Sunrun to buy Vivint for $1.5 billion; UK developers ramp up solar-storage build

Our pick of the latest solar news you need to know.

Related Articles

Sunrun to buy rooftop competitor Vivint for $1.5 billion

US residential solar installer Sunrun is to buy competitor Vivint Solar for around $1.5 billion, the companies announced July 6. The new company will have a combined enterprise value of $9.2 billion.

"This transaction will increase our scale and grow our energy services network," Lynn Jurich, CEO of Sunrun said.

"Joining forces with Sunrun will allow us to reach a broader set of customers and accelerate the pace of clean energy adoption and grid modernization," David Bywater, Vivint CEO, said.

Sunrun shareholders will hold around 64% of the combined company, with the remainder held by Vivint stockholders. Together, the companies have around 500,000 customers, representing 3 GW of capacity.

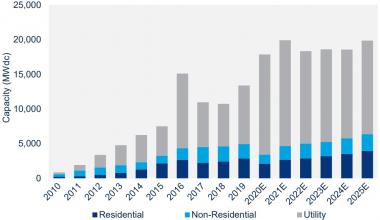

Forecast US solar installations by segment

(Click image to enlarge)

Source: Wood Mackenzie, SEIA (June 2020)

The acquisition will create around $90 million of annual savings, the companies said.

"We see opportunities across the entire cost base, including consolidating and optimizing our branch footprint, reducing redundant spending on technology systems, scaling our proprietary racking technology, as well as improving sourcing capabilities within our supply chains," they said.

Battery products will expand revenue opportunities.

"A larger footprint of solar and battery assets...increases the value of what we bring to our grid services partnerships and strengthens our ability to deliver considerable value in that business," the groups said.

US House committee backs solar, wind in new climate plan

A U.S. House select committee has called on Congress to enact a range of long-term measures to reduce emissions and improve the health of US citizens.

The U.S. House Select Committee on the Climate Crisis called for the US to achieve net zero carbon dioxide emissions by 2050 and to establish interim targets to assess progress. Greenhouse gas emissions must fall to 37% below 2010 levels by 2030 and 88% below 2010 levels by 2050, it said.

Congress must support the "rapid deployment" of solar, wind, energy efficiency and other low carbon measures, as well as new transmission infrastructure, the committee said.

Measures that incentivize domestic manufacturing of clean technology must be implemented, including clean vehicles, it said.

New laws must also be put in place by 2030 to protect at least 30% of all US land and ocean areas, prioritizing areas with high ecological and carbon sequestration value, the committee said.

Limits on fossil fuel extraction must be implemented on onshore and offshore areas, it said.

The committee also called for the launch of new economic sectors such as direct air capture and low carbon building materials.

Further measures are required to protect US citizens from high pollution areas and the effects of climate change, it said.

Macquarie, Enso to build 1 GW of UK solar plus storage

Macquarie’s Green Investment Group (GIG) and renewable energy developer Enso Energy have formed a joint venture to develop 1 GW of unsubsidized solar plus storage capacity in the UK, the companies announced June 29.

"Initial projects are grid secured and are being submitted for planning approval," the partners said. "This includes projects across England and Wales, where the team are currently conducting virtual community consultations."

The coupling of solar and batteries will allow the plants to supply peak demand periods as well as grid services that help mitigate rising solar and wind capacity.

Many of the projects will use the latest bifacial and tracking technology, which should increase efficiency and lower average costs.

GIG and Enso plan to sign corporate power purchase agreements (PPAs) for the projects.

GIG was initially launched by the UK government in 2012 as the Green Investment Bank. Bought by McQuarrie in 2017, GIG has financed 7.5 GW of renewable projects in the UK and has a global development pipeline of 25 GW.

Enso has developed over 1.5 GW of renewable energy projects in the UK.

EDF partners with Octo Energy to develop UK solar plus storage

French electricity giant EDF has partnered with UK renewable energy developer Octo Energy to build 200 MW of solar plus storage capacity in England and Wales, EDF announced June 29.

Octo will seek out opportunities on dual-use sites, such as farmland, the companies said.

EDF is one of the "Big Six" energy suppliers in the UK. The group currently owns 1 GW of UK solar capacity and 1 GW of wind. The group also operates a 49 MW battery, the largest in the UK, at its West Burton gas-fired power station.

EDF's partnership with Octo forms part of the group's plan to build 10 GW of storage capacity in Europe by 2035 and double its renewable energy capacity to 50 GW by 2030.

Last November, EDF bought Pivot Power, a UK-based developer of storage and infrastructure for electric vehicle charging. Pivot plans to install 2 GW of battery capacity directly to the high-voltage transmission system. The first projects are expected online in south-east England in 2020.

Reuters Events