US sets out cost benefits of offshore wind grid ahead of rule changes

A new federal report proposes the buildout of interregional offshore wind transmission but looming rule changes must minimise development risks to drive the plan forward.

Related Articles

As offshore wind developers deploy the first large arrays along the U.S. East Coast, plans are in motion to create an offshore grid network.

The first large offshore wind farms, such as the 800 MW Vineyard Wind 1 project in Massachusetts, will connect to land via direct ‘radial’ transmission lines but an interlinked offshore network along the U.S. Northeast coast could help optimise wind assets and make the grid more reliable, according to a two-year study by the Department of Energy (DOE).

The Biden administration aims to install 30 GW of offshore wind by 2030 and the DOE proposes an interregional transmission network built over the next decade that would offer a higher benefit to cost ratio than other scenarios.

Offshore wind capacity of 30 GW would require 24 points of interconnection and 14 of these would offer "weak grid strength conditions" for offshore wind output if only radial links were developed, the DOE said in its report, based on research by the National Renewable Energy Laboratory (NREL) and Pacific Northwest National Laboratory (PNNL).

Grid reliability would be strengthened by interconnecting offshore wind substations, either within each grid and/or between grids, and could be further bolstered by the addition of an offshore backbone running the entire length of the coast, the study said.

Greater integration of offshore transmission would increase total grid costs but could also boost revenue for offshore wind developers by helping ensure power flows towards the areas of highest demand while reducing congestion and curtailment, DOE’s modelling showed.

“The benefits are more system-wide than just for developers," Gregory Brinkman, Researcher V-Model Engineering at NREL and the report’s Technical Lead, told Reuters Events.

While wind developers could gain access to higher price delivery points, ratepayers could benefit from lower renewable energy certificate (REC) payments, or lower energy market prices, Brinkman said.

"There’s lots of ways various groups could benefit, but it does depend on how markets change and contracts are set up," he said.

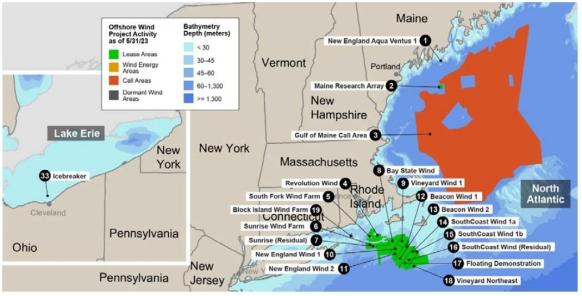

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Some states are already encouraging more interlinked offshore wind projects in their latest procurement auctions but greater cooperation across the region will be required to ensure any interregional links are built on time and on budget.

Market experts warn that common offshore grid standards must be rapidly implemented along the East Coast to provide transparency to developers and minimise risks.

The DOE and the federal Bureau of Ocean Energy Management (BOEM) have called for the creation of new Atlantic grid coordination groups and BOEM is considering whether shared transmission should be required or encouraged, possibly through the bureau's offshore lease tenders.

The BOEM has consulted the market and will soon publish wide-ranging revisions to its offshore wind rules, potentially as early as this month.

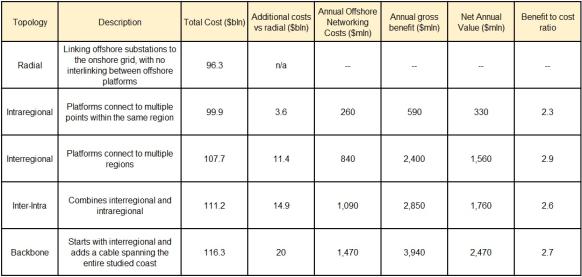

Connectivity costs

To install 85 GW of offshore wind capacity by 2050, the lowest grid costs would be achieved by building radial links from future offshore wind projects, while the highest cost option would be to install a backbone line running the entire length of the coast that is supplemented by interregional grid links, the DOE said in its study.

Capital costs of US offshore transmission scenarios

(Click image to enlarge)

Source: Reuters Events, using data from DOE's Atlantic Offshore Wind Transmission Study, March 2024

States are making commitments on grid investments as they strive to meet their offshore wind goals but a state-by-state approach to transmission will mean higher costs for ratepayers, clean power advocates told Reuters Events in September.

The entire cost of transmission will be placed “on the shoulders of the ratepayers in that state, while the projects that are being integrated benefit consumers far beyond the state borders,” said Dana Ammann, a transmission grid analyst at the Natural Resources Defense Council (NRDC).

A major challenge in coordinated offshore grid deployment is the fair allocation of costs between parties.

The process must also minimise completion risk, for transmission developers as well as offshore wind developers, potentially by enforcing milestone deadlines for either side.

“Transmission developers don’t want to commit to a capital-intensive investment unless they are assured demand for their lines," Timothy Fox, Vice President of energy consultants Clearview Energy, noted.

Technology standards

Common technology standards are needed to ensure efficient implementation of an interregional network, the DOE study said. For example, state and grid authorities will need to align on whether AC or DC lines are used.

More than one-third of the value of the interregional network could be at risk if technology standards are not developed by 2035, the report said.

BOEM could impose shared transmission technology standards via the lease contracts they sign with developers, while states could mandate shared transmission technology in power purchase agreements (PPAs) between developers and power utilities, Fox said.

Several states are moving towards such standards. New York called for “meshed-ready” proposals in its latest offshore wind auctions while New Jersey’s latest solicitation requires common transmission standards.

An interregional system will require more coordination between different states, grid operators and federal authorities and progress could be significantly impacted by the presidential elections in November.

A Biden administration would likely pursue the current trajectory whereas a Trump administration could look to slow the pace of development, based on the lack of progress made under the previous Trump administration and his comments criticising the approval of Vineyard Wind 1 by the Biden administration in 2021.

Trump strategies on offshore wind could range from "refocus" to "retaliate," by redirecting resources towards conventional energy or pushing back harder against the offshore wind sector by undermining finalised lease sales and environmental reviews of projects, Fox warned.

Reporting by Neil Ford

Editing by Robin Sayles