New England secures large offshore wind bids; US defines 32 GW build area in Gulf of Maine

The wind power news you need to know.

Related Articles

Leading offshore wind developers bid in New England

Developers including Orsted, Avangrid, Vineyard Offshore, EDP and Engie bid to secure up to 6 GW of new offshore wind capacity in the latest power auctions by three New England states.

Massachusetts, Connecticut and Rhode Island agreed to seek multi-state proposals for large-scale offshore wind projects in auctions that closed March 27.

Massachusetts will review the 3.6 GW of proposals it received over the coming months and will “coordinate with Connecticut and Rhode Island to evaluate multi-state projects that would increase benefits for the region, lower costs, and enhance project viability,” Elizabeth Mahony, Massachusetts Energy Resources Commissioner, said.

Connecticut and Rhode Island received proposals for 2 GW and 1.2 GW, respectively.

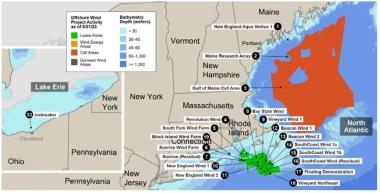

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Note: Based on data from 2023 - does not include all projects

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Avangrid, owned by Spanish group Iberdrola, submitted proposals for its 791 MW New England Wind 1 and 1,080 MW New England Wind 2 projects off the coast of Massachusetts. Avangrid also presented a combined proposal for these two projects as well as additional bids for single-state procurements in Massachusetts, Connecticut and Rhode Island.

Orsted proposed its 1.2 GW Starboard Wind project, which could supply power to Connecticut and/or Rhode Island. Orsted partnered with U.S. utility Eversource to build the 704 MW Revolution Wind project off the coast of Rhode Island, which is expected to start producing power in 2025.

Vineyard Offshore, owned by Copenhagen Infrastructure Partners (CIP), proposed its 1.2 GW Vineyard Wind 2 project, which would sit 29 miles (46.7 km) south of Nantucket in Massachusetts. Vineyard Wind 1 is currently under construction and Vineyard Wind 2 could start producing power in 2031.

Meanwhile, EDP and Engie presented a joint proposal for their SouthCoast Wind project that would be developed in two phases of 1.2 GW each.

US narrows down Maine offshore wind lease area

The U.S. Bureau of Ocean Energy Management (BOEM) has identified a Wind Energy Area (WEA) in the Gulf of Maine that could host up to 32 GW of offshore wind capacity in preparation for the first commercial lease sale in Maine later this year.

The WEA covers around 2 million acres off the coast of Maine, Massachusetts and New Hampshire. The closest point to land is 23 miles off the coast and the furthest is 92 miles. Floating wind technology is likely to be favoured due to deep waters.

BOEM reduced the potential development area by 43% following consultations with fisheries and local tribes that had expressed concerns about potential impacts on lobster fishing and North Atlantic right whale habitat.

In preparation for the lease sale, BOEM will conduct an environmental impact assessment over the next few months before issuing a sale notice describing the terms of the auction and the lease areas.

Maine plans to install commercial-scale floating wind by 2032 and the state’s governor, Janet Mills, last summer signed into law a bill to procure 3 GW of floating wind by 2040 through long-term power purchase agreements (PPAs).

Foreign developers including Repsol, Avangrid and TotalEnergies have expressed interest in building offshore wind facilities in the Gulf of Maine WEA, BOEM said.

Global wind turbine orders rise as Western markets recover

Wind developers ordered a record 155 GW of turbines in 2023, a 12% increase versus the previous year, research group Wood Mackenzie said.

Developers placed orders for 100 GW in China, 19 GW in Europe and 17 GW in North America. The turbine manufacturers receiving the largest volume of orders were China's Envision (22 GW), Denmark's Vestas (19 GW) and China's Goldwind (18 GW).

“A record haul outside of China in Q4 and a near doubling of order capacity in North America throughout 2023 helped continue market recovery for Western markets, with a 26% increase in order intake YoY,” said Luke Lewandowski, Vice President, Global Renewables Research at Wood Mackenzie.

U.S. turbine orders surged 130% last year to around 17 GW, Samantha Woodworth, senior researcher at Wood Mackenzie told Reuters Events.

Global onshore wind orders increased by 15%, or 17.7 GW, from the previous year. Turbine dimensions continue to grow as developers seek to optimise revenues and orders for the largest onshore turbines with capacities of between 7 and 9.9 MW saw a seven-fold increase in 2023, Wood Mackenzie said.

