New trans-Africa CSP, PV plan tests regional scaling skills

A 4.5 GW solar build plan proposed by multilaterals and governments in Botswana and Namibia will present significant scaling challenges, requiring clear political momentum and a ramped tendering and development process, regional experts told New Energy Update.

Related Articles

In August, the World Economic Forum's Global Future Council on Energy unveiled a giant solar expansion plan in Botswana and Namibia that could provide over 4.5 GW of PV and CSP power to customers in southern and eastern Africa.

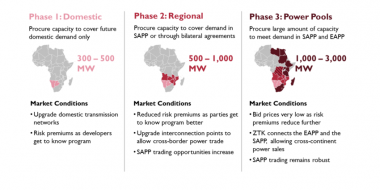

The plan, which has received the backing of Botswana and Namibia government officials and the World Bank, proposes a phased approach to large-scale PV and CSP construction.

The first phase would consist of 300 to 500 MW of new PV and CSP capacity built in Botswana and Namibia to supply domestic demand. Two subsequent phases could see the construction of a further 4 GW of capacity which would be exported via upgraded power interconnectors to supply the 17-member Southern Africa Power Pool (SAPP).

The Southern Africa solar plan

(Click image to enlarge)

Source: Power Africa, World Economic Forum (WEF)

Botswana and Namibia both host vast swathes of low-cost land that records direct normal irradiance (DNI) of over 2,200 kWh per year, similar to solar levels seen in Morocco, a fast-growing CSP market. Previous CSP feasibility studies in Botswana have earmarked the country’s North West copper mining region and the diamond mining area of Jwaneng. In Namibia, CSP projects have been proposed in Arandis, Swakopmund District and Khorixas, Kunene Region, but these have been shelved.

A combination of large-scale PV and CSP capacity would provide reliable daytime, evening and overnight power supply, cut dependence on fossil fuels and boost local employment. The development of a 275 MW PV plant and a 500 MW CSP plant could create 27,000 temporary jobs and 857 permanent jobs, WEF said.

“The biggest risk to the program moving forward is political will," Lisa Pinsley, Director of Energy at emerging markets investment firm Actis, an investor in PV, wind and gas projects in Southern Africa, told New Energy Update.

"So the Namibian and Botswanan support for the program that Power Africa [Global Future Council member] and WEF have assembled is critical,” Pinsley said.

Technology leap

The WEF's proposal has blindsided many regional experts that have been working with national utilities on domestic solar PV programs.

By mid-2019, Namibia had closed on 90 MW of renewable projects, including the country’s only large-scale PV project to-date, the 37 MW Hardap PV Project.

In July, NamPower unveiled a 4.7 billion Namibian dollar ($338 million) plan to build 220 MW of new renewable capacity at four plants. The new capacity will reportedly include PV, wind and biomass. NamPower would itself develop 150 MW and the remaining 70 MW would be procured from independent power producers, Simson Haulofu, managing director of NamPower, said.

Developing local expertise for larger solar projects will be critical to the success of the WEF's program, Chris Ahlfeldt, Owner & Founder of Blue Horizon, a Southern Africa-based consultancy, said. Blue Horizon co-authored Namibia's latest renewable energy policy and other feasibility studies such as the Uppington solar park in Northern Cape, South Africa.

“Most of the solar projects built in Namibia to-date have been 5 MW or less. Botswana began procurement for 100 MW of solar PV a couple years back, but has yet to successfully build any utility-scale projects in the country,” he said.

NamPower has been assessing the feasibility of a 135 MW CSP project in Arandis, near Swakopmund on the Atlantic coast, but this project is now not expected to be built within the company’s 2019-2023 business plan.

Recently, several global CSP developers have combined CSP and PV technologies in hybrid plant designs to minimize costs while fulfilling energy storage requirements. These include ACWA Power's 950 MW Noor Energy 1 project in Dubai and EDF's 800 MW Noor Midelt 1 project in Morocco.

“The scale of the [WEF's] planned program far exceeds what has already been done in [those] markets to date," Pinsley said.

"So the governments will need to convince investors that the program will materialize,” she said.

International bids

The first phase of deployment in Botswana and Namibia would "develop the market and build local capacity for managing the required technologies," WEF said in a statement.

"Critical to its success, and in a strong demonstration of political will, the proposed mega-solar project development approach proposes a competitive tendering process that will phase in the solar power,” it said.

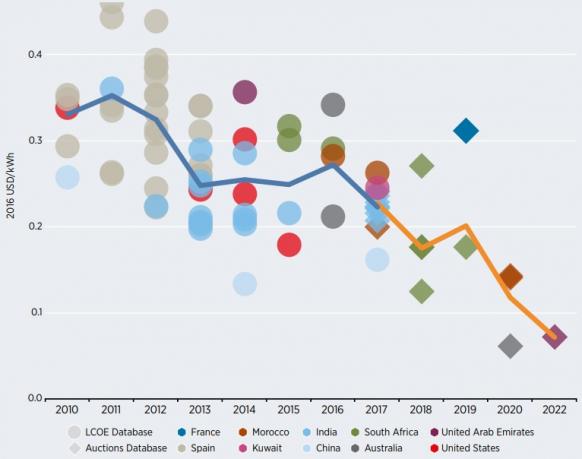

National authorities are increasingly replacing renewable energy feed in tariff programs with competitive tenders to take advantage of falling technology costs.

CSP tender prices, costs in 2010-2022

(Click image to enlarge)

International Renewable Energy Agency (IRENA), January 2018.

Well-structured tenders attract international groups with established track records and healthy balance sheets, helping to minimize project risks and bring industry expertise into the market.

This was evident in South Africa, where competitive tenders saw CSP prices fall by around a half over a five year period. South Africa's has installed 500 MW of CSP capacity and ACWA Power is building the 100 MW Redstone CSP plant in the Northern Cape province. South Africa's latest 20-year Integrated Resource Plan (IRP) includes no explicit support for new CSP projects.

"All EPCs [engineering procurement construction groups] and most developers in South African CSP projects have been international companies who have brought their technical and development know-how to the market,” one project adviser active across southern Africa, said.

“We expect to see the same unfold in Botswana and Namibia,” the source said.

The first phase of construction would require upgrades to domestic transmission networks and would incur risk premiums to cover early development challenges, WEF noted.

Grid capacity has been an issue for South Africa's renewable energy developers. Faced with financial difficulties, state utility Eskom has not made certain grid investments required to support sharp rises in renewable energy capacity, increasing project risks and costs.

“A phased approach will ensure that overbuild does not happen and grid reliability is maintained through modest amounts of renewables coming online at the same time,” Pinsley said.

Market open

The WEF proposal comes as Namibia and Botswana move towards more liberalized power markets that should attract more international developers.

On September 1, Namibia enforced a new Modified Single Buyer Market Structure which allows electricity generators to trade power directly with consumers. Previously, power generators could only sell power to NamPower.

Namibia and Botswana both have "strong legal and regulatory environments" that will encourage investors to participate, WEF noted.

They also have the lowest corruption indexes in Africa while Botswana has the strongest credit rating in the continent, it said.

“Both are strong markets and will attract investors should a structured and reliable program be put in place,” Pinsley said.

By Kerry Chamberlain