New York rejects changes to offshore power contracts; EU to aid wind financing

The wind power news you need to know.

Related Articles

New York denies request to adapt offshore wind contracts

New York regulators rejected a request from major offshore wind developers to improve the financial terms of their power purchase agreements (PPAs), a setback that could lead to delays and cancellations.

The petitioners included Orsted, the world's largest offshore wind developer, which had asked for amendments to the PPA for its 880 MW Sunrise Wind project, as well as Equinor and BP, which requested modifications to the contracts for their Empire 1, Empire 2 and Beacon Wind projects with a total capacity of 3.3 GW.

The companies argued that the contracts should be renegotiated to account for rampant inflation, higher interest rates and supply chain disruptions that have led to higher construction costs.

But the New York State Public Service Commission said that the requested amendments were not “in the best interests of the State’s ratepayers” because they would have increased energy prices by up to 6.7% for residential customers and 10.5% for industrial clients.

The decision puts the projects in “serious jeopardy,” the New York Offshore Wind Alliance (NYOWA) said.

"These four projects represent nearly half the [offshore wind] capacity New York has committed to develop by 2035, and should they be allowed to fail, the state must redouble its efforts to make up this shortfall and honor its commitment to climate progress," said NYOWA Director Fred Zalcman.

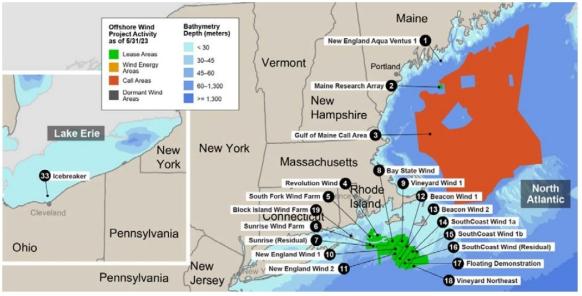

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

New York PSC's decision also applied to 81 solar projects and five onshore wind projects for a total 7.5 GW of capacity, the Alliance for Clean Energy New York said.

In response to the decision, New York Governor Kathy Hochul released an "action plan" to support the renewable energy industry. The plan includes an accelerated procurement process for offshore and onshore projects "to backfill any contracted projects which are terminated."

New York officials will seek to simplify bid requirements, incorporate inflation indexing, and increase collaboration among stakeholders to accelerate the procurement process.

Higher costs have forced developers to announce contract terminations for three offshore projects in Massachusetts and Connecticut with a total production capacity of 3.2 GW.

Rhode Island launches inflation-linked offshore wind tender

The state of Rhode Island has reopened a solicitation to secure up to 1.2 GW of offshore wind energy.

Denmark's Orsted and U.S. utility Eversource were the only bidders for a previous solicitation but Rhode Island Energy in July rejected their joint bid for the 884-MW Revolution Wind 2 project saying that the power prices sought by the companies were too high.

Orsted owns the only two offshore wind projects in the state, the 30 MW Block Island Offshore Wind Farm, which started commercial operations in 2016, and the planned 704 MW Revolution Offshore Wind, which will provide 400 MW of clean energy to Rhode Island and 304 MW to Connecticut.

The latest solicitation process allows offshore wind companies to request inflation-indexed prices in their bids, with a maximum inflationary adjustment of 16%. Companies have been calling for indexation after soaring inflation and interest rates pushed up project costs.

"With a larger capacity available, a streamlined application process, additional flexibility on contract durations, and the potential for multi-state coordination, we believe this solicitation could provide greater economies of scale for developers," Rhode Island Energy said in a statement.

Developers have until January 31 to submit bids for power purchase agreements (PPAs) of between 15 and 30 years and the winner will be revealed next summer.

The solicitation would allow Rhode Island to source about 70% of its electricity needs from renewables.

Earlier this month, Massachusetts, Rhode Island and Connecticut signed an agreement to jointly procure offshore wind power.

The states plan to launch procurement auctions for a total of 6 GW of offshore wind energy in 2024 and may decide to select multi-state proposals and split the renewable energy that would be generated by such projects.

US reveals Maine floating wind lease area

The U.S. Bureau of Ocean Energy Management (BOEM) has identified an area in the Gulf of Maine that could host up to 40 GW of offshore wind in preparation for the first commercial lease sale in Maine next year.

The draft Wind Energy Area (WEA) covers around 3.5 million acres offshore the three Gulf of Maine states ― Maine, Massachusetts and New Hampshire. The closest point to land is 23 miles off the coast and the furthest is 120 miles.

