Turbine data sharing gains momentum as owners seek edge

Anonymised data sharing platforms are providing wind operators with greater performance insights but turbine suppliers could instigate far larger gains, industry experts said.

Related Articles

As wind farm owners strive for greater competitiveness, the importance of turbine data is growing. Greater sharing of operations and maintenance (O&M) data could benefit the entire supply chain, from research and development (R&D) through O&M and lifetime extension.

Benchmarking of O&M data can lead to better equipment selection or improved designs, as well as a raft of operational savings. Despite this, there is limited data available publicly, mainly due to the commercial sensitivities of turbine suppliers and operators.

Wind asset owners are increasingly using sensors and analytics to implement predictive maintenance strategies and reduce downtimes. Fleet operators are building up in-house O&M expertise and growing datasets give larger owners an advantage.

Pockets of data sharing initiatives have sprouted up throughout the wind industry but a wider global initiative could offer greater breakthroughs and innovations.

Successful early data sharing schemes have shown that by anonymising the data, participants can access cost-saving insights without compromising commercial interests.

Data inspectors

Valuable data points for wind turbine operators include vibration data, supervisory control and data acquisition (SCADA), records of component failure and repair and return to service dates, Noah Myrent Global Head of Monitoring at ONYX InSight, a predictive maintenance specialist, told Reuters Events.

Some of the greatest savings from data insights are in major component maintenance, where planning is key, he said.

Gearboxes remain a key source of asset failure and many fail to reach their expected 20-year lifetime. Bearing issues are the main cause and by spotting issues at an early stage, operators can avoid gearbox replacements that can cost several hundreds of thousands of dollars.

Operators can assess bearing health by monitoring vibration, temperature and grease sample particle counts and comparing records of previous failures, Myrent said.

"By utilising these data sources, spare parts, downtime and crane mobilisation can all be planned properly," he said. By combining this data with weather and crane availability data, operators could move to a more automated and predictive maintenance approach.

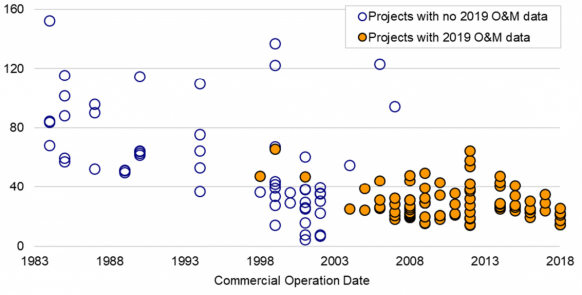

US average wind O&M costs by installation year ($/kW-yr)

(Click image to enlarge)

Note: Limited data set

Source: Lawrence Berkeley Lab, August 2020.

Data pooling can be particularly valuable for high-impact failures that occur less frequently, Sally Shenton, Director at Generating Better, an O&M consultancy, said.

This would help operators better estimate contingency funds for major repairs, such as subsea cable repairs in offshore wind farms, Shenton said.

“Access to a wider data set would reduce the uncertainty around this number and hence reduce cost risk," she said.

Group gains

Many offshore wind operators continue to miss out on the vast potential of data analytics. Offshore wind O&M costs are falling and data and digital twins are playing an increasing role in this, but the progress towards predictive maintenance has been relatively slow, Mark Spring, Principal Engineer for Renewables O&M at Lloyd’s Register, said.

A benchmarking platform for UK offshore wind farms shows how operators can embrace data sharing concepts to improve performance.

Launched in 2014 by the UK innovation hub Offshore Renewable Energy (ORE) Catapult, the System Performance, Availability and Reliability Trend Analysis (SPARTA) platform collects anonymised operational data from 94% of UK installed offshore wind capacity.

SPARTA collects data on 88 key performance indicators at system level, from blades to onshore substations. The platform issues monthly reports to participants, allowing them to compare against industry standards and identify areas of cost reduction.

By collecting anonymised data, a greater level of detail can be shared with partners. Given the high level of participation in SPARTA, the value to operators is clear.

"If you don’t supply the data you won’t be able to see how the sector is performing,” Steve Ross, Digital & Data Business Lead at ORE Catapult, said.

Last year, the US Electric Power Research Institute (EPRI) launched the Wind Network for Enhanced Reliability (WinNER), a new collaborative reliability database for wind O&M.

Operators supply anonymised data on turbine health to the platform and are able to compare asset reliability against the wider industry as well as against specific models of turbine and major components, Raja Pulikollu, Principle Technical Lead in the EPRI's wind power R&D program said. The platform currently includes around 12 GW of installed onshore capacity and EPRI expects to double this by the end of the year.

"Participants can use WinNER for O&M budget projections, and OEM/supplier quality assessments," he said.

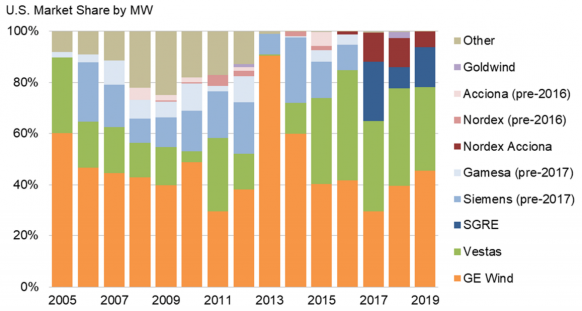

Annual US market share of wind turbine suppliers

(Click image to enlarge)

Source: Lawrence Berkeley Lab, August 2020

Other turbine reliability databases include WindStats in Denmark, and the WMEP, LWK and Landwitschaftskammer platforms in Germany.

In addition, consultancies such as Nabla Wind Power have built up turbine reliability databases using a combination of propriety data, monitoring and modelling to estimate performance and lifespan. Reports from such databases could become increasingly important as fleets age and more investors make decisions on major component replacement and lifetime extension.

Higher margins

A greater willingness of turbine suppliers to share data could have the largest impact on O&M efficiency. As the value of data grows, suppliers have been keen to protect their intellectual property but this could be hampering broader innovations across the wind sector.

Data sharing could also create savings for turbine suppliers as they look to diversify their income sources. Already providers of data analytics solutions, turbine suppliers are competing for third-party maintenance contracts to increase their share of the O&M market, where margins are higher than for turbine supply.

"We can’t say for certain whether the turbine suppliers will change their stance going forward, but through policy and standardisation we can guide the inertia towards more open data access," Myrent said.

"If the industry were to move in this direction, I would expect the turbine design constraints and overall reliability of future turbines to improve at a faster rate over time."

Reporting by Neil Ford

Editing by Robin Sayles