Germany sees jump in wind installations as new laws hike activity

Government action has led to rising wind installation and permit rates and other EU nations should follow suit to achieve renewable energy targets, industry participants said.

Related Articles

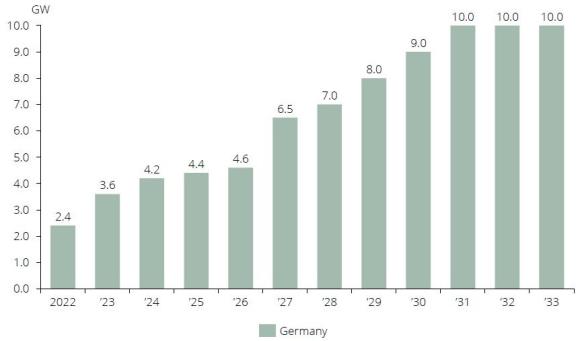

Germany's annual onshore wind installations hiked by 48% in 2023 to 3.6 GW according to the latest figures from Deutsche WindGuard and the German Federal Wind Energy Association (BWE). In stark contrast, installations across Europe fell by 18% last year to 14 GW.

The sharp rise in Germany follows a range of laws passed by Germany's Social Democrat-Green-Liberal coalition since 2021 to accelerate renewable energy capacity and end the country’s reliance on Russian fossil fuels. Germany currently operates 61 GW of onshore wind capacity and aims to reach 115 GW by 2030. An ambitious target, but rising permitting rates indicate it may not be far off.

Laws such as the Renewable Energies Act (EEG) “have had a palpable influence on individual aspects of planning, permitting and expansion of onshore wind energy," BWE spokesperson Frank Gruneisen, told Reuters Events.

EEG sets ambitious annual installation goals and the Federal Network Agency (Bundesnetzagentur) has increased prices in wind power auctions to account for rising costs. To reduce permitting barriers, the EEG fast-tracks new EU directives that require members to set aside land for faster permitting and designate renewable energy as projects of overriding public interest.

Permits are now being issued far more quickly, a spokesperson for utility RWE told Reuters Events. A total of 7.5 GW was permitted last year, up from 4.3 GW the previous year.

The amount of onshore wind allocated contracts in auctions almost doubled last year to 6.4 GW and data analysis group Enervis expects Germany to auction 14 to 15 GW in 2024. The government has set an annual target of 10 GW a year for each year 2024-2028 but any capacity not taken up in any given year is added to the following year’s allocation.

Rising permitting approvals will hike installations in the second half of the decade as the average time from permitting to project completion is 27 months, data from BWE shows.

Germany is now on track to install 105 GW of onshore wind by 2030, according to Brinckmann consultancy group, leaving its European neighbours far behind.

Forecast onshore wind installations in Germany

(Click image to enlarge)

Source: Brinckmann Group, January 2024

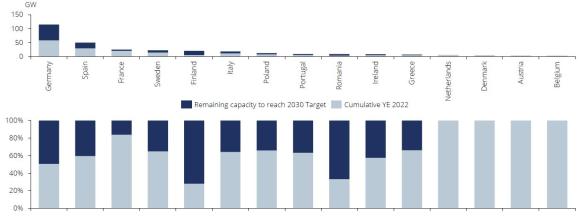

Other EU countries should follow Germany's example of top-down directives on faster permitting and power contract auctions, market participants told Reuters Events.

EU nations must focus on removing permitting hurdles while raising auction volumes and prices in line with recent cost hikes, Shashi Barla, Director and Head of Research at Brinckmann, said.

EU leader

Germany was an early mover in wind power and benefits from a large number of wind developers as well as a deep network of wind manufacturers.

Germany's onshore wind development is mainly concentrated in four states. Schleswig-Holstein installed 1,210 MW last year, followed by Lower Saxony (638 MW), North Rhine-Westphalia (527 MW) and Brandenburg (425 MW). The same four states have most total installed capacity: Lower Saxony (12.5 GW), Brandenburg (8.6 GW), Schleswig-Holstein (8.5 GW) and North Rhine-Westphalia (7.1 GW).

Germany acted fast to increase auction prices in line with rising global costs, a spokesperson for turbine supplier Siemens Gamesa told Reuters Events. The Federal Network Agency increased the maximum price on offer from 58.8 to 73.5 euros/MWh for projects completed from 2024 onwards.

Other European governments have focused too heavily on securing the lowest price, the spokesperson said. Price caps and permitting woes have led to undersubscribed auctions in Spain, UK and France, among other countries.

EU onshore wind capacity, targets by country

(Click image to enlarge)

Source: Brinckmann Group, January 2024

Development in Germany has also been aided by a requirement in the EEG that states make 2% of their land available for wind power projects, although many states still have “general minimum distance rules that hinder expansion," a spokesperson for developer Statkraft said.

Bavaria has the strictest rules, requiring the distance between turbines and households to be at least 10 times the height of the turbine.

Permit approvals accelerated in North Rhine-Westphalia and Baden-Wurttemberg on the back of energy security concerns following Russia's invasion of Ukraine, Gruneisen noted.

Developers in Germany also have a right to a grid connection, unlike in other EU countries, Nicolai Herrmann, Managing Director at Enervis, added.

“This improves the general risk profile for renewable project development and investments," he said.

Repower market

Around one third (1.1 GW) of onshore wind installations in Germany last year were repowering projects and Siemens Gamesa sees a huge potential for repowering in the coming years.

Repowering involves upgrading existing wind farms with higher capacity turbines, increasing the overall output and extending the lifetime of the asset without having to do the full permitting process required for greenfield projects.

Some 17 GW of onshore wind capacity in Germany has been operating for 15 years or older making it a viable repowering opportunity, Siemens Gamesa said. In one example, the turbine supplier is installing 16 new turbines to the Elster wind farm in Saxony-Anhalt to replace 50 older turbines and reduce the land footprint by 30%.

Barla estimates repowering projects will represent around 10 to 15 GW of new projects online by 2030.

National action

The pace at which countries transpose EU permitting directives into national law will be a key driver of growth in the coming years. Germany was quick to act, but developers in other EU nations are held back by bureaucratic approval processes.

In France, Italy and Greece, it can take seven to eight years to permit a wind project, raising the risk of further delays from obsolete technology as the wind market advances, Barla said.

Faster wind permitting was a key pledge in a new European Wind Charter backed in January by all EU countries except Hungary as well as 300 wind energy companies.

The charter builds on the Wind Power Action Plan announced by the European Commission in October and calls for auction mechanisms that protect investors from inflation and volatile prices as well as non-price criteria that favour European wind manufacturing over imported components.

“National implementation of the actions is key,” industry group WindEurope said.

Actions on permitting and auctions would "help boost the expansion of wind energy and strengthen Europe’s wind industry," Giles Dickson, CEO of WindEurope, said.

Reporting by Neil Ford

Editing by Robin Sayles