The Gulf of Maine hosts 156 GW of potential offshore wind capacity but most of this is floating wind as the waters are too deep for fixed-bottom technology.

Maine plans to install commercial-scale floating wind by 2032 and the state’s governor, Janet Mills, this summer signed into law a bill to procure 3 GW of floating wind by 2040 through long-term power purchase agreements (PPAs).

The legislation requires the state Public Utilities Commission to issue its first request for contract proposals by January 2026 and says that future solicitations will each seek at least 600 MW of offshore wind energy.

The three Gulf of Maine states have set up a taskforce to proactively study transmission needs alongside environmental and research concerns in pre-leasing discussions with the BOEM. Areas of discussion include possible landing points, how transmission is factored into the leasing process and requirements for onshore grid upgrades.

Aqua Ventus, a partnership between Mitsubishi subsidiary Diamond Offshore Wind and German energy group RWE, plans to start construction of the country’s first floating offshore wind project in a research area off the coast of Maine next year.

US invests in five Midwest power line projects

The Biden administration announced $3.5 billion of grid investments that will include five transmission projects across seven Midwest states under a new interregional planning process.

New power lines will be built in Iowa, Kansas, Nebraska, North Dakota, Minnesota, Missouri, and South Dakota to support renewable energy deployment, under a coordinated interregional assessment process that studies multiple projects at once, rather than in sequential timelines. This new process will result in "scalable transmission solutions, new renewable generation, lower energy costs, and enhanced community engagement and workforce development," the Department of Energy (DOE) said in a statement.

A lack of grid capacity and slow grid approvals have delayed wind and solar projects across the U.S.

In total, the investment plan features 58 projects to strengthen the transmission grid in 44 states and make it more resilient to extreme weather events brought about by the climate crisis, the DOE said. The plan will help bring more than 35 GW of wind and solar energy online, it said, and is the first round of selections under the $10.5 billion grid resilience and innovation partnerships (GRIP) program that is funded by the 2021 Bipartisan Infrastructure Law.

"The grid, as it currently sits, is not equipped to handle all the new demand ... we need it to be bigger, we need it to be stronger, we need it to be smarter, to bring all of these new projects online," Energy Secretary Jennifer Granholm told reporters.

EU to support financing for wind suppliers

The European Union plans to boost financial support for wind turbine manufacturers and shorten permitting times for wind farm projects, in a set of "immediate" measures unveiled by the European Commission on October 24.

The action plan includes financial support for wind turbine suppliers through access to the EU Innovation Fund and de-risking guarantees from the European Investment Bank, the EC said.

The commission wants to improve manufacturers' access to financing so they can expand and reduce Europe's reliance on foreign components. Europe's largest turbine makers all posted operating losses in 2022 as soaring inflation dented already tight margins and supply delays hampered deployment. The EU has set a target of 42.5% of energy from renewable sources by 2030, almost double the current share.

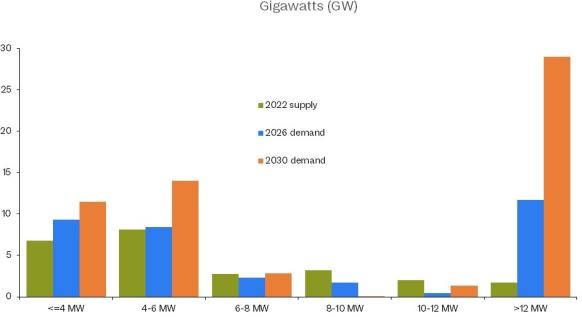

European wind turbine manufacturing capacity, by size

(Click image to enlarge)

Source: Rystad Energy

The EC also said it would scrutinise foreign subsidies, as local manufacturers face increased competition from China. An EU official told Reuters October 24 the EU still lacks sufficient evidence of unfair practices to launch a formal probe into China's wind power industry.

Other new measures set out by the EC include guidelines for national renewable energy auctions that would favour local content by introducing non-price criteria.

On permitting, the commission will launch an initiative to "ensure swift implementation of the revised EU renewable energy rules, putting more focus on the digitalisation of permitting processes and technical assistance to Member States," it said.

Slow permitting is one of the main hurdles preventing the EU from achieving its goal of 480 GW wind capacity by 2030. The EU installed 19 GW of wind power in 2022, well below the 30 GW a year needed to meet the goal.

New rules provisionally approved by EU officials earlier this year set a two-year maximum for permitting new onshore wind projects and one year for repowering projects but member states have some time to implement the rules.

The EC will also "support the necessary build-out of electricity grids with a Grids Action Plan later this year," it said.

Reuters Events