US states urged to co-plan grids to curb offshore wind costs

East Coast grid investments are rising ahead of a surge in offshore wind deployment but wider regional transmission planning will be crucial to minimising costs and delays, clean power associations said.

Related Articles

From Maine to Virginia, state authorities and grid operators are scrambling to expand transmission grids ahead of a surge in offshore wind deployment.

Power authorities are looking to connect at least 20 offshore wind projects in the U.S. Northeast, many of which aim to start producing power by 2030. The Biden administration aims to complete environmental reviews of at least 16 projects by 2025 and install 30 GW by the end of the decade.

Earlier this year, New York State announced a $4.4 billion investment for 62 grid projects to reduce congestion and prepare the grid for future renewable energy projects, as well as nearly $3.3 billion for transmission to deliver 3 GW of offshore wind power from Long Island. The state aims to install 9 GW of offshore wind by 2035.

Scheduled to be completed by 2030, the grid projects would remove a major hurdle for offshore wind growth in New York, Fred Zalcman, director of the New York Offshore Wind Alliance, told Reuters Events. A shortage of land connection points means New York could currently only connect around 4 GW of offshore power, Zalcman said.

"We welcome the increased transmission investments," said a spokesperson for Equinor, developer of the Empire Wind and Beacon Wind offshore wind projects.

"New York is facing a significant deficit in power over the coming years and needs continued investment in transmission and developing renewable energy sources."

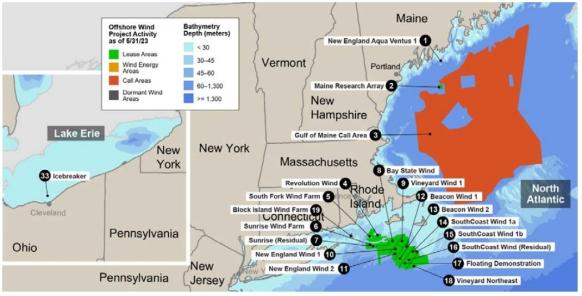

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Last year, the state of New Jersey raised its offshore wind target to 11 GW by 2040 and unveiled a plan to build the transmission needed for 3.5 GW of offshore wind capacity under development using a new “state agreement approach” created by regional grid operator PJM.

Under this method, mid-Atlantic states propose transmission upgrades that support public policy goals such as offshore wind targets. PJM analyses the most cost-efficient transmission solution and state authorities decide whether to pay the costs associated with the upfront planning and build out of infrastructure.

Maryland, which aims to build 8.5 GW of offshore wind energy by 2031 also plans to follow the state agreement approach.

Many states are ramping up offshore wind goals and a state-by-state approach to transmission will mean higher costs for ratepayers, clean power advocates told Reuters Events.

The entire cost of transmission will be placed “on the shoulders of the ratepayers in that state, while the projects that are being integrated benefit consumers far beyond the state borders,” said Dana Ammann, a transmission grid analyst at the Natural Resources Defense Council (NRDC).

Joint planning by regional grid operators could save the U.S. offshore wind industry around $20 billion in transmission costs by 2050, the Brattle Group consultancy estimates. NYISO is likely to require 25 GW of offshore wind by 2050 while ISO-NE may need to connect 40 GW, and PJM and the Carolinas up to 70 GW, it said.

“If each state goes it alone within a territory, it's going to be very expensive and a much slower process," said Kat Burnham, an analyst with Advanced Energy United that specializes on Connecticut, Massachusetts, and Rhode Island.

Slow approvals

In New England, offshore wind developers are concerned about a lack of land connection points and slow grid approvals.

"We are in a bit of a bottleneck right now in terms of how long it takes for evaluation studies to be completed. This can impact project timelines, which has caused cost concerns," Burham said.

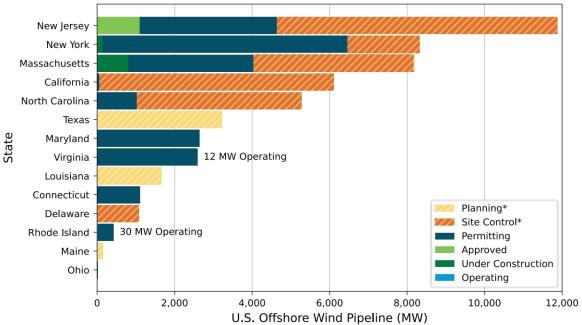

US offshore wind project pipeline by state

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Like onshore wind and solar, offshore wind developers face delays in interconnection approvals as grid operators struggle to process a high number of applications and optimise the grid design for a clean power future.

Developers hope reforms agreed by the Federal Energy Regulatory Commission (FERC) will streamline interconnection approvals and reduce costs. The reforms call on grid operators to follow a first-ready-first-served cluster study process which should speed up processing and spread the cost between several projects. The Southwest Power Pool has shown that cluster studies can accelerate approvals and PJM plans to roll out the same process from 2026. Before then, PJM will look to reduce a backlog of applications that has created some of the highest interconnection costs in the U.S.

Offshore wind offers higher capacity factors than onshore wind and solar, and Ammann argues it should be treated with priority by grid operators as developers face additional technical, legal and permitting challenges.

"Given the outsize renewable energy supply from offshore wind and its unique challenges, there is potential merit in studying this resource separately from the rest of the queue, an idea that the California system operator has recently begun to explore,” Ammann wrote in a recent report about PJM.

Joint plans

Last week, the federal government unveiled an action plan that calls for more collaboration among Atlantic Coast states to identify landing points for offshore wind and transmission paths on the outer continental shelf with the goal of building an offshore network of HVDC interlinks by 2050. Europe is already heading towards an offshore wind grid, starting with offshore interconnectors between countries.

“Along with ensuring that we can develop our industry, building out the grid in a coordinated fashion will yield enormous benefits for ratepayers and the environment, build confidence in the market’s trajectory, and accelerate development,” the Business Network for Offshore Wind said in a statement.

A major inter-regional transmission study by the New England States Committee on Electricity highlights a growing appetite for coordinated transmission planning.

The study is due by the end of the year and, alongside this, six New England states will collaborate with New York and New Jersey to study the need for interregional transmission.

Regional grid operators support the move, saying they are looking for "opportunities for increased interconnectivity, including for offshore wind, between our regions.”

A more bottom-up approach to transmission planning would allocate costs more efficiently since the new infrastructure will be shared by projects and regions, Burnham said.

A multi-value project (MVP) process for transmission investments may be more beneficial than a cluster process when assessing the wider region, Ammann said.

The MVP process assesses the transmission needs for a wide region going forward and divides the costs between all stakeholders that benefit. The process is already in use by regional grid operator MISO in Central US.

"By enabling a multi value procurement process across states, you're able to [find] streamlined processes, savings on costs and ultimately saving money for rate payers,” Burnham said.

Burnham is optimistic that efforts to increase coordination among state agencies, regional transmission organizations, and other stakeholders will ultimately lead to more interregional transmission planning.

"My hope is that by streamlining some efforts and offering transparency to information, we will be able to cut down on some of those project development timelines and save costs,” she said.

Reporting by Eduardo Garcia

Editing by Robin Sayles