US unveils Oregon floating wind areas; FERC implements faster grid connection rules

The wind power news you need to know.

Related Articles

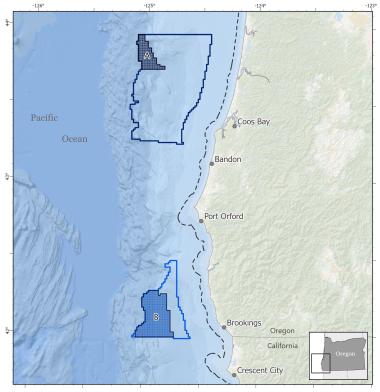

US sets out first Oregon floating wind lease areas

The U.S. Bureau of Ocean Energy Management (BOEM) has launched a consultation for two offshore wind areas off the coast of Oregon that could host 2.6 GW of capacity.

The Wind Energy Areas (WEAs) cover around 220,000 acres offshore southern Oregon and would host the state's first commercial-scale floating wind capacity. The closest point to land is 18 miles off the coast.

Oregon's draft offshore wind areas

(Click image to enlarge)

Source: BOEM, August 2023.

Over a 60-day public comment period starting on August 15, BOEM will hold an intergovernmental task force meeting and several public meetings with the region's fishing community.

The WEAs have water depths of around 1,300 meters, requiring the deployment of floating offshore wind turbines that can be manufactured domestically, the Business Network for Offshore Wind noted.

“The introduction of these new WEAs will benefit not just Oregon, but California and Washington by attracting new investments in ports, vessels, and supply chain companies and delivering reliable power to the Western grid,” said Liz Burdock, founder and CEO of the Business Network for Offshore Wind.

Oregon plans to develop 3 GW of floating wind capacity by 2030 and is following progress made in California.

BOEM has allocated five lease areas off the coast of California and the state aims to install 5 GW by 2030.

US approves fourth large-scale offshore wind farm

The U.S. Bureau of Ocean Energy Management (BOEM) has approved the construction plan for the 704 MW Revolution Wind project off the coast of Rhode Island.

Revolution Wind is being developed by Denmark's Orsted and U.S. utility Eversource. The partners plan to start onshore construction in the coming weeks and complete the project in 2025.

The project has secured power purchase agreements (PPAs) with Rhode Island and Connecticut, for 400 MW and 304 MW respectively.

Construction will include 65 wind turbines and two offshore substations within the lease area. The developers reduced the number of turbines “to reduce impacts to visual resources, benthic habitat [on the seabed] and ocean co-users,” BOEM said in a statement.

The bureau is on track to review at least 16 offshore wind projects by 2025, in line with the target set by the Biden administration and representing more than 27 GW of capacity. On August 29, BOEM will launch the first ever offshore wind energy lease sale in the Gulf of Mexico.

The other three projects approved by the U.S. are Vineyard Wind in Massachusetts (Copenhagen Infrastructure Partners and Avangrid), South Fork Wind in Rhode Island and New York (Orsted and Eversource) and Ocean Wind 1 in New Jersey (Orsted).

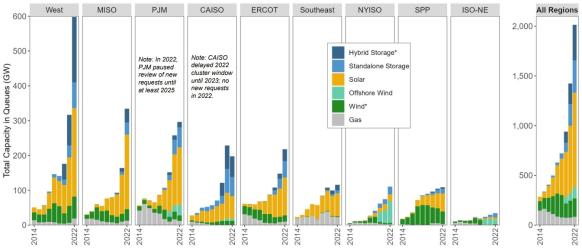

US regulator streamlines grid connections to ease bottlenecks

The U.S. Federal Energy Regulatory Commission (FERC) has agreed to streamline grid connection processes for wind and solar farms under new rules that prioritise projects that have secured permits and impose penalties for transmission operators that miss deadlines.

The final ruling aims to reduce delays in grid connections that are stunting renewable energy growth. Developers currently take several years to secure grid connections as transmission operators work through a backlog of projects.

Capacity in US grid connection queues

(Click image to enlarge)

Source: Berkeley Lab, April 2023

The FERC's reforms mean developers will be required to meet financial requirements to enter the grid connection queue and projects that have gained land rights and permits would be assessed before less advanced projects.

Grid operators will also be required to assess multiple projects in clusters to make best use of their resources and will be subject to a daily penalty for overdue approvals.

FERC said this first-ready-first-served cluster study process will help clear up bottlenecks and share out costs between projects.

“Conducting a single cluster study and cluster restudy each year can minimize delays overall and minimize the risk of cascading restudies when a higher-queued interconnection customer withdraws its request,” FERC said.

The Southwest Power Pool (SPP) grid operator already uses a cluster assessment process and PJM, the largest U.S. network operator, plans to use a cluster study process from 2026. Before then, PJM will use a range of other measures to clear the backlog in a transition phase that has been approved by the FERC.

SPP typically conducts studies for groups of 30 to 50 projects, sometimes as many as 200, as this approach is "much more efficient," SPP’s vice president of engineering David Kelley told Reuters Events in April.

SPP provides preliminary cost data within 60 days of a request and a final in-depth cost analysis within around a year, Kelley said. The whole study process takes between 12 and 18 months, compared with over three years in most other regions.

American Clean Power (ACP) welcomed the FERC's reforms but urged lawmakers to pass more comprehensive reforms to improve the permitting process for high-impact transmission lines.

FERC is studying reforms to speed up the deployment of long-distance transmission lines that are crucial to wind and solar growth. Developers have called for deeper federal interventions in transmission planning, including the bulk planning of new lines from specially designated wind and solar zones. Power will need to be transmitted from Central US and other high resource areas to major demand centres around the country. California recently agreed to develop upfront bulk transmission to speed up solar, wind and storage projects.

New Senate bills could help spur interregional grid expansions but industry groups are calling for FERC to act sooner on the issue.

Europe installs 2.1 GW of offshore wind in first half of 2023

Developers installed 2.1 GW of offshore wind capacity in Europe in the first half of 2023 while six projects reached final investment decisions for 5 GW of new capacity, according to data from industry group WindEurope.

Over half of the new capacity was built in the Netherlands and the rest was in the UK, Germany, and Norway, the trade association said.

European Union countries installed 1.4 GW, far below the 11 GW/year required to meet EU renewable energy targets, WindEurope said.

To speed up deployment, the EU must rapidly expand its supply chain for turbines, foundations and cables and, alongside this, secure more installation vessels and invest in ports and grid infrastructure, the industry group said.

National governments must also index offshore wind power contracts, allocated through auctions, to account for inflation, WindEurope said.

“If governments don’t recognize that, they’ll lose projects, just like the UK has lost Vattenfall’s Boreas offshore wind project,” it said.

Vattenfall halted the development of the 1.4 GW Norfolk Boreas offshore wind project off the east coast of England due to rising costs and supply chain delays. Vattenfall said that the entire wind industry has seen costs increase by 40% while contract terms have remained the same, which is making some projects unsustainable. The utility expects to incur a loss of 5.5 billion Swedish crowns ($537 million) due to the decision.

According to WindEurope, 60% of the 12 GW of offshore wind power contracts allocated this year was awarded through uncapped negative bidding, “which adds significantly to the costs of building the wind farm and developers will have to pass these costs on to electricity consumers and/or the supply chain, both of which are already struggling.”

Reuters Events