EU 2030 wind target within sight as activity rebounds; UK hikes funding for crucial offshore wind auction

The wind power news you need to know.

Related Articles

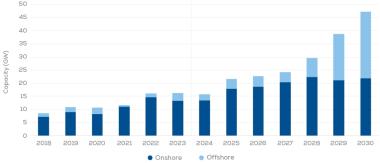

EU annual wind installs forecast to hit 29 GW in 2024-2030

Annual wind installations in the European Union are forecast to rise to 29 GW on average in 2024-2030 after a rise in permitting rates last year and a rebound in investments, industry group WindEurope said in its latest annual report.

Installed wind capacity will hit 393 GW by 2030, just shy of the 425 GW needed to meet EU renewable energy targets, WindEurope said.

Two thirds of new wind installations will be onshore but offshore capacity will rise rapidly towards the end of the decade, the industry group said.

Forecast EU wind installations

(Click image to enlarge)

Source: WindEurope, March 2024

Onshore wind installations fell by 18% in 2023 to 14 GW as volatile costs and permitting delays slowed development but rising permitting rates and growing auction volumes will hike installations in the coming years.

Last year, Germany and Spain permitted 70% more onshore wind than in 2022, while France, Greece, Belgium and the UK also saw higher permitting volumes, WindEurope said.

Rampant inflation, supply chain disruptions and higher borrowing costs disrupted the wind sector over the past couple of years but WindEurope noted that the EU has responded with sweeping legislation to prop up the industry.

In October 2023, EU policymakers approved the Wind Power Package to accelerate permitting and boost supply chain investments, which will likely lead to faster growth in the coming years. In December, all EU members except Hungary signed the European Wind Charter, committing to swiftly implement measures ascribed to them in the EU's action plan.

The Net-Zero Industry Act (NZIA) approved in February urges EU members to include pre-qualification and non-price criteria in future auctions to boost the domestic wind supply industry.

"The biggest threat now to the accelerated expansion of wind is the timely expansion of Europe’s onshore and offshore electricity grids," WindEurope said.

Vast amounts of grid investments are required in the coming years at transmission and distribution grid level to accommodate a looming surge in wind and solar projects.

Germany launches 5.5 GW offshore wind tender

The German government has launched an auction to secure up to 5.5 GW of offshore wind capacity from three sites in the North Sea.

The sites are situated about 110 km north-west of the island of Borkum, bordering the Netherlands. The government will provide preliminary data on wind resources, subsea surface and environmental impacts ahead of the auction.

The auction closes on August 1 and is part of Germany's efforts to quadruple offshore wind capacity to 30 GW by 2030.

Projects will be awarded based on a point-based system that awards up to 60 points based on price and up to 30 points for qualitative criteria.

The qualitative criteria will include factors such as the proportion of renewable energy sources used in manufacturing and the environmental impact of the components, the government said.

Last July, oil and gas groups BP and TotalEnergies were the only winners of a 7 GW offshore wind auction in Germany.

Earlier this year, Germany launched a separate tender for 2.5 GW of offshore wind energy for areas in which the government has not conducted preliminary studies.

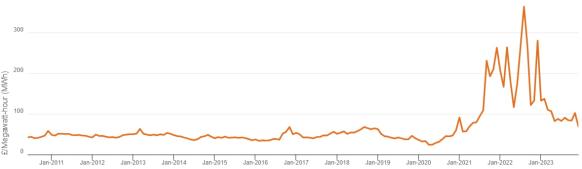

UK government hikes funding for renewable energy auction

The UK government plans to allocate up to 1 billion pounds ($1.3 billion) to buy clean power in its Round 6 renewable energy auction this month as it looks to reignite offshore wind activity following its failed previous auction.

The government hiked the offshore wind price cap for Round 6 by 66% to 73 pounds/MWh following no eligible bids in last year's auction.

Some 14 offshore wind projects with a total projected capacity of almost 10.3 GW are eligible to bid and a further 4.7 GW of projects could be eligible to participate by the time the auction opens on March 27, industry group RenewableUK said in a report.

UK average day-ahead wholesale power prices

(Click image to enlarge)

Source: UK energy regulator Ofgem, February 2024.

The auctions allocate contracts for difference (CfDs), which provide operators with guaranteed electricity prices for 15 years.

The last tender failed to attract any offshore wind bids as developers deemed the guaranteed prices offered too low, dealing a blow to the country's goal of installing 50 GW by 2030, up from 14.7 GW currently.

Keith Anderson, the CEO of Iberdrola-owned developer ScottishPower, described the budget increase for Round 6 as “a major step in the right direction.”

"I expect the auction to be hugely competitive. Given the scale of the available pipeline," he wrote in a statement.

Spain launches consultation on new offshore wind rules

The Spanish government has opened a public consultation on regulations for offshore wind installations, laying the groundwork for the country’s first solicitation.

Under the proposed rules, lease areas, remuneration schemes and grid connections will be allocated at the same time in order to speed up project approvals.

Solicitations will consider qualitative criteria, such as the creation of local jobs and environmental impact, in addition to technical and economic factors, the Ministry for Ecological Transition said.

Spain will need to launch its first solicitation this year in order to meet its goal of building 3 GW of offshore wind by 2030, Spanish wind industry association AEE said.

Large offshore arrays are expected to use floating technology in Spain’s deep water areas, the industry group said. Spain has earmarked 147 million euros ($159.5 million) to build smaller pilot offshore wind projects.

The month-long consultation will end on March 25.

U.S. opens up clean energy tax credits to tax-exempt groups

Tax-exempt U.S. jurisdictions will be able to benefit from clean energy tax credits under new rules announced by the U.S. Treasury Department on March 5.

State, local, and Tribal governments, as well as Puerto Rico, the U.S. territories, and other non-taxable entities will be able to directly benefit from clean energy tax credits allocated under the 2022 Inflation Reduction Act.

The tax credits have spurred activity in wind and solar development as the Biden administration strives to meet ambitious clean energy targets.

The new rules will enable the tax-exempt parties to "build clean energy projects, lowering the cost of energy for working families and advancing environmental justice,” the American Council on Renewable Energy (ACORE) said in a statement.

To directly receive the tax credits, applicable entities can form co-ownership arrangements with private investors to produce clean power, or choose to transfer “all or a portion of their credits” to a third party in exchange for cash, the Treasury said.

As of January, 145 entities had filed requests to build 1,290 clean energy and semiconductor technology projects that would benefit from these new provisions, across 40 U.S. states.

Reuters Events