US wind factory growth patchy as installations rise

Manufacturers are expanding U.S. production capacity to meet rising demand but tax credits favour some American components over others.

Related Articles

Onshore wind manufacturers have announced 15 expansions of U.S. factory capacity since the Biden administration introduced new tax credits in its 2022 Inflation Reduction Act, data from the Department of Energy (DOE) shows.

Suppliers are looking to capitalise on rising wind installations as supply chain disruptions ease and global costs stabilise.

Wood Mackenzie forecasts 7 GW of U.S. wind installations this year and 11 GW in 2025. Average annual installs are forecast to hit 14 GW between 2025 and 2030, the research group said.

Manufacturers are expanding U.S. production of key components including towers, nacelles and blades, but growth is steered somewhat by whether developers must source those parts from America to qualify for bonus tax credits.

New factory investments will benefit from the advanced manufacturing production tax credit (AMPTC), allocated on a $/watt rate according to the type of component, as well as the production tax credit (PTC) or the investment tax credit (ITC) offered to wind developers.

The PTC is set at 2.6 cents per kilowatt-hour for the first 10 years of electricity generation and the ITC allocated at up to 30% of project capex. Importantly, developers also gain bonus tax credits for domestic content (DCB) worth 10% of capex if they source towers and steel or iron rebar domestically and 40% of the total component value is sourced from U.S. manufacturers. This requirement will gradually increase to 55% by 2027.

Prices could fall due to "dynamic competition" from domestic and foreign suppliers, particularly for turbine towers, Aubryn Cooperman, a wind energy analyst at the National Renewable Energy Laboratory (NREL), told Reuters Events.

The advanced manufacturing tax credits "could allow domestic manufacturers to sell products cheaper than imported goods," said Cooperman, noting that some suppliers may choose to use some of the extra profits to boost their bottom line.

Five tower manufacturers have announced factory investments since 2022, including Arcosa, which is building a $60 million facility in New Mexico that is slated to come online in mid-2024. The company, which also has plants in Oklahoma, Iowa, and Illinois said it has a $1 billion backlog in wind tower orders for the 2024-2028 period.

“We expect that 2024 is the beginning of a multi-year upcycle for our wind towers business,” John Pello, Arcosa vice president for wind, told Reuters Events.

While supply chain bottlenecks have stabilised or abated, Pello warned that steel prices and interest rates remain relatively high and manufacturing growth will require strong demand signals.

Nacelles wanted

The U.S. was capable of manufacturing 19,750 onshore wind towers per year as of November 2023, along with 6,400 nacelles and 7,826 blades, NREL data shows.

Wind developers sourced 85% of their nacelles domestically in 2022 and manufacturing volume is set to increase thanks to the domestic content bonus.

Nacelles house the drivetrain and yaw (turbine orientation) components and account for about half of the value of qualifying components so “if you don’t have a domestic nacelle it will be difficult to qualify,” Cooperman said.

U.S. turbine supplier GE Vernova has announced plans to build a $50 million nacelle facility in New York while German group Siemens Gamesa plans to restart a nacelle plant in Kansas. Denmark's Vestas is expanding nacelle production in Colorado and Germany's Nordex has indicated that it may reopen its nacelle manufacturing facility in Iowa. The companies declined to comment.

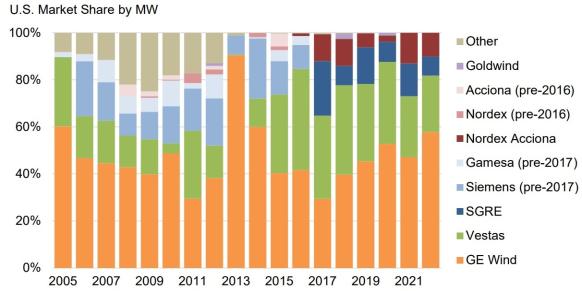

US market share of wind turbine manufacturers by MW

(Click image to enlarge)

Source: DOE's Land-Based Wind Market Report, August 2023. Data: American Clean Power (ACP)

BlueWind produces nacelles for GE Vernova turbines and has invested $2 million to double production capacity in Pensacola, Florida to 24 nacelles a week, Carlos Sinhori, BlueWind's industrial director, told Reuters Events.

“With the [inflation reduction act] package from the U.S. government we see more opportunities to increase production and we have to make preparations ahead of time,” Sinhori said, predicting a 50% increase in demand over the next few years.

Wind imports

U.S. blade manufacturing capacity is also on the rise but is less boosted by the new domestic content incentives.

American blade manufacturing fell to a low of 4 GW in 2022 after years of intense market competition that crushed margins. Since then, Vestas and Siemens Gamesa have announced investments to restart or expand U.S. blade manufacturing capacity and GE Vernova has signed long-term agreements to source blades from TPI Composites factories in Iowa and Mexico.

Developers can qualify for the domestic content bonus by sourcing just 20% of their blades domestically, in addition to U.S. nacelles, NREL said in a study published in March.

“Transportation is one issue that could cause domestically manufactured blades to be more appealing but it depends on where wind farms are because Mexico is relatively close to many places in the U.S.,” Cooperman said.

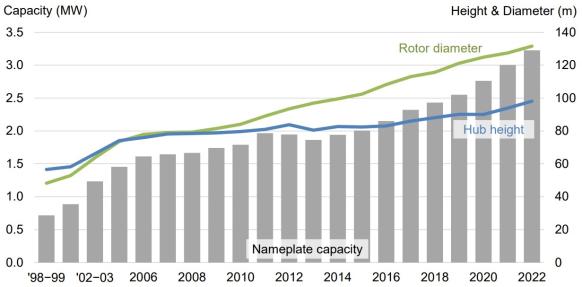

Average US turbine capacity, hub height, rotor diameter

(Click image to enlarge)

Source: DOE's Land-Based Wind Market Report, August 2023. Data: American Clean Power (ACP), Berkeley Lab

Developers are also not obligated to source gearboxes from American factories to gain the domestic content bonus.

Leading gearbox manufacturer Flender plans to supply the U.S. market from manufacturing facilities in India, where raw materials are cheaper, as well as from Finland, company executives told Reuters Events.

The German company plans to invest a double-digit million dollar amount to expand its service and repair operations in Illinois over the next few years.

Flender needs to see a strong long-term demand outlook and attractive factory input prices before committing to U.S. factory investments, Aarnout Kant, the president of Flender’s Winergy Gearbox unit, told Reuters Events.

“If we see strong demand for 10 years and good prices and supply of raw materials, we will consider expanding in the U.S.," Kant said.

"We’ve seen a lot of fluctuations in the U.S. in recent years and you can’t build a business on that,” he said.

Reporting by Eduardo Garcia

Editing by Robin Sayles