China market study confirms CSP value in high wind, solar markets

CSP could be economically viable without subsidies in markets with over 50% variable renewable energy penetration and wind curtailment needs could create the greatest opportunities, a study by Chinese and U.S. researchers has found.

Related Articles

CSP developers predict rising wind and solar capacity will open up new opportunities to provide flexible power generation and overnight supply.

Wind and solar capacity has soared on the back of falling technology costs, but the higher the penetration, the smaller the incremental benefits to the grid. At the same time, Western countries and others like China are reducing fossil fuel generation capacity which has typically provided a reliable source of flexible power.

Researchers from China’s Tsinghua University and the U.S. National Renewable Energy Laboratory (NREL) recently studied the economic value of the construction of CSP plants in markets with high variable renewable energy (VRE) penetration.

Led by China, the scientists compared the economic system benefits of adding CSP capacity against adding further wind and PV capacity.

The study found CSP can be economically-viable without incentives when VRE is at 50%, and the economics improve further as VRE climbs above this level.

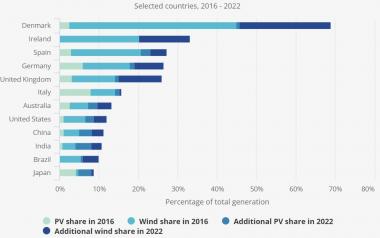

VRE share of generation by country

(Click image to enlarge)

Source: International Energy Agency, October 2017.

While CSP technology costs are higher than wind and PV, CSP plus storage plants provide greater value to the grid as they can respond to supply fluctuations and curtailments, Ning Zang, associate professor at the department of electrical engineering of Tsinghua University, told New Energy Update.

“When there’s high penetration for PV and wind, and high curtailment (of electricity generation) installing CSP is more economic,” Zang said.

The findings come as CSP developers pursue new high-temperature designs which should lower the cost of CSP storage. Developers in Europe and U.S. predict falling costs and growing VRE could support a wave of new CSP development in future years.

Wind synergy

China is currently the largest CSP market, building 1.4 GW of new CSP capacity in a Commercial Demonstration Pilot Program which is set to drive down costs across the industry. China’s rapid expansion of PV and wind capacity and domestic supply chains significantly impacted global renewables prices and Chinese CSP groups are now targeting supply chain efficiencies and forging links with international developers.

The study by Tsinghua University and NREL analyzed the levelized overall benefit of replacing 5–20% of VRE with CSP generation in the Chinese provinces of Gansu and Qinghai. The “overall benefit” was defined as the sum of the energy benefit and flexibility benefit. The researchers simulated power system generation costs over a whole year.

Be the first to receive more articles like this. Sign up to our CSP newsletter

For the Gansu model, 20 GW of wind power and 7 GW of PV are installed to represent 104% of maximum load demand. Gansu therefore has a relatively inflexible power system, drawing on significant wind and existing thermal capacity. In contrast, Qinghai benefits from considerable hydroelectric power capacity and the model includes 3 GW of new wind and 10 GW of PV to represent 82% of maximum demand.

The study concluded that the benefits of CSP capacity were higher in the Gansu province. The researchers calculated the levelized overall benefit of CSP in Gansu at $238-$300/MWh and the benefit in Qinghai at $177-$191/MWh.

One key driver of greater CSP value in Gansu is the need for wind curtailment, Zang said. There are less synergies for CSP and PV, in terms of flexibility value, as the energy source is closely correlated, he noted.

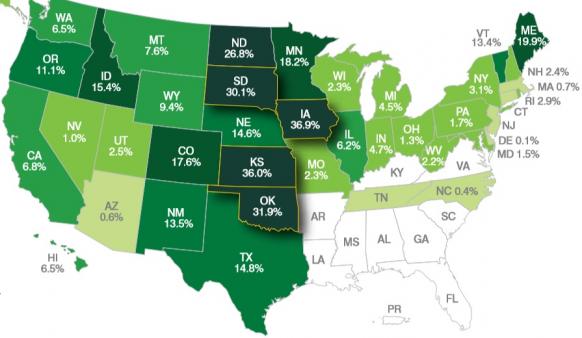

Wind energy share of US power generation in 2017

(Click image to enlarge)

Source: American Wind Energy Association (AWEA)

Longer storage

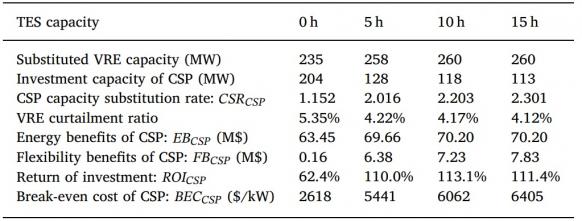

The study found that CSP plants with storage capacity over 10 hours would provide greater flexibility value as they would be able to compensate fluctuations in wind and solar across longer time windows. In addition, CSP plus storage is more competitive against PV plus battery storage for longer storage durations.

Cost benefit analysis of different CSP storage capacities

(Click image to enlarge)

Source: 'Economic justification of concentrating solar power in high renewable energy penetrated power systems.' Tsinghua University, NREL (2018).

Many of the latest global CSP projects have incorporated large storage capacities which maximize capacity factors while fulfilling a specific market need.

ACWA Power's giant 700 MW DEWA CSP project in Dubai will host up to 15 hours of storage capacity, while Acciona's 110 MW Cerro Dominador CSP plant in Chile incorporates 17.5 hours of storage. The Cerro Dominador plant will be joined with an operational 100 MW PV plant to form a 210 MW hybrid solar energy complex.

The findings from the China-led study can “provide a reference for the planning-making on the CSP development and the reasonable configuration of CSP,” the study said in its conclusion.

“CSP plants may play a significant role for power systems towards renewable-dominated and minimum-cost targets,” it said.

By Beatrice Bedeschi