Europe agrees 40% local manufacturing plan; US approves largest offshore wind project

The wind power news you need to know.

Related Articles

EU agrees rules to boost clean energy manufacturing

EU policymakers have provisionally agreed new rules to promote local production of clean technology equipment, including wind turbines and solar panels.

The EU is heavily dependent on Chinese manufacturers and European wind turbine makers have long called for the introduction of non-price criteria in future auctions in a bid to fend off Chinese rivals.

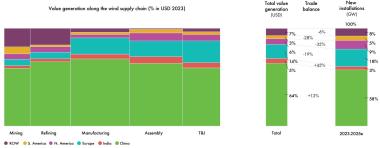

Value added to wind supply chain by region

(Click image to enlarge)

Source: GWEC, IEA, BCG analysis (December 2023).

Under the Net-Zero Industry Act (NZIA) approved on February 6, at least 30% of the volume of renewable energy auctioned every year must include pre-qualification and non-price award criteria to encourage developers to source materials from EU suppliers. These criteria will include environmental sustainability, contribution to innovation, and integration of energy systems, EU policymakers said.

“Europe is taking another decisive step away from auctions based on price only. The Net Zero Industry Act enshrines pre-qualification criteria to ensure auctions don’t award the cheapest projects but those projects that bring the biggest value to Europe,” Pierre Tardieu, Chief Policy Officer at WindEurope, said in a statement.

The NZIA aims to ensure that at least 40% of all clean energy technology is manufactured in the EU by 2030, including solar photovoltaic panels, wind turbines, and batteries. Under the proposed legislation, EU members must issue construction permits for large clean energy manufacturing facilities (of more than 1 GW) within 18 months, while smaller projects must be approved within 12 months.

The NZIA has been provisionally approved by the European Council and the European Parliament, but still needs to be formally endorsed and adopted by both institutions.

Vestas bounces back to operating profit

Vestas, the world’s largest wind turbine maker, returned to operating profit last year, bouncing back from losses in 2022 that were driven by supply chain challenges and higher prices for raw materials.

The Danish company made a full-year operating profit before special items of 231 million euros ($249 million) in 2023, compared with a loss of 1.2 billion euros the year before.

Adjusted operating profit in the fourth quarter was 191 million euros versus a loss of 514 million euros a year earlier, beating analysts' forecasts.

"In 2023, Vestas managed to get 'back in black' as our commercial and operational discipline is paying off," Vestas said in its annual report.

In a statement, the company said it received record orders of 18.4 GW in 2023, “which was driven by a record-setting fourth quarter that underlines our strong momentum at the end of the year.”

"Continued geopolitical volatility as well as slow permitting and insufficient grid build-out across markets are expected to cause uncertainty in 2024," CEO Henrik Andersen said in a statement.

However, the company expects to see “growth in revenue” in 2024, thanks to an increase in wind installations and higher prices for its products.

Earlier this month, Vestas started construction of a new nacelle and hub assembly factory in the port city of Szczecin, Poland, that is expected to begin operations in 2025. The turbine maker said it plans to establish another facility in Szczecin, which is near the Baltic Sea, to manufacture offshore blades.

“Vestas’ investment in Szczecin is fantastic news. It will make Europe’s wind supply chain more resilient and help boost our energy security,” WindEurope said in a statement.

US approves its largest offshore wind farm yet, in Virginia

Utility Dominion Energy has received federal approvals to start building the 2.6 GW Coastal Virginia Offshore Wind (CVOW) farm that will be the largest in the United States.

The project is located 27 miles off the shore of Virginia Beach and the Bureau of Ocean Energy Management (BOEM) has granted Dominion permission to install 176 turbines and three offshore substations while the Army Corps of Engineers has given the company the go-ahead to build a transmission line to connect the farm with the onshore grid.

"These regulatory approvals keep [the project] on time and on budget as we focus on our mission of providing customers with reliable, affordable and increasingly clean energy," said Bob Blue, Dominion Energy's chair, president, and chief executive officer.

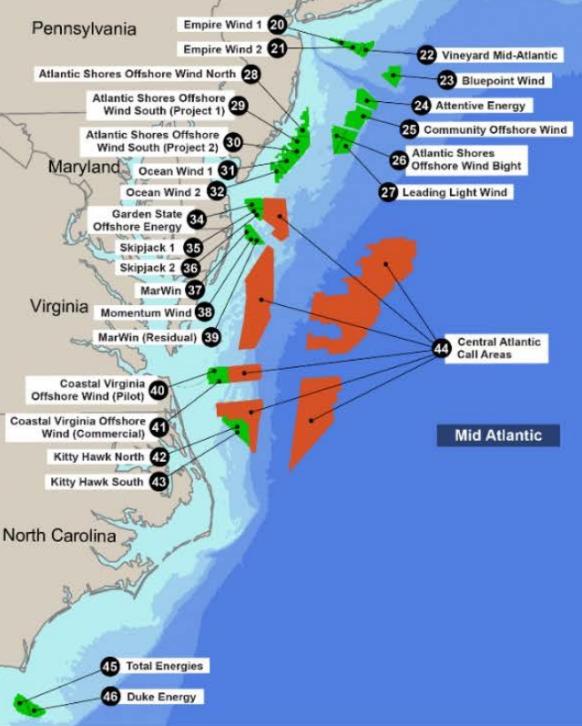

Offshore wind projects in US Mid Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Some onshore construction activities began in November 2023 and offshore construction for the export cable and monopile installation is slated to start in the second quarter of 2024, with completion expected for 2026.

“As the largest planned offshore wind project in the nation, the CVOW project will power approximately 660,000 homes with renewable energy while unleashing increased economic growth and jobs in the Mid-Atlantic region and shipbuilding in the Midwest and Gulf Coast,” American Clean Power (ACP) association said in a statement.

To install the turbines, Dominion has commissioned the first U.S.-built and Jones Act-compliant offshore wind turbine installation vessel. The 'Charybdis' is expected to be completed in late 2024 or early 2025 and start installing turbines for the Coastal Virginia project in 2026.

US bill could more than double interregional transmission

New legislation being considered by U.S. lawmakers could increase national interregional transmission capacity from 84.4 GW to 191 GW within 10 years, a study shows.

More interregional transmission will accelerate clean energy deployment, lower prices for consumers, and increase grid reliability, the analysis by the Center on Global Energy Policy at Columbia University (CGEP) said, citing data from the U.S. Department of Energy.

However, grid operators have barely built any interregional transmission over the past 10 years.

To ensure that renewable energy can be transported to urban and industrial centers, the U.S. Congress is considering several pieces of legislation, including the Big Wires Act, which would require grid operators to have interregional grid capacity equivalent to at least 30% of peak electricity demand.

Under the proposed legislation, the Federal Energy Regulatory Commission (FERC) must set these minimum transfer requirements within 18 months of the bill’s passage, and regions will have two years to outline what kind of infrastructure needs to be built to meet those targets.

“More critically, these joint filings would have to incorporate a deadline for the construction of new transmission lines by the end of 2035, including which entity or entities would build the facilities and how costs would be allocated on an interregional basis,” CGEP said in its analysis.

The bill was introduced in September by Senator John Hickenlooper and Representative Scott Peters. The Democratic legislators last summer said they are working with stakeholders and industry experts to ensure "the bill is on the right track." However, it is unclear if the bill will be approved before November's presidential and congressional elections.

“If passed, the Big Wires Act could set in motion an expansion in transmission capability unprecedented in speed and scope, a crucial factor for a more integrated, cleaner, and cost-effective national grid,” CGEP said.

Reuters Events