US wind rebounds to set up stronger mid-term outlook

Onshore wind activity is picking up as costs stabilise, delivery risks ease and large clients continue to seek wind power resources.

Related Articles

After a slowdown last year, U.S. wind installations are on the rise as confidence gradually returns to the sector.

Onshore wind installations fell 27% in 2023 to 6.4 GW but Wood Mackenzie forecasts 7 GW this year and 11 GW in 2025. Average annual installs are forecast to hit 14 GW between 2025 and 2030, the research group said.

Turbine orders surged 130% last year to around 17 GW and 80% of these orders are due in 2025 or later, Samantha Woodworth, senior researcher at Wood Mackenzie told Reuters Events.

Developers have faced volatile costs and logistics challenges since the coronavirus pandemic, alongside lengthy permitting processes and interconnection queues.

Tax credits in the Biden administration's 2022 Inflation Reduction Act have significantly improved the economics of wind power but developers continue to face rising prices and high interest rates and this will curb the level of growth in the short to medium term.

Long lead times continue for some equipment but investments in new U.S. manufacturing facilities, spurred by inflation act tax credits, should help stabilise prices and provide developers with more certainty going forward.

Twelve onshore wind manufacturing facilities have been announced since the inflation act was passed, according to industry group American Clean Power (ACP). Turbine suppliers GE Vernova and Siemens Gamesa have built onshore wind manufacturing facilities in New York and Iowa, respectively, while Arcosa and CS Wind are building plants in New Mexico and Colorado.

“The market is starting to believe that we’re going to see some price stability coming,” said Jim Murphy, President and Corporate Business Leader of renewable energy developer Invenergy.

There is still uncertainty regarding steel and concrete prices, as well as interest rates, he noted.

Invenergy installed over 550 MW of wind in 2023 and expects a nearly 50% increase in installations this year, followed by 100% year-on-year growth in 2025.

“Things got backed up a bit with Covid and supply chain disruptions but we’re pushing through and hitting the finishing line now,” Murphy said.

Growth regions

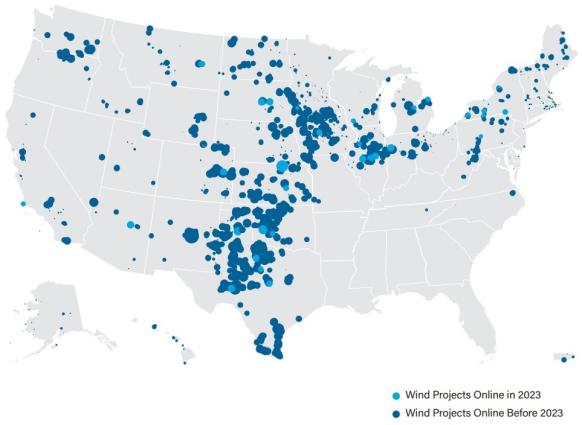

Texas, Illinois and Kansas accounted for about half of all new wind capacity installed last year.

US onshore wind capacity in 2023

(Click image to enlarge)

Source: American Clean Power (ACP), March 2024

Texas and the Midwest are set to remain the most active areas for wind development but some large projects are being developed in other states, including Pattern Energy's 3.5 GW Sunzia Wind project in New Mexico.

The Southeast and desert areas in the Southwest are still underdeveloped, often due to lower wind levels than prime Midwest sites or high cost of new transmission to send the power to large load centres.

Nationwide, the growth in wind installations will be eclipsed by solar power but many utilities and corporate clients are seeking wind energy to ensure they can have a clean energy mix around the clock.

This demand has helped push up the price of wind power purchase agreements (PPAs) since 2021 and although the “steepness of the rise has slowed, we see no indication of prices going down,” said Laura Caspari, President of Power Marketing and Commercial Strategy at Engie North America.

In the right markets, wind PPAs can still be signed at "more competitive" prices than solar, Caspari said.

Transmission challenge

Project siting is an increasing challenge for developers as areas with top wind resources get saturated and developers move to less optimal locations.

“Interconnection and ever increasing siting challenges are making wind more and more difficult to deliver. This is part of the reason we’re seeing larger and larger wind facilities,” said Hunter Armistead, CEO of Pattern. The company is investing billions of dollars to develop new transmission capacity to transport power from its giant Sunzia wind farm project in New Mexico to markets in Arizona and California.

A lack of transmission infrastructure and slow approval processes can delay projects by years.

“It's certainly a problem all throughout the US. Each different ISO or RTO does have its own particular individual challenges,” Caspari said.

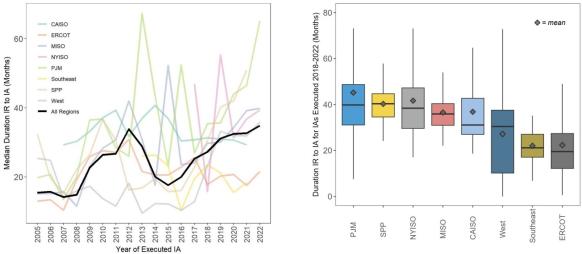

US grid connection approval times, by market

(Click image to enlarge)

IR = Interconnection Request

IA = Interconnection Approval

Source: Berkeley Lab, April 2023

Some local authorities have banned installations or placed onerous regulations on projects and local opposition has increased in some areas of the Midwest, including Illinois and Ohio, amid polarization ahead of the presidential and congressional elections in November.

The inflation act includes a bonus energy community tax credit to encourage development in areas impacted by the transition away from fossil fuels. Several developers, including Pattern, said they have wind projects that are receiving the energy community tax credit.

Upgrading wind

Some companies are choosing to repower older wind farms with new higher capacity turbines in areas such as the Pacific Northwest, California, the Northeast and the Mid-Atlantic, Woodworth said.

Repowering allows operators to increase revenues on existing sites without having to go through a lengthy permitting process.

“Going back to those areas where you have great wind resources and good relations with communities and local landowners, and where you already have interconnection points, is much easier than to do a greenfield project where you are doing all of that from scratch,” Leeward Energy CEO Jason Allen told Reuters Events. In January, Leeward completed the repowering of the 80 MW GSG Wind project in Illinois.

Wood Mackenzie forecasts 1 GW of new wind capacity per year through repowerings between 2024 and 2030, representing around 8% of all new wind installations.

Tax credits for energy storage in the inflation act have accelerated demand for utility-scale batteries and some developers are choosing to build hybrid facilities that combine wind and batteries. Solar plus storage projects are more common but batteries can improve the economics of wind farms.

In August 2023, Engie acquired Broad Reach Power, a Texas-based battery storage company, in a bid to move toward “an integrated model” for its solar and wind projects, the company said.

“Engie, and I think most other major players, are including a battery component in their queue positions as a standard in most projects that we expect to build in the next 10 years,” Caspari said.

Reporting by Eduardo Garcia

Editing by Robin Sayles