Wind builders head south, seek batteries in lowest-cost US market

Rising congestion in the Southwest Power Pool is prompting developers to shift south and turn to energy storage while major transmission projects lift future prospects.

Related Articles

Wind project activity continues to surge in the Southwest Power Pool (SPP), where high wind speeds and large swathes of agricultural land offer economies of scale and lower costs.

The SPP runs down through the great Plains, from Montana in the north to New Mexico in the south, across 15 states in total.

Wind activity has grown despite few mandatory state renewable energy portfolio standards in the region and tax credits in the Biden administration's Inflation Reduction Act have fuelled further demand. Wind projects represented 85% of all new power installations in SPP in 2022, according to the Department of Energy's latest land-based wind report.

The SPP market boasts the lowest cost of wind energy in the U.S., but high wind penetration means it also has the lowest wholesale market value for wind, taking into account wholesale prices and grid congestion. This presents developers with important siting decisions.

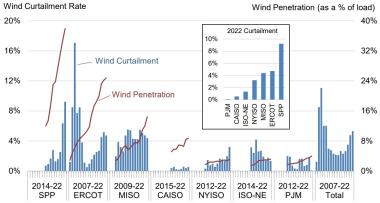

Most wind capacity has been installed in the West of SPP, away from the large load centres of Kansas City, Oklahoma City, Tulsa, Omaha and Wichita in the East, leading to grid congestion. As in Texas, curtailment risks are rising as renewable energy build outpaces grid expansions, denting the value of projects.

US wind curtailment, penetration rates by market

(Click image to enlarge)

Source: Department of Energy's annual land-based wind report (August 2023).

Developers in SPP face congestion on West-East and North-South axis and congestion is most common in Oklahoma, Gemma Bewley, Market Analyst at Wood Mackenzie, told Reuters Events.

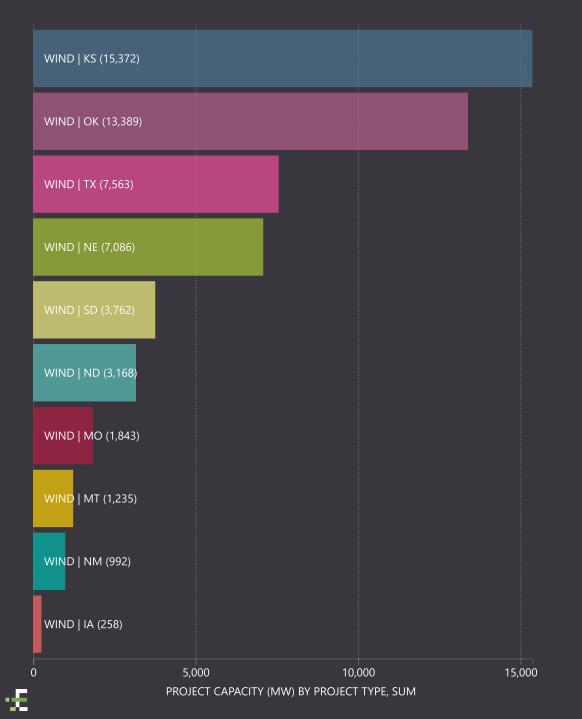

Developers are shifting activity to the south and building projects in Kansas, Oklahoma and parts of Texas and New Mexico, to take advantage of lower interconnection and congestion costs, Adam Jordan, Director of Power & Renewables at data provider Enverus, said.

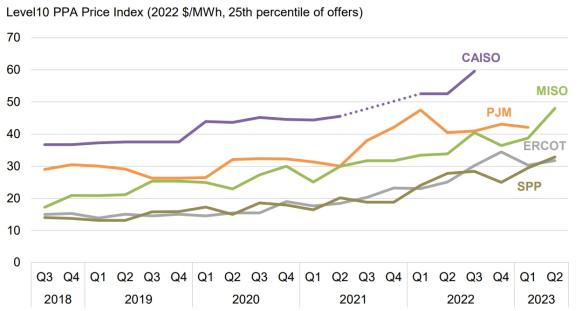

A recent increase in power purchase agreement (PPA) prices is providing some comfort to wind developers and several grid upgrades are planned in southern and eastern areas. Future opportunities could hinge on the success of long-distance transmission projects such as Invenergy’s $7 billion Grain Belt Express line which would transform market dynamics.

