Wind supply bottlenecks threaten climate goals; EU unveils grid action plan

The wind power news you need to know.

Related Articles

Global wind supply gaps threaten climate goals

Bottlenecks affecting the wind supply industry could undermine global efforts to prevent temperatures from rising more than 1.5°C above pre-industrial levels, according to a report by the Global Wind Energy Council (GWEC).

The report came ahead of the first ever global agreement to begin reducing global consumption of fossil fuels to avert the worst of climate change, signed by nearly 200 countries at the COP28 climate summit on December 13.

The agreement calls for "transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner ... so as to achieve net zero by 2050 in keeping with the science."

The world needs to triple wind energy capacity to 2.7 terawatts (TW) by 2030 to reach the global warming target set at COP21 in Paris in 2015 but the supply chain for minerals, turbines and key components such as towers and nacelles is “not fit for purpose,” GWEC warned.

The global supply chain is too dependent on China with the U.S. and Europe lagging far behind despite ambitious renewable energy goals, the industry group said.

As a result, installed wind capacity will only reach 2 TW, it said.

Supply chain investments in the U.S. and Europe have been insufficient in recent years, mainly due to “stop-start government policies, permitting bottlenecks and a lack of clarity and regular cadence for tenders," the report said. Policies have largely focused on obtaining the lowest possible prices for wind energy, failing to account for higher capital and material costs, “making investment in supply chains unviable."

The lack of manufacturing capacity will cause shortages of carbon fiber, blades, castings, towers and foundations. Nacelle assembly capacity will likely face serious bottlenecks outside of China and India, while rare earths refining is now dependent on China and projects elsewhere are not expected to start production until 2028, it said.

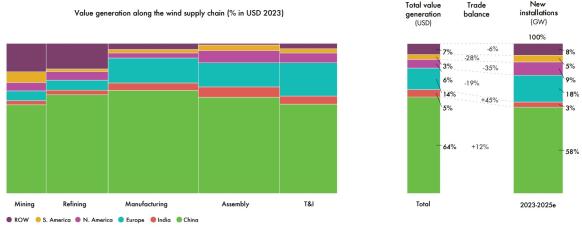

Value added to wind supply chain by region

(Click image to enlarge)

Source: GWEC, IEA, BCG analysis (December 2023).

GWEC called on Europe and the U.S. to speed up permitting, increase auction prices to incentivise domestic manufacturing, and build regional supply chain hubs while keeping trade open to ensure that raw materials and components can flow across borders.

Europe should put a strong focus on increasing gearbox, converter and generator manufacturing, while the U.S. needs to establish those industries from scratch, the report said. Meanwhile, leading original equipment manufacturers (OEMs) need to standardise production by focusing on modular designs.

“Through a coordinated global effort from industry and policymakers, we firmly believe that the challenges in the global wind supply chain can be resolved over the course of this decade,” GWEC said.

Europe fast tracks 68 power grid projects in action plan

The European Union has identified 68 electricity grid projects that will gain priority access to permits and EU funding in a new plan to accelerate grid expansions and accommodate growing renewable energy capacity.

The EU aims to install 1,000 GW of solar and wind capacity by 2030, compared with 400 GW in 2022, requiring 584 billion euros ($637 billion) of investments in the power grid, the European Commission said in a statement.

To this aim, the EC has identified 68 grid projects, along with five smart grid projects and 12 offshore wind infrastructure projects, as projects of common interest (PCIs) that are eligible for funding from the EU's Connecting Europe Facility.

These 85 projects address the "most pressing bottlenecks" in the EU transmission networks and around half are scheduled to be commissioned in 2027-2030, the EC said.

"Their timely completion is key to ensure that they can have an impact within this decade. Avoiding the slippages and delays that hampered PCI completion in the past requires an extra effort of monitoring progress and swiftly removing bottlenecks and obstacles to implementation," the commission said.

Cross-border transmission capacity must double in the next seven years, including an additional 23 GW by 2025 and a further 64 GW by 2030, the EC said.

Industry group WindEurope welcomed the announcement, saying it will improve long-term planning. The action plan mandates the European Network of Transmission System Operators (ENTSO-E) to identify needed grid investments for onshore and offshore developments, as well as storage and green hydrogen projects, it noted.

The EC will also work to increase coordination between investors, policymakers and regulators to improve access to finance for transmission projects.

WindEurope called for the European Investment Bank (EIB) to provide counter-guarantees that could lower financing costs for large-scale grid projects.

The commission also called on regulators to address speculative connection requests that are blocking up permitting queues, a move welcomed by WindEurope. Around 80 GW of EU wind projects are stuck in permitting queues.

EU approves France’s floating wind price guarantees

The European Commission has approved a French government scheme worth 4.12 billion euros ($4.4 billion) to support the construction of two floating wind farms in the Mediterranean Sea.

France will launch a tender next year for two wind farms in the Gulf of Lion of between 230 MW and 280 MW.

France will offer long-term contracts for difference (CFDs) that provide developers with a minimum revenue set during the tender process. The UK has long since used CFDs to support offshore wind growth and the contracts are increasingly being used across Europe.

Day-ahead wholesale power prices in Central Western Europe

(Click image to enlarge)

Source: European Commission's Quarterly Electricity Market Report.

The EU approved the scheme under the Temporary Crisis and Transition Framework, a program that aims to accelerate the clean energy transition and reduce dependency on Russian fossil fuels.

US approves Orsted’s Revolution Wind offshore wind farm

U.S. regulators have approved the construction of the 704 MW Revolution Wind project off the coast of Rhode Island.

Orsted and Eversource made the final investment decision on the $1.5 billion project in October. Onshore construction has already begun and offshore construction will start in 2024 with project completion expected in 2025.

The companies are pushing ahead with the project despite a sharp increase in costs since offtake contracts were signed. Orsted recorded an impairment of 3.3 billion Danish krone ($485 million) on the project in Q3 but said it has "an attractive forward-looking value creation with a forward-looking spread to [weighted average cost of capital] above Orsted’s guided range."

On December 6, the project partners produced the first power from their 130 MW South Fork wind farm off the coast of New York. Two turbines have been installed and ten more will be installed in early 2024, Orsted said.

The project milestones come at the end of a turbulent year for the U.S. offshore wind industry, which has been squeezed by higher interest rates, rampant inflation, and supply chain disruptions.

Efforts by several offshore wind developers to renegotiate their power purchase agreements and secure higher prices have largely failed, leading to project cancellations along the Northeast coast and threatening President Joe Biden's target of installing 30 GW of offshore wind capacity by 2030. Last month, Orsted said it will cease development of its offshore wind projects Ocean Wind 1 and 2 in New Jersey, in large part due to a shortage of installation vessels.

In March, the Rhode Island utility rejected Orsted's proposal to build an additional 884 MW Revolution Wind 2 project, saying it would be too costly for consumers.

Reuters Events