California grid targets 38 GW new solar; China oversupply set to soar

The solar news you need to know.

Related Articles

California targets 38 GW of new solar in latest grid plan

California has proposed $6.1 billion of new grid investments in 2023-2024 that will help to connect new offshore wind farms as well as 38 GW of new solar capacity.

The draft plan set out by the California grid operator CAISO plans to connect up new solar capacity in areas such as the Westlands area in the Central Valley, Tehachapi, the Kramer area in San Bernardino County, Riverside County, as well as in southern Nevada and western Arizona.

The grid investments will also connect 3 GW of in-state wind generation in existing development regions including Tehachapi, strengthen south-eastern borders to import over 5.6 GW of out-of-state wind generation from Idaho, Wyoming and New Mexico, and also improve access for battery storage projects co-located with clean power as well as stand-alone batteries closer to major load centers in the LA Basin, greater Bay Area, and San Diego, CAISO said.

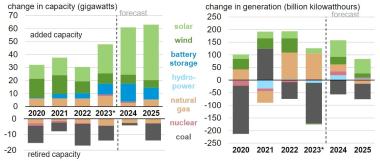

U.S. installed battery capacity is set to double this year to 30 GW with Texas and California installing the majority of projects, the Energy Information Administration (EIA) said in January.

Forecast US power installations

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

CAISO's proposed grid expansions will also help to connect over 2 GW of geothermal power, primarily in the Imperial Valley and in southern Nevada, but the majority of the funds will be spent on connecting new floating wind farms planned in Humboldt County in Northern California.

Some $4.6 billion of the investment will be used to build three major transmission lines that will deliver power from floating wind turbines off the coast of Humboldt County.

The grid plan will together allow the connection of over 4.7 GW of offshore wind, including 3.1 GW in Morro Bay on the Central Coast and 1.6 GW from Humboldt in the North.

Stakeholders have until April 23 to comment on the new plan and CAISO expects to decide on the final plan in May.

Europe launches probes into Chinese solar bids

The European Union has launched investigations into two solar project bids featuring Chinese components to determine whether foreign subsidies gave them an unfair advantage.

The probe will focus on two consortiums bidding for the development of a 455 MW solar park in Romania, part financed by EU funds. The first consortium is composed of Romania's ENEVO Group and a subsidiary of LONGi Green Energy Technology Co and the second involves subsidiaries of Chinese state-owned Shanghai Electric Group.

"Following its preliminary review of all the submissions, the Commission considered it justified to open an in-depth investigation for two bidders, since there are sufficient indications that both have been granted foreign subsidies that distort the internal market," the European Commission (EC) said in a press release.

The EC will now seek to establish whether the companies were able to submit "an unduly advantageous offer," it said.

Within three months, the EC will decide whether to prohibit the award of the contract, require commitments from the companies to remedy any distortion, or issue a "no objection" verdict.

Europe's solar industry has been calling for emergency aid to help sell local modules after surging exports from China drove down prices.

Europe faces the widespread closure of solar factories within months without emergency support measures from EU authorities, the European Solar Manufacturing Council (ESMC) warned in a letter to the European Commission (EC) in January.

EU module prices plummeted from 30 cents/Watt to around 10 cents/Watt during 2023 and this is “below the manufacturing cost even for the largest Chinese module producers,” the ESMC warned.

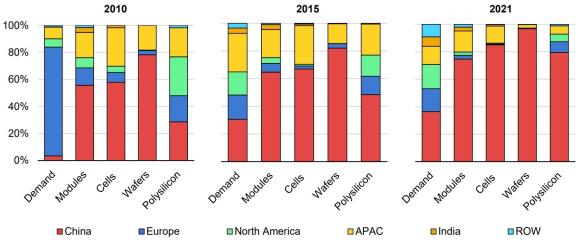

Solar manufacturing capacity by region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

The ESMC suggested trade defence measures as a last resort but in March EU energy policy chief Kadri Simson ruled out cutting off solar imports to ensure developers have sufficient supplies.

Years of Chinese state investment in factories has seen China dominate the global supply market. EU suppliers produced just 2 GW of modules last year while EU stockpiles of Chinese solar modules have surged to between 70 and 85 GW, ESMC said. The EU installed a record 56 GW of solar power capacity last year as member states ramp up renewable energy goals.

EU authorities have agreed new rules that will require at least 40% of all solar components to be manufactured in the EU by 2030 but it could take years for many member states to implement the measures.

China solar oversupply set to soar further

Consolidation in China's crowded solar power sector is pushing smaller companies out of the market but excess production capacity continues to rise and threatens to keep global prices low for years, according to analysis by Reuters.

China accounts for around 80% of global solar module production capacity and growing exports have triggered a collapse in global prices.

Oversupply pushed prices of finished solar panels in China down 42% in 2023, making Chinese panels more than 60% cheaper than U.S.-made equipment, with some module-only manufacturers taking orders at negative margins to preserve market share, said Wood Mackenzie analyst Huaiyan Sun.

At the end of 2023, China had 861 GW of annual solar module production capacity, according to China Photovoltaic Industry Association data, more than double global module installations of 390 GW.

China's production capacity is expected to increase by a further 500 or 600 GW this year as large suppliers continue to build new plants, according to forecasts by Wood Mackenzie and Rystad Energy.

Reuters Events