Meanwhile, developers are using long-term financial contracts to mitigate market risks and including battery storage in project applications to boost revenues.

Growth pockets

As more wind power is installed in SPP, developers are forsaking the windiest regions to avoid grid risks and ensure sufficient income.

Wind capacity under development in SPP market, by state

Source: Enverus Intelligence Research, October 2023

The highest local wholesale prices in the SPP market are along the eastern border with the neighbouring MISO and co-op owned AECI regions, as these areas offer lower wind resources, Jordan said.

Here, the cost of interconnection and geographical challenges "make many projects infeasible which is why we continue to see most projects moving through the queue in western Oklahoma and Kansas," he said.

Developers in SPP will need to “weigh the risks of increasing curtailment” and rising PPA prices can help mitigate these risks, Patrick Huang, Research Analyst, North America Power Service at Wood Mackenzie, told Reuters Events.

After years of falling costs, U.S. market-averaged PPA prices have been rising for the past five years due to project delays and supply chain and inflationary pressures, according to LevelTen Energy pricing platform.

US Wind PPA price index by quarter of offer

(Click image to enlarge)

Source: LevenTen Energy. Published in DOE's land-based wind report (August 2023).

To mitigate market risks, many operators in SPP use long-term swap contracts, Jordan said.

Battery storage deployment could aid some developers, Pradeep Podal, Technical Lead, Energy Markets at energy consultants ICF, told Reuters Events. New tax credits for stand-alone storage in the inflation act have accelerated demand for utility-scale batteries.

"We do see a strong interest in standalone and hybrid storage projects in recent [interconnection impact studies] in SPP," Podal said. Only one new hybrid wind-storage facility was commissioned in the U.S. in 2022 while there were 59 PV plus storage plants brought online, according to DOE data.

Going forward, the use of dynamic transmission line (DLR) capacity could also aid wind operators, enabling grid operators to adapt flows to ambient conditions, Shankar Chandramowli, ICF Senior Manager, Energy Markets said.

"Currently, there are a few pilot line segments operating using DLR technology across multiple power markets," Chandramowli said. "With emphasis on grid enhancing technologies in [Federal Energy Regulatory Commission orders], we do expect wider deployment of these technologies across the grid network in the coming years."

Grid openings

The north of SPP boasts relatively untapped high-voltage transmission capacity but high network connection costs have deterred many developers, Jordan said.

Costs can be double that of connecting in Western Kansas and Oklahoma, equating to a $60 million difference for a 200 MW wind farm, he said.

SPP has streamlined grid study processes and provided greater transparency to developers but upgrades vital to reducing congestion are "often delayed and in some cases years behind their intended ‘in service’ date," Jordan noted.

Less than half of the 280 SPP grid upgrades with an in-service date less than four years are on schedule, with many delays caused by fluctuating costs or uncertainty over federal cost rules, he said.

In the near future, the 345kV Roundup-Kummer Ridge and Leland Olds-Tande transmission lines in North Dakota are advancing through permitting and look likely to be built, Jordan said.

New lines are also planned in the next few years in Oklahoma and eastern Kansas, but the Grain Belt Express high-voltage line could have a more profound impact on the market.

Developed by renewable energy group Invenergy, Grain Belt would provide 5 GW of capacity from western Kansas through Missouri to the border of Illinois and Indiana, providing greater connection with the MISO market.

Last week, the project received its final state approval from Missouri and Invenergy aims to begin construction in 2025, pending full permitting approval.

The 800-mile line is being developed on a merchant basis and Invenergy may start accepting bids for power delivery contracts as early as this year, it said.

If completed, the line would “completely change the grid dynamics in western Kansas and SPP,” Jordan said.

"Having a large 'customer' for the ample amounts of wind power in western Kansas and Oklahoma would alleviate, but not cure, the west to east flows that drive so much congestion across southern SPP," he said.

"It will potentially reduce curtailments at wind farms in the area as lower constraints on the system allows for more power to flow from the wind farms."

Reporting by Neil Ford

Editing by Robin Sayles