US urged to carve out wind, solar build zones to curb delays

Federal permitting reforms agreed by Congress do not aid developers with local and regional pitfalls and bulk planning of renewable energy and transmission is needed, industry experts said.

Related Articles

The bipartisan debt deal approved by Congress in recent weeks will limit the duration of environmental impact studies for energy projects but left out important legislation to expand power transmission capacity between regions.

Reforms to federal energy permitting in the National Energy Policy Act (NEPA) will require environmental assessments to be conducted within one year and impact statements within two years. U.S. wind and solar installations must accelerate rapidly to meet President Biden's climate goals but permitting and grid connection delays are holding back growth.

The NEPA reforms are unlikely to have a major impact on wind deployment unless accompanied by additional measures, industry experts warn.

“The debt limit deal essentially targets NEPA review delays only, and while these are certainly present and frequently substantial, they are not necessarily the predominant source of delay,” Sanjay Patnaik, a fellow at the Brookings Institution think tank, told Reuters Events.

Local opposition and restrictive local regulations will continue to hamper some projects. Other key factors include a permitting process that is too reactive, as well as understaffed and underfunded federal agencies and poor coordination between agencies, industry sources said.

The U.S. needs a federal siting authority that could direct bulk transmission approvals from high resource areas, Patnaik said.

The debt ceiling reforms are a "good bipartisan first step" but the U.S. needs a "gigawatt scale solution to permitting" to bring online larger wind farms than in the past, Roger Martella, Vice President of Government Affairs and Sustainability for GE Vernova, the largest U.S. turbine supplier, told Reuters Events.

"Upgrading the transmission system and comprehensive permitting reform is critical to ensure that we can install and move power from where it’s generated to where it’s used,” Martella said.

Local matters

The NEPA update is the latest in a string of policies by the Biden administration aimed at accelerating renewable energy deployment. President Biden aims to decarbonise the power sector by 2035 and the Inflation Reduction Act (IRA) passed in August 2022 extended tax credits for wind and solar for at least ten years and also allowed stand-alone energy storage projects to qualify for the deduction for the first time.

The tax credits could hike annual utility-scale wind installations threefold to 39 GW/year by 2025, Princeton University said in a special report. Solar installations could hike to 49 GW/year by 2025, five times higher than in 2020, and growth rates would continue to increase thereafter, it said.

Soaring demand will heap further pressure on permitting authorities already inundated with applications.

Developers will continue to face complex regulations that differ between regions, which can increase timelines and costs, Andrew Berg, Senior Research Analyst, S&P Global Commodity Insights, told Reuters Events.

Projects can face opposition from local residents due to the visual impact, noise, or perceived impact on property values, Berg noted. Concerns over local airspace have also halted projects, such as the 500 MW Crescent Peak Renewables wind project in Nevada and the 300 MW Byers and Bluegrove wind project in Texas.

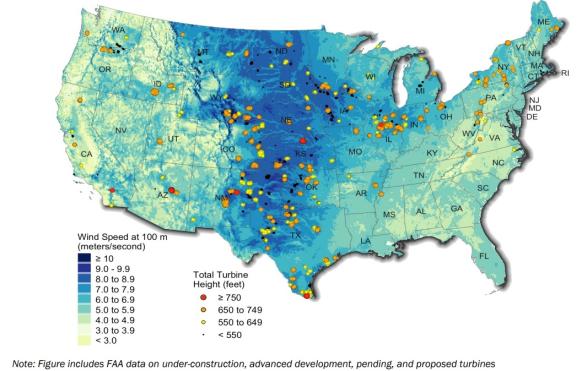

Proposed heights of US wind turbines

(Click image to enlarge)

Source: Department of Energy's 'Land-based Land-Based Wind Market Report,' August 2022.

The NEPA reforms could aid projects in states with favourable policies for renewable energy development, such as New York State, Berg said.

New York has set an ambitious target of 70% of power from renewable energy by 2030, but federal permitting challenges have made it difficult for the New York State Energy Research and Development Authority (NYSERDA) to procure enough supply to meet demand, according to Berg.

Other projects which could benefit from the deadlines include those that are located on federal land in Western U.S. The Biden administration aims to permit 25 GW of renewable energy on federal lands by 2025 and by March 2023 it had approved 8.2 GW of projects, mostly solar, data from the Interior Department's Bureau of Land Management (BLM) showed.

Development zones

A more proactive approach to transmission and renewable energy permitting through a federal siting authority would allow developers to send power from the great Plains and other areas with strong resources, to large cities and other high consumption centres, Patnaik said.

This approach could have aided the 3.5 GW SunZia transmission project in New Mexico, which was finally approved by the BLM in May after 16 years in development. The project was halted for two years after the New Mexico Public Regulation Commission denied a permit in response to local opposition.

Advanced bulk permitting of transmission and wind projects "would enable optimal siting of wind energy in high potential zones, instead of just places where permitting is easier,” Patnaik said. To accelerate deployment, the European Union is requiring its members to set out renewable energy development areas with streamlined permitting processes.

A recent study by the U.S. Department of Energy (DOE) highlighted the importance of new transmission capacity in the middle of the country.

Significant transmission deployment is needed by 2030 in the Great Plains, Midwest, and Texas but the largest benefits will come from expanding transmission between regions, the DOE said in its study.

"Large amounts of low-cost generation potential exist in the middle of the country and accessing this generation through increased transmission is cost-effective for neighboring regions," the study found.

Reporting by Mark Shenk

Editing by Robin Sayles