Developers ordered 19 GW of offshore wind turbine capacity in 2023, 7.2% less than in the previous year which was mainly due to a 56% drop in orders from China.

“Despite high-profile offtake cancellations and industry headwinds for offshore wind, firm order intake for the offshore sector tripled for markets outside China in 2023,” Lewandowski said.

US revises tax credit rule to help offshore wind projects

New U.S. Treasury rules will make it easier for offshore wind developers to claim a tax credit if they build port facilities in areas that have historically relied on fossil fuel industries for employment.

Offshore wind projects can claim the energy communities tax credit, which is worth 10% of a project's cost, if they build supervisory control and data acquisition (SCADA) facilities that will ensure local investments are made, the Treasury said. SCADAs will allow offshore wind developers to attribute their nameplate capacity to an onshore facility to claim the energy community tax credit.

“This change reflects the fact that onshore SCADA equipment at ports is critical to offshore wind projects and that offshore wind projects make significant investments and create jobs at these ports over the duration of the projects, which is the goal of the energy communities bonus,” the Treasury said in a statement.

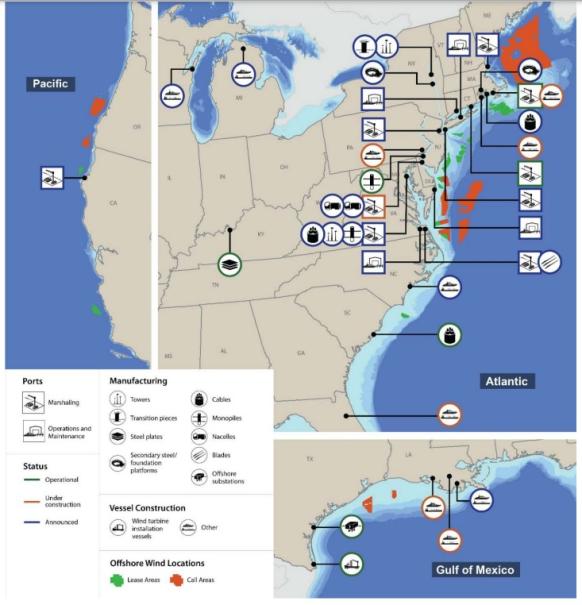

US offshore wind supply chain activity (2023)

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

To qualify for the tax credit, SCADA facilities have to be located in an “energy community” that previously had fossil fuel infrastructure, such as a coal power plant, or high unemployment.

Projects with multiple points of interconnection can also receive the credit if at least one of them is within an “energy community,” the rules state.

"In a move to bolster the transition from fossil fuel to clean energy, the eligibility expansion for the 10% energy communities credit creates an easier path to market for many offshore wind projects," Liz Burdock, CEO of Oceantic Network industry group, said in a statement.

The revision comes after a turbulent year for the U.S. offshore wind industry due to sharp cost increases. Developers canceled 8.9 GW of offshore wind power contracts in the U.S. Northeast in 2023 and requested to improve financial terms for an additional 4.3 GW, according to Oceantic Network.

US offshore transmission network would lower costs

An offshore power transmission network along the U.S. Northeast coast could help lower costs for offshore wind developers and make the grid more reliable, according to a two-year study by the Department of Energy (DOE).

The current approach is to directly link offshore wind projects to the onshore grid but DOE envisions building an interregional transmission network off the coast over the next decade.

“The study found that connecting offshore wind platforms together to create transmission networks outweighs the costs, often by a ratio of 2 to 1 or more, when compared with each project having its own isolated transmission connections,” DOE said in a statement.

The Biden administration aims to install 30 GW of offshore wind capacity by 2030 and lay the groundwork to build 110 GW by 2050.

Stakeholders have long said that a lack of interconnection points and interregional transmission capacity will constrain offshore wind development in the Northeast, where the federal government has so far approved the construction of 8.3 GW of projects.

A network of high-voltage direct current (HVDC) lines would allow for the deployment of clean energy to high-demand areas, which would “ease congestion, increase system reliability, lower curtailment, and flow power from lower-price regions to higher price regions, reducing costs for consumers,” DOE said.

Europe aims to quadruple North Sea offshore wind capacity to 120 GW by 2030 and is already heading towards an offshore wind grid, starting with offshore interconnectors between countries.

Reuters Events