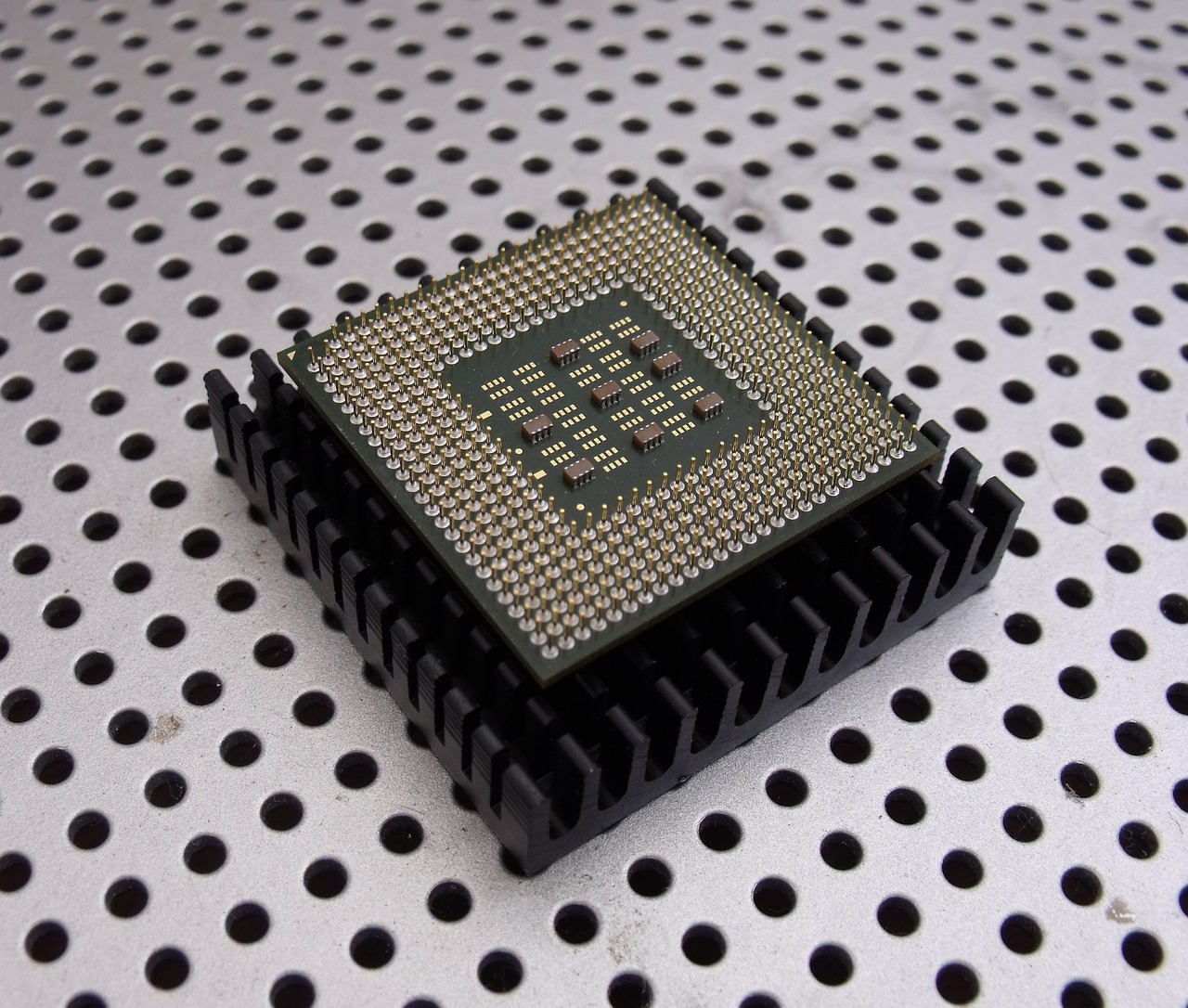

Microchip supply chains now part of geopolitical strategy

Microchips are now at the forefront of policy makers minds as global supply chains reconfigure

Whereas the location of oil reserves has defined much of geopolitics for the last fifty years, the next five decades could see global politics dominated by the availability, trade and investment in microchips.

Pat Gelsinger, CEO Of Intel, says the company’s investment in manufacturing facilities in the US, Europe and elsewhere is key to the “globalisation of the most critical resource to the future of the world. We need this geographically balanced, resilient supply chain.”

The concentration of chip manufacturing in Asian countries, and the subsequent shortages during the Covid-19 crisis, have led to a rethink about manufacturing sources.

The company has said it will invest $20bn in US chipmaking facilities and up to $90bn in new European factories in an effort to regain its position as the leader of the semiconductor industry.

The US CHIPS and Science Act of 2022 should lead to an investment of more than $200bn in helping companies grow US domestic chipmaking and research. Key companies are now waiting for the funds, as a result of this law, to be dispersed.

Gelsinger expects to see those funds in 2023 and is investing Intel funds on that basis.

Similarly, the European Commission has also moved towards securing more supply of chips, enacting the European Chips Act, the European Commission, which puts aside 15 billion euros for public and private semiconductor projects by 2030.

The UK also plans to provide subsidies to chip manufacturers in assign of a heating battle to gain production facilities between major global players.

Companies such as Infineon and Intel have already announced investments, and GlobalFoundries, which already has European fabrications plants is planning to expand in France.