Offshore wind analytics to cut opex to less than quarter of costs

Growing predictive maintenance capabilities, drones and multi-turbine control strategies will combine with logistics innovations to lower operations and maintenance (O&M) costs, industry experts said.

Related Articles

Sweden's Vattenfall launched last month its pioneering 93 MW European Offshore Wind Deployment Centre (EOWDC) in Aberdeen Bay, north-east Scotland. The new 300 million-pound ($393.0 million) facility hosts the largest operational turbines to date and will be used to test the latest technology and services designed to cut operations and maintenance (O&M) costs.

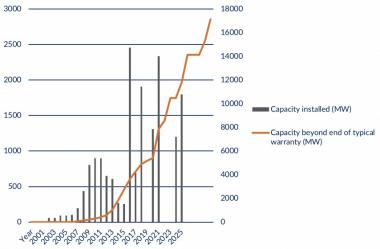

Falling offshore wind capex costs have placed increasing importance on O&M costs which account for approximately 25-30% of total costs. As installed capacity grows, an increasing number of turbines will be operating out of original warranty, typically set at around five years.

UK offshore wind installs, capacity out of warranty

Source: U.K.'s ORE Catapult. March 2018.

Operators are looking to the latest technology advancements and using economies of scale and series to maximize turbine efficiency.

Larger, higher efficiency turbines, improved component reliability, and improvements in vessel logistics are all helping to reduce costs. Going forward, wider gains are expected from monitoring and analytics solutions which spur predictive maintenance gains.

These improvements will reduce O&M costs to a lower share of overall costs, Matti Niclas Scheu, Senior Engineer at Ramboll consulting engineering group, told New Energy Update.

“This will be achieved mainly by reducing indirect O&M costs, i.e. production losses during downtime, which is achieved by substituting corrective by preventive maintenance”, he said.

Advancements in drone technologies and artificial intelligence will also create savings. Combined with logistics innovations, these technologies will reduce downtimes and improve access to new development sites.

Design gains

Growing turbine capacities could directly impact as much as 60% of offshore O&M costs, according to Bloomberg New Energy Finance (BNEF).

Higher capacity turbines require less maintenance resources per MW, reducing the outlay for spare parts, vessels and personnel during operations.

O&M considerations are playing a growing role in project design and development.

New planning tools, dedicated support resources and improved site access will all help to lower maintenance costs, according to experts.

In addition to vessel solutions, inspection drones, remotely operated vehicles (ROVs) and increasing automation will facilitate operations in harsher conditions, expanding the areas suitable for development, Scheu noted.

“Sensors, monitoring, artificial intelligence and related advanced data analytics algorithms will be the facilitator for this trend”, he said.

Drones could cut offshore wind inspection costs by $1,000 per turbine per year, according to BNEF.

Annual offshore wind inspection costs per 3.6 MW turbine

Source: Bloomberg New Energy Finance (BNEF), Sterblue, VisualWorking

Developers are now combining drones with faster processing power to shorten inspection times and issue faster actions, sector experts told New Energy Update.

In a recent example, Enel Green Power North America (EGPNA) has partnered with artificial intelligence developer Raptor Maps to deploy an integrated drone-artificial intelligence solution for real-time inspection analysis of solar plants.

More standardised O&M practices, including data collection, transmission and analysis, will be required to maximise cost reductions, Scheu noted.

“Considering the existence of multiple suppliers for the different systems, it is key to use a similar baseline in order to create information instead of massive amounts of data,” he said.

Complete control

Operators are also looking to introduce new turbine control strategies which maximize site revenues.

A more "holistic" approach, where the control strategy is considered at a site level and incorporates electricity market prices as well as asset life implications, should reduce costs going forward, Owen Murphy, team leader, Engineering at ORE Catapult, said in a recent report on offshore O&M opportunities.

Last December, the UKs’ Carbon Trust launched the Wind Farm Control Trials (WFCT) project to assess turbine control strategies which increase energy yield and reduce costs. The trials represent the first-ever field tests on offshore wake steering at a full-scale commercial facility.

Industry partners in the 2.3 million-euro WFCT project include Vattenfall, E.ON, ENBW, Innogy, Statoil and several technology firms and the full results are expected in 2019.

The results of the tests could impact component design as well as O&M practices. Performance data could inform future array concepts and other areas such as foundation designs, Megan Smith, Offshore Wind Manager at the Carbon Trust, told New Energy Update in January.

"I can certainly see a potential in the future to affect the design of the wind farms. That could be a natural outcome of understanding this more,” she said.

New hardware

Suppliers are collaborating to accommodate rising turbine capacities and sites in deeper waters, further offshore.

In June, Vestas and Maersk Supply Service, a major marine and logistics group, formed a partnership to develop logistics and installation technologies to reduce the cost of onshore and offshore wind.

The first joint project is a new Vertical Installer crane, which will "significantly" reduce capex costs and removes the need for seabed-based jack-up vessels, the companies said.

The crane solution can be used in all locations, including deep-sea sites. Vestas and Maersk are mainly targeting fixed bottom offshore turbines, but the solution could also be used for floating offshore wind farms as developers seek sites further offshore.

As Europe's offshore wind industry grows, operators will benefit from a wider range of support services from dedicated O&M hubs. These hubs will support continuing vessel innovations and improved spare parts strategies including centralized storage facilities.

Leading offshore developer Orsted recently built the U.K.'s largest offshore wind O&M hub at Grimsby, north-east England.

The hub will initially support Orsted's 210 MW Westermost Rough, 573 MW Race Bank and 1.2 GW Hornsea Project One wind farms. By 2019, Orsted has pledged to spend some 6 billion pounds in the wider Humber area.

New entrants

Cross industry innovations, particularly from Oil and Gas groups, are set to drive fresh efficiency gains for offshore wind projects.

Back in 2016, Orsted CEO Henrik Poulsen predicted the offshore wind sector will “be flooded by competition” as oil giants increasingly move into the sector.

“We’re talking about huge companies with significant capital and execution power,” Poulsen told the Wall Street Journal.

Oil and Gas groups will be able to transfer to wind projects decades of operational experience in health and safety, vessel logistics, installation efficiency, and O&M practices.

Oil and Gas firms can also transfer long-running supply and service partnerships which should boost efficiency and mitigate project risks, Jim Lanard, CEO of U.S. offshore wind firm Magellan Wind, told New Energy Update in 2017.

“Oil and Gas has very strong Approved Vendor Lists (AVLs) and established supply-chains, a massive play for big Oil and Gas will be bringing over that supply chain which all offshore wind will benefit from,” he said.

Offshore wind O&M offers new entrants to the sector “a relatively low barrier to entry” and this should encourage a wide range of innovations from other industries, Murphy said in his report.

New technologies and a deeper pool of service companies could see a dwindling role for major power suppliers in offshore wind farm operations, Murphy said.

“In the future we may see the emergence of a more comprehensive layer of service specialists below major utilities, who in some cases are expected to become increasingly ‘hands-off’ over time”, he said.

By Neil Ford