EU ban on forced labour set to hit Chinese imports; US solar panel imports soar

The solar news you need to know.

Related Articles

EU bodies agree to ban goods made with forced labour

European Union Council and the European Parliament reached a provisional agreement on March 5 to ban imports of products made with forced labour.

Under the agreement, EU authorities would monitor global reports of forced labour to identify offending companies and ban their products.

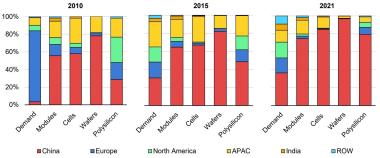

Solar manufacturing capacity by country, region

(Click image to enlarge)

Source: International Energy Agency's Report on Solar PV Global Supply Chains, August 2022

In 2022, the U.S. blocked imports from Xinjiang province in China as part of an effort to eliminate goods made with the forced labor of Uyghur minorities.

The Xinjiang region produces almost half of all global polysilicon used to build solar panels and the EU has continued to import large amounts of solar panels from the region.

The EU agreement would ban products made with forced labour as well as products made in the EU that contain parts made with forced labour.

"With this regulation we want to make sure that there is no place for their products on our single market, whether they are manufactured in Europe or abroad," Pierre-Yves Dermagne Belgium's Economy and Labour Minister said in a statement.

The agreement, which requires formal approval by the European Parliament and the Council to be enforced, comes as Europe's solar industry calls for emergency support for manufacturers following a glut of Chinese solar products that has pushed down prices.

US solar panel imports hike 82% to 54 GW

U.S. solar panel imports soared by 82% in 2023 to 54 GW following an unprecedented wave of imports from Southeast Asia, analysts at S&P Global Market Intelligence said in a note.

The U.S. installed around 33 GW of solar in 2023, early data showed.

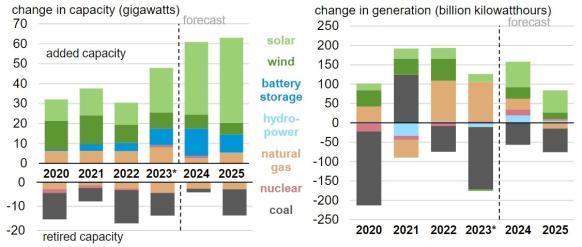

Forecast US power installations

(Click image to enlarge)

Source: U.S. Energy Information Administration, January 2024

China dominates global solar supply and the Biden administration is using tax credits in the 2022 Inflation Reduction Act to encourage investment in new U.S. factories. The U.S. had only 8 GW of solar module production capacity in 2022 and solar installations must triple to over 60 GW/year to hit President Biden’s climate goals.

U.S. solar panel imports in the fourth quarter rose by 40% on a year ago to 15 GW, S&P Global analysts said, citing data reported to the U.S. Census Bureau.

Global solar prices have fallen following a glut of products from Chinese companies, some of which are being produced in other Southeast Asian countries.

The U.S. imposes import tariffs on products from China but many companies have looked to bypass these rules by producing in other Southeast Asian countries. The U.S. has widened tariffs to include some of these facilities but the Biden administration waived these new measures until June 2024 to ensure U.S. solar developers have sufficient supply.

The European Union is also looking at ways to protect solar manufacturers after the industry warned a glut of Chinese imports have crushed prices and put some European suppliers at risk of bankruptcy.

Solar costs fall in Asia Pacific as China ramps up supply

The cost of building utility-scale solar in Asia Pacific (APAC) fell by 23% last year and is forecast to drop by a further 20% by 2030 on the back of "falling module prices and increasing oversupply from China," Wood Mackenzie said in a research note.

Costs fell last year as post-pandemic supply chain disruptions ended and inflation eased. A glut of low cost Chinese panels has driven down global solar prices and impacted suppliers in the U.S. and Europe.

In China, the levelised cost of solar, onshore wind and offshore wind is 40 to 70% cheaper than in other Asia-Pacific markets and China is expected to maintain a "50% cost advantage for renewables out to 2050," Wood Mackenzie said.

“Utility PV solar has emerged in 2023 as the cheapest power source in the [APAC] region, while onshore wind is expected to become cheaper than coal after 2025," Alex Whitworth, Vice President, Head of Asia Pacific Power Research at Wood Mackenzie, said.

"Renewables firmed with battery storage is becoming competitive with gas power today but will struggle to compete with coal before 2030,” Whitworth noted.

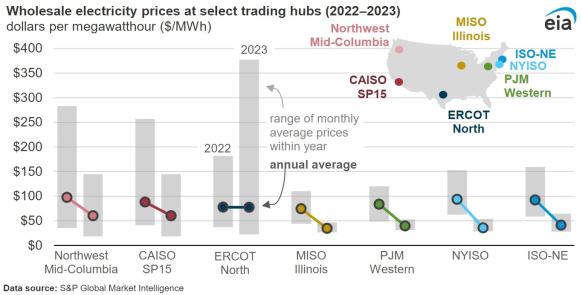

US wholesale power prices fall as gas prices soften

U.S. wholesale power prices fell in 2023 and price volatility eased in most markets, mainly due to lower gas prices, milder temperatures, reduced power consumption and improved hydroelectric conditions, the U.S. Energy Information Administration (EIA) said in a research note.

"Lower natural gas prices were the most uniform contributor to reduced wholesale electricity prices across regions in 2023," EIA said. Gas-fired plants tend to set the marginal price for electricity.

Power prices in Texas, the fastest growing U.S. solar market, were propped up by spiking prices during heat waves in June and July, EIA said. The state hit new electricity demand records on 12 days in late June and early July.

US wholesale power prices by market

(Click image to enlarge)

In the large eastern PJM market and the Midcontinent Independent System Operator (MISO) network, prices were lower in every month of 2023 compared with the same month in 2022.

Siemens to build $150 million US transformer factory

Siemens Energy plans to build a $150 million facility to manufacture power transformers in the U.S., the company said, potentially easing a major supply bottleneck for solar and wind developers.

The German power equipment supplier said construction of the factory in Charlotte, North Carolina, would create almost 600 local jobs.

In November, U.S. developers said a lack of high-voltage transformers could hold back solar, wind and battery deployment. Lead times for transformers and circuit breakers can be more than two years.

"As global demand for this critical technology increases, we see the long-term potential to increase our U.S. footprint, building on our longstanding presence in North Carolina," Siemens said in a statement.

Construction of the factory is slated to start this year with manufacturing due to begin in 2026.

Reuters Events