US hammers out hydrogen hubs' final details

There remain loose ends that must be addressed if the U.S. hubs strategy is to be a success.

Related Articles

A breakdown of the seven U.S. Regional Clean Hydrogen Hubs (H2Hubs) was released in October, but critics say there has been little transparency, few details, and too much focus on steam methane reforming (SMR) coupled with carbon capture and storage (CCS) rather than renewable electrolytic hydrogen production.

Meanwhile, crucial guidelines on what constitutes true, clean hydrogen are still to be hammered out and the details of these guidelines could determine the success or failure of the program in reducing carbon emissions and creating a new energy industry.

Some are concerned overly strict regulation could create unecessary obstacles for the industry.

“Slowing down or making the progress of this very important piece of the puzzle towards decarbonization more difficult or expensive, especially when you're trying to grow the industry and it hasn't even started, is probably not the most optimal way to move forward,” says CEO of California’s winning hubs group ARCHES Angelina Galiteva.

“Let's make sure we learn some of the lessons that are out there and then create the most beneficial environment for green, renewable hydrogen to succeed at scale on a national level.”

Others fear failure to create significant guardrails on an entirely new energy system could lead to expensive dead ends as companies invest in untested systems that draw on fossil fuel generation and leak methane and CO2.

“We want to make sure that these projects are held to the strongest standards,” says Pete Budden who leads the Natural Resources Defense Council’s (NRDC’s) state and regional-level hydrogen policy work.

“Whatever blue hydrogen gets built needs to be held to accurate standards in terms of upstream methane leakage, in terms of uncaptured carbon, and in terms of permanence of sequestration. We need to be monitoring all of that.”

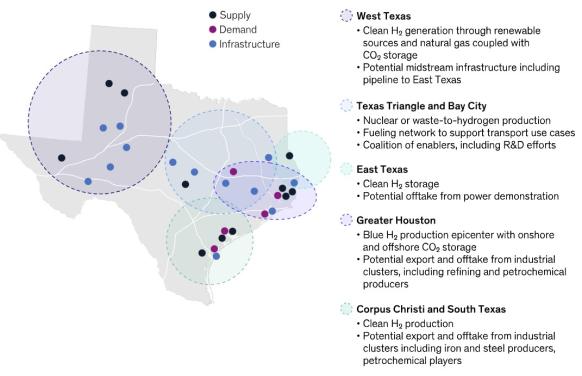

Various hydrogen clusters could potentially emerge in Texas

(Click to enlarge)

Source: Exhibit from “Unlocking clean hydrogen in the US Gulf Coast: The “here and now””, August 25, 2023, McKinsey & Company, www.mckinsey.com. Copyright (c) 2023 McKinsey & Company. All rights reserved. Reprinted by permission.

Talking blue

‘Blue’ hydrogen, or hydrogen produced from methane and CCS, was included in three of the seven hubs plans but has been criticized as a false start in clean hydrogen production.

“I am very disappointed that the Biden administration included blue hydrogen in their awards,” says biogeochemist and ecosystem scientist at Cornell University Robert Howarth.

“It takes a lot of natural gas to make blue hydrogen, and since one cannot develop and use natural gas without some of it being emitted unburned to the atmosphere, and since methane is more than 80 times more powerful than carbon dioxide as a greenhouse gas, methane emissions from blue hydrogen are very problematic.”

Howarth’s 2021 Cornell University study, “How green is blue hydrogen?” showed greenhouse gas footprint of hydrogen produced from SMR and CCS is more than 20% greater than burning natural gas or coal for heat and some 60% greater than burning diesel oil for heat.

It made no sense to boost production of a fuel that has little chance of success and cannot be economically produced, IEEFA Director of Resource Planning Analysis David Schlissel and IEEFA energy policy analyst Suzanne Mattei said in an opinion piece for ‘The Hill’ entitled ‘Why Blue Hydrogen is a Big Mistake.’

“What happens when they discover these projects are emitting a lot of CO2 and methane? Are they going to shut them down? I doubt it. We're going to have these large facilities emitting a lot of greenhouse gases for decades, whatever happens with green, renewable hydrogen,” says Schlissel.

Necessary Safeguards

Another question facing the United States as it designs its hydrogen infrastructure is how to define what is ‘clean’ hydrogen, a question hard-baked into the government’s other large industry subsidy via the Inflation Reduction Act (IRA).

Rules governing which projects will see cash from the IRA’s 45V Production Tax Credits (PTC) are currently under debate at the Treasury and are expected to be decided by the end of the year.

Weak guidance could result in subsidizing hydrogen projects that have more than twice the emissions of today’s status quo hydrogen and drive increased emissions of more than 100 million tons of CO2 this decade, according to the NRDC.

The main points of contention revolve around the ‘Three Pillars’: new production (known as additionality), hourly matching, and deliverability.

Additionality posits that all electricity used to produce hydrogen via electrolysis must be from new renewable sources so that production sites don’t draw from the grid and prompt increased fossil-fuel generation.

Hourly matching requires electrolyzers’ power consumption to match clean energy production down to the hour, while deliverability requires electrolyzers to source clean electricity from with their same operating region.

Eight U.S. Senators sent an open letter to the Secretary of the Treasury Janet Yellen mid-October calling for stringent standards on the IRA’s 45V tax credit which will be granted to hydrogen producers in a tiered manner depending on how much CO2 is produced in the creation of a kilo of hydrogen.

Hydrogen, which they call a potential clean energy Swiss-army knife, could help reduce emissions from some of the hardest to abate sectors: aviation, shipping, steelmaking, and heavy-duty vehicles, and in certain instances could even serve as long-term grid storage, they say.

But the industry must be closely regulated.

“Without safeguards, 45V risks creating a shell game in power markets, where existing clean generation gets nominally claimed by hydrogen electrolyzers but the resulting gap in grid capacity is backfilled by fossil fuel generation,” the Senators wrote.

“In such a scenario, the program would undermine climate progress and lead to the production of hydrogen with a true emissions intensity higher than even its conventional fossil fuel-derived counterpart.”

Many in the industry, meanwhile, say that overly strict implementation of the ‘Three Pillars’ could kill the new-born industry in the crib.

“If you put stringent limits on this, the ability to move quickly to introduce hydrogen as a decarbonizing tool gets hampered. You defer investments and you avoid creating diversity,” President and CEO of the Fuel Cell and Hydrogen Energy Association Frank Wolak says.

“Rigid interpretations of additionality and hourly matching don't help the industry grow and don't help and the cause of decarbonization necessarily.”

By Paul Day