European supply chains predict falling demand, weak ocean freight market

Sentiment projects global demand for goods to fall, creating overcapacity in shipping market

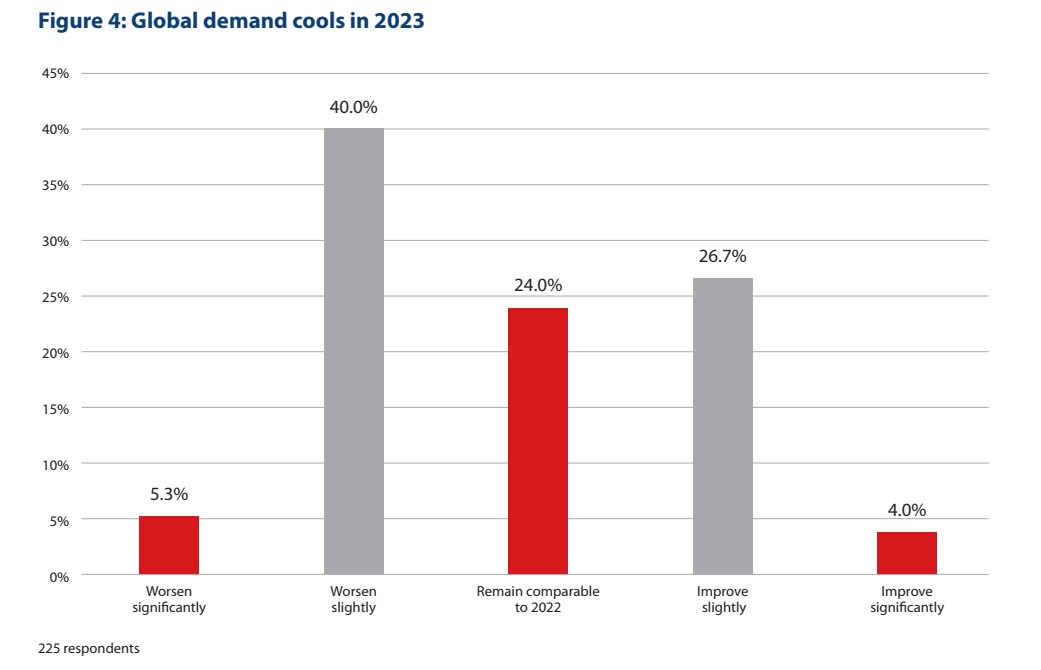

A new white paper has found that 45% of EMEA supply chain professionals anticipate global demand for goods to fall, while 31% forecast expansion, representing a -15% net balance.

The research, which drew on opinions from nearly 300 individuals, does note, however, that there are relatively few that expect these swings to be dramatic. Just 5% predict conditions to ‘worsen significantly’ and 4% foresee a significantly improved demand outlook.

Inflation key to outlook

A large part of that expectation is driven by the inflationary environment, which the white paper notes is a major concern. Fifty-five per cent of respondents said that they expect disruption as a result of inflation diminishing consumer spending power.

David Rea, Chief Economist EMEA for JLL, notes in the paper that: “Household incomes are still going up. However, a greater share of that disposable income is being diverted to pay for energy, food and the essentials, and less for the non-essentials, which make up the remainder of consumer spending.

“I think you've got short term pressure while we're in this period of heightened inflation that poses a negative cyclical element for goods demand, but it's not amplifying any structural elements, so it should be relatively short term.”

A weaker ocean freight market

A weakening demand for goods is predicted to feed into the shipping market, as supply chain professionals largely expect over capacity in the ocean freight market in 2023.

In the survey 23% more respondents expect there to be overcapacity than a shortage in 2023, with 58% predicting too many ships chasing too few buyers. Thirty-one percent expect that oversupply to be moderate or severe.

This will be a continuation of conditions seen in 2022 and reversal of what was seen in the immediate aftermath of the pandemic.

The upside of this should be to reduce inflationary pressure as ocean freight contracts are renegotiated and feed into the wider pricing picture throughout 2023.

Asia-Pacific expected to lead

When it comes to the regional outlook, EMEA professionals predict that Asia-Pacific will be the global growth engine, with 42% predicting it will be the fastest growing region.

This is twice the share of the next most chosen region, North America, and only 13% believe that EMEA will lead the way.

However, coming back to those concerns regarding a global recession, nearly a fifth – 18% – said that they don’t expect growth in any global region in 2023, marking out a cautious opening to the year.

For more insights into the core trends that will shape European supply chains over 2023, download the white paper for free here.