US states to jointly buy offshore wind power; Avangrid cancels Connecticut contracts

The wind power news you need to know.

Related Articles

East Coast states agree to jointly procure offshore wind

Massachusetts, Rhode Island and Connecticut have signed an agreement to jointly procure offshore wind power.

Under the memorandum of understanding (MoU), the New England states will seek multi-state proposals for large-scale offshore wind projects, which could help reduce construction costs and lower energy prices for consumers.

“By working together, we can amplify the many benefits of offshore wind for all three states, including regional economic development opportunities, healthier communities, lower energy bills, and advantages to environmental justice populations and low-income ratepayers,” said Massachusetts Governor Maura Healey.

The states plan to launch procurement auctions for a total of 6 GW of offshore wind energy in 2024 and may decide to select multi-state proposals and split the renewable energy that would be generated by such projects.

Massachusetts opened a solicitation for up to 3.6 GW of offshore wind in August, Rhode Island plans to seek proposals for approximately 1.2 GW of new offshore wind later this month, and Connecticut is slated to launch a solicitation for up to 1.2 GW in the coming weeks.

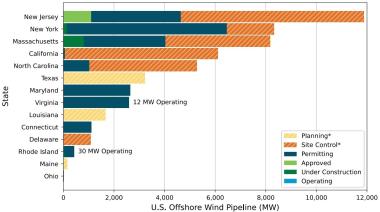

US offshore wind project pipeline by state

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

The MoU could facilitate larger projects that will drive new investment in the supply chain while lowering risks for investors, the Business Network for Offshore Wind said.

“Big scale drives real cost reductions, fosters a pipeline large enough for new manufacturing investments, and should create enough certainty to entice developers and vessel owners to enter into framework agreements that would unlock capital sitting on the sidelines,” said Liz Burdock, the group’s founder and CEO.

Project partners have long argued that increased collaboration between states could help accelerate the construction of transmission infrastructure, offshore wind ports, and manufacturing facilities.

In September, the federal government launched an initiative to strengthen inter-state collaboration to expand the transmission grid on the Atlantic Coast, while nine states and four federal agencies agreed to coordinate efforts to accelerate the construction of manufacturing facilities for the offshore wind industry.

Avangrid terminates power contracts for Connecticut offshore wind project

Avangrid has terminated the power purchase agreements (PPAs) for the 804 MW Park City Wind offshore project in Connecticut.

The Iberdrola subsidiary said that rampant inflation, high interest rates and supply chain disruptions made the project “unfinanceable under its existing contracts” but that it plans to rebid for the project in future offshore wind solicitations.

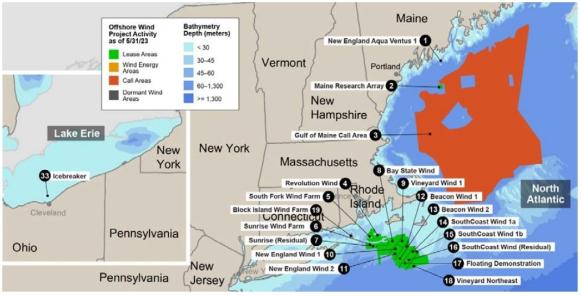

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Last month, Massachusetts utility regulators approved a proposal by Shell and Ocean Winds to terminate the PPAs for their 1.2 GW SouthCoast Wind project. Ocean Winds is a joint venture by EDPR and Engie and the project partners agreed to pay local energy companies $60.4 million to terminate the contracts.

The project partners previously said they intend to rebid for those PPAs and continue to advance the project, which would include a second 1.2 GW development.

In all, several developers including Orsted and Equinor are seeking new terms on at least 10 East Coast projects in renegotiations that will further endanger President Biden's goal of 30 GW offshore wind by 2030.

Poland awards five offshore wind permits to national oil company

The Polish government has awarded oil and gas company Orlen a permit to build five offshore wind farms in the Baltic Sea with a total production capacity of approximately 5.2 GW.

The license allows the Polish company to start the preparatory phase for the projects, including wind resource studies, preliminary geotechnical surveys and environmental impact assessments. Orlen is 50% owned by the Polish government.

Orlen and Canada’s Northland Power are already developing the 1.2 GW Baltic Power array, which would be the first offshore wind farm in the Polish section of the Baltic Sea and is slated to start producing power in 2026. As part of the project, Orlen is building Poland’s first offshore wind farm assembly terminal at the Port of Swinoujscie, which would be able to handle 15 MW turbines and is scheduled to start operations in 2025.

The Polish government aims to build 12 GW of offshore wind energy by 2030, it said earlier this year, up from a previous target of 5 GW.

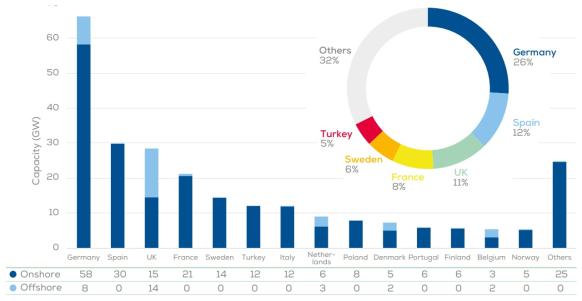

Installed wind capacity in Europe at end of 2022

(Click image to enlarge)

Source: WindEurope

The eight countries bordering the Baltic Sea have pledged to increase offshore wind capacity to nearly 20 GW by 2030, up from just 2.8 GW currently.

The Baltic Sea could host up to 83 GW of offshore wind, according to industry association WindEurope.

Ireland fails to secure target volume in wind, solar auction

Ireland awarded just 150 MW of onshore wind and 500 MW of solar in its latest renewable energy auction, securing only 934 GWh of the 2,000 GWh-3,500 GWh of power generation it was seeking for 2026-2027.

The auction sought applications from mature projects with planning permissions and grid connection offers that would allow them to start delivering clean power by 2027 at the latest.

Around 3 GW of projects were eligible to compete but just under 1 GW applied, equating to 1,223 GWh of bids, the government said.

“The auction volumes underpin the need for a larger pipeline of onshore wind and solar projects coming through the grid connection and permitting processes,” it said, adding that a larger renewable energy auction will be held next year.

The government agreed to pay an average price of 100.47 euros per MWh ($73.7/MWh), compared with 97.87 euros/MWh in the previous auction.

Prices rose due to “inflationary pressures and interest rate rises,” the Minister for the Environment, Climate and Communications said.

The price increase was limited by the government's decision to partially index the costs to inflation and factor in curtailment in the conditions of the auction, industry group Wind Energy Ireland said in a statement.

Slow permitting is one of the biggest hurdles for the wind industry with developers waiting an average of 90 weeks for planning authority An Bord Pleanala to process applications for renewable energy projects, Wind Energy Ireland said.

Ireland plans to reach 9 GW of onshore wind, 5 GW of offshore wind and 8 GW of solar by 2030, allowing it to meet at least 80% of electricity demand from renewable energy sources.

Reuters Events