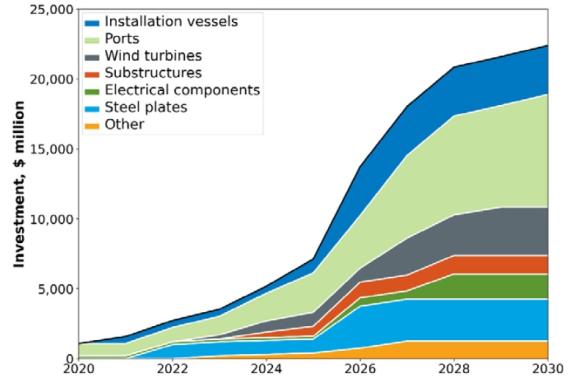

Investments needed to build a US offshore wind supply chain

(Click image to enlarge)

Source: U.S. National Renewable Energy Laboratory's Offshore wind Supply Chain Road Map, January 2023.

Cable supplier Nexans predicts strong growth in U.S. offshore wind and last year's cancellations were “a bump on the road,” Pascal Radue, Nexans’ Executive Vice President, Generation and Transmission Business Group, said.

Capacity at Nexan's cable factory in Charleston, South Carolina is fully booked until 2026/2027, Radue said.

The company has agreed to supply subsea transmission cables to Orsted’s South Fork and Revolution Wind projects, as well as Equinor’s Empire Wind projects, and Ocean Wind’s Moray West project in Scotland.

Nexans wants to sign more supply agreements with U.S. projects “that are meaningful and that we are sure that they will actually happen,” Radue said.

In Massachusetts, Prysmian Group has announced plans to build a $200 million facility to manufacture submarine inter-array and export cables at a new offshore wind port in Brayton Point that is slated to start operations in 2026.

East Coast network

States are clearly keen to promote local investment but they are also looking to share "services and suppliers" to create a regional supply chain, NYSERDA said.

New England states of Massachusetts, Connecticut and Rhode Island have agreed to seek multi-state proposals for up to 6 GW of large-scale offshore wind projects in auctions this year in a bid to reduce construction costs and minimise price increases for ratepayers. The Biden administration is also working with nine East Coast states to strengthen supply chain collaboration in a new initiative announced last year.

“Our coordinated approach will help us build a regional economy that can support the industry, including through investments in transmission, port infrastructure, advanced manufacturing, and workforce development,” Massachusetts Secretary of Energy and Environmental Affairs Rebecca Tepper told Reuters Events.

We "don't need seven or eight small supply chains,” McDiarmid said. “We need a supply chain with multiple nodes.... that will be ideal from economic efficiency standpoint and will save ratepayers money."

Reporting by Eduardo Garcia

Editing by Robin Sayles