Wind, solar groups call on Spain to reignite power demand

Spain must implement measures to boost power demand alongside faster permitting and grid approvals to meet ambitious wind and solar targets, industry experts said.

Related Articles

In June, the Spanish government raised its wind power target to 62 GW by 2030, up from a previous target of 50 GW, as part of an ambitious climate plan to generate 81% of the country's electricity from renewables by 2030. The draft plan doubles the solar target from 39 GW to 76 GW and sets a slightly higher storage target of 22 GW.

To meet this objective, wind developers will need to install roughly 4 GW a year over the next seven years, well above the 1.4 GW they installed in 2022.

However, surging solar capacity and a lack of power demand are deflating power prices and increasing the curtailment of solar and wind farms. Last year, solar installations hit a record 7 GW, whereas energy demand declined by 2.9% as high costs, economic slowdowns and energy efficiency measures impacted power consumption across the European Union.

Curtailments are creating "a headache for many investors,” Antonio de Juan Fernandez, the director of AFRY Management Consulting, told Reuters Events. Developers also face permitting and grid delays that delay projects and increase costs.

Spain's policymakers need to boost demand and accelerate grid expansions to curb the risks, Fernandez said.

Spain is “building more and more megawatts of renewable energy…but to ensure that energy is injected into the power grid we need electric vehicles, storage, green hydrogen, and more connections with other countries to export power … that is not happening right now,” he said.

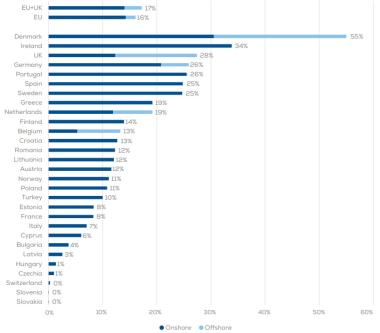

National energy demand supplied by wind in 2022

(Click image to enlarge)

Source: WindEurope

Curtailments mainly affect solar operators at peak solar times but they have started hitting wind producers too, said Juan Virgilio Marquez, general director of Spanish wind industry group Asociacion Empresarial Eolica (AEE).

Developers have been aided by a healthy demand for corporate power purchase agreements (PPAs) but Marquez warns developers will withhold investments if they fear oversupply.

“Curtailments are going to get worse unless there is an increase in demand and the power grid is expanded … these things need to happen simultaneously,” he said.

Upgrading assets

More developers in Spain may opt to install hybrid projects such as solar farms on existing wind sites, to better align generation and load, utilise existing grid connections, and avoid permitting delays. In one example, Spanish utility Iberdrola will add solar panels to an existing wind farm in Castilla y Leon and plans to build more hybrid installations in the next few years to “optimize grid connections and minimize environmental impacts.”

Similarly, some developers are repowering existing wind farms with higher capacity turbines rather than developing greenfield sites. According to AEE data, 36% of the 21,000 wind turbines installed in Spain at the end of 2020 were more than 15 years old and approaching their design lifespan of 20 years.

Repowering projects can avoid opposition from local groups that are pushing back as solar and wind farms expand through rural communities in conservative regions such as Castilla y Leon, Aragon, and Galicia.

“Even if approval procedures are necessary for repowering projects, the advantages are obvious: we can increase electricity production by installing bigger and more modern turbines, while using existing sites where we can build on the acceptance of the population,” a spokesperson for developer RWE said.

Permit hurdles

Developers continue to face a range of headwinds that can delay projects and dent investor confidence.

Spain is unlikely to achieve its higher 2030 targets unless permitting of wind and solar is accelerated, said Pratheeksha Ramdas, a senior Renewables and Power analyst at Rystad Energy. Wind developers say it can take five to seven years to get environmental and construction permits for a project as approval authorities work through a flood of wind and solar requests in recent years.

New rules provisionally approved by EU officials earlier this year set a two-year maximum for permitting new projects and one year for repowering projects but member states have some time to implement these regulations.

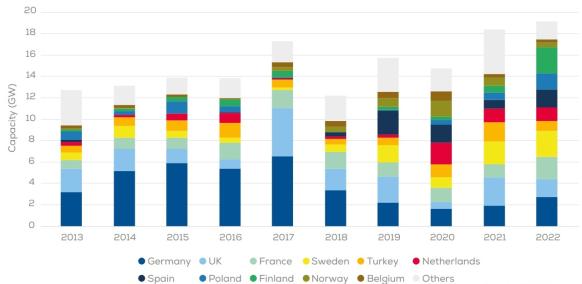

Annual wind installations in Europe by country

(Click image to enlarge)

Source: WindEurope

Spain currently has 91 GW of solar projects and 37 GW of wind that have received grid access permits and are awaiting environmental impact approvals, administrative authorizations and construction permits, which can take around five years, Ramdas said. A further 21 GW of solar capacity and 13 GW of wind projects are awaiting grid access permits.

Spain could achieve its new 62 GW of wind target by 2030 if it shortens permitting procedures to two years, Ramdas said. On its current trajectory, the target of 50 GW is more likely, she said.

Last month, the EU unveiled a European Wind Power package to fast-track permitting, improve auction systems and prop up the bloc’s supply chain industry. More details are expected next month.

Auction failings

Spain must also overhaul its auction system to provide greater certainty to developers and suppliers.

Power authorities should set a higher strike price for contracts allocated in the auctions, index the contracts to account for inflation and include incentives for using domestic content, industry participants say.

A power auction in Spain last year allocated a minuscule 46 MW out of an available 1.5 GW as an undisclosed price cap was below most developers’ bids.

Alongside this, rising global demand for wind and solar and a lack of investment in European manufacturing capacity could lead to supply bottlenecks. Europe's onshore wind industry needs financial incentives because local manufacturers are struggling with inflation, high borrowing costs, and cut-throat competition from Chinese suppliers.

President Biden's 2022 Inflation Reduction Act provides tax credits to domestic manufacturers but many EU countries have been slow to introduce similar measures. EU support proposals could take years to implement and industry participants hope the EU's latest wind power package will offer more immediate support.

Sparking demand

The deployment of batteries and long duration energy storage such as pumped storage hydro power could help to ease curtailments and allow wind and solar operators to obtain higher market prices but these technologies are unlikely to be deployed on a mass scale unless authorities provide subsidies, sources said.

The Spanish government in July unveiled a 280 million-euro ($296 million) program to support the construction of storage projects and regional authorities offer financial aid for large-scale storage projects but Marquez said the country lacks a "strategy" or a "regulatory framework" to "ensure that storage is rolled out in an efficient manner."

Pumped storage hydro could offer "long-duration storage and higher capacities but it needs incentives and authorities need to pass regulations to speed up permitting and develop a capacity market,” said Rodrigo Alvarez, business development director, Spain at Norwegian utility Statkraft.

In future years, the rollout of green hydrogen projects could increase demand for wind and solar.

Spain's draft climate plan sets a target of 11 GW of electrolysers that would turn renewable energy into green hydrogen by 2030, up from a previous target of 4 GW. The green hydrogen industry is in its infancy and projects will take years to be completed due to high capex costs and a lack of hydrogen transport infrastructure.

Greater power interconnection capacity with France would also help to reduce grid bottlenecks and increase the demand for Spanish wind and solar power.

Spain currently has 2.8 GW of interconnection capacity with France and the draft climate plan requires a further 5 GW but cross-border powerlines face numerous national and international hurdles and can take more than a decade to be completed.

Reporting by Eduardo Garcia

Editing by Robin Sayles