US ramps up offshore wind grid, supply efforts; EU to offer rapid support for wind industry

The wind power news you need to know.

Related Articles

US unveils offshore wind grid, supply chain initiatives

The U.S. has launched initiatives to expand the transmission grid on the Atlantic Coast and build a supply chain for the offshore wind industry.

A new federal government plan seeks to increase collaboration among Atlantic Coast states to identify landing points and transmission paths on the outer continental shelf that will support an offshore network of HVDC interlinks by 2050.

The Action Plan for Offshore Wind Transmission Development in the U.S. Atlantic Region is a two-pronged strategy ― it seeks to ensure that offshore wind projects can connect to the grid by 2030 and outlines transmission investment plans for the following two decades.

In the short term, the plan will seek to identify where offshore transmission may interconnect with the onshore grid and address costs through voluntary cost assignments.

From 2025 to 2030 the document calls for more coordination between states, federal agencies and other stakeholders to plan an offshore network of HVDC cables on the outer continental shelf.

In the following decade, the U.S. would “establish a national HVDC testing and certification center to ensure compatibility when interconnecting multiple HVDC substations to form an offshore grid network,” it said.

Developers have long identified a lack of transmission infrastructure as a key threat to the deployment of offshore wind on the Atlantic Coast. The Biden administration aims to install 30 GW of offshore wind energy by 2030 and 110 GW or more by 2050.

“Along with ensuring that we can develop our industry, building out the grid in a coordinated fashion will yield enormous benefits for ratepayers and the environment, build confidence in the market’s trajectory, and accelerate development,” the Business Network for Offshore Wind said in a statement.

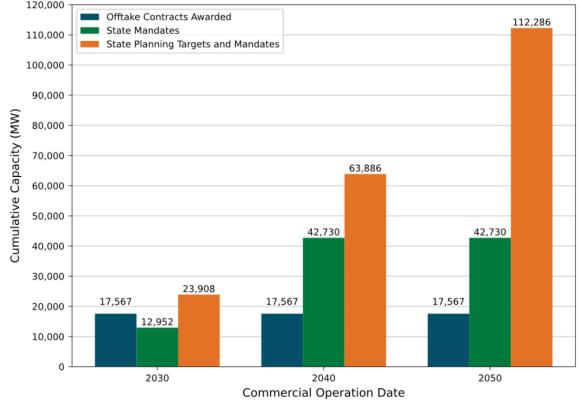

US offshore wind state planning goals, offtake contracts

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Meanwhile, nine East Coast states and four federal agencies signed a Memorandum of Understanding (MOU) to coordinate efforts and build a supply chain for the nascent offshore wind industry.

Signed on September 20, the MOU pledges to “help expand manufacturing facilities, port capabilities, workforce development, and other key supply chain elements in a coordinated and sustainable way,” the White House said in a statement.

The agreement seeks to incentivise the domestic production of offshore wind vessels and steel.

According to the federal government, companies have announced 19 offshore wind shipbuilding projects, 12 manufacturing facilities and 13 ports that will form the basis of the U.S. offshore wind supply chain.

Two large US offshore wind projects receive permits

Two more offshore wind projects on the U.S. Atlantic Coast have received their Final Environmental Impact Statement from regulators for a total planned capacity of over 5 GW.

Equinor and BP’s 2.1 GW Empire Wind project off the coast of New York will consist of Empire Wind 1, with 57 wind turbines, and Empire Wind 2, with 90 turbines, as well as two offshore substations.

Dominion Energy’s 3 GW Coastal Virginia Offshore Wind project will feature 202 wind turbines that will produce enough clean power for 1 million homes.

Offshore wind projects in US Mid Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

The U.S. has so far approved four commercial-scale offshore wind projects on the Atlantic Coast ― Vineyard Wind (Copenhagen Infrastructure Partners and Avangrid), Ocean Wind 1 (Orsted), as well as South Fork Wind and Revolution Wind (both by Orsted and Eversource).

The six projects will have a combined production capacity of 7.4 GW.

In 2021, Siemens Gamesa announced plans to build the U.S.' first offshore wind turbine assembly facility to support the construction of the Coastal Virginia Offshore Wind project. Dominion Energy has commissioned the construction of the U.S.' first wind turbine installation vessel for the project.

California creates central buyer for offshore wind power

California lawmakers approved a bill giving the state the authority to purchase renewable energy, removing a major hurdle for the development of floating offshore wind projects.

The administration of President Joe Biden last year awarded five offshore wind leases off the coast of California to Norway's Equinor, Denmark's Copenhagen Infrastructure Partners, Germany’s RWE, Ocean Winds ― a joint venture between France’s Engie and Portugal’s EDP Renewables ― and U.S. developer Invenergy.

But to kickstart these floating wind projects, which have a total capacity of 4.6 gigawatts (GW), the companies need to secure power purchase agreements (PPAs) from utility companies that may not be willing to pay a premium for clean energy, stakeholders say.

The AB 1373 bill is designed to create a central buyer for offshore wind and long-duration energy storage, hence “creating a market for diverse sources of clean electricity that will spur more projects to break ground,” the office of Governor Gavin Newsom said.

The legislation “is an important milestone that will establish a robust mechanism to facilitate procurement and provide a clear path to market for large-scale clean energies like offshore wind,” Offshore Wind California said in a statement.

However, California faces other challenges to meet its target of building 2 GW to 5 GW of offshore wind by 2030 and 25 GW by 2045.

The deep waters of the Pacific Coast mean that, unlike on the East Coast, developers will not benefit from infrastructure built earlier for conventional fixed-bottom offshore projects. The state will need to make huge investments in ports and transmission upgrades, build a regional supply chain from scratch, set up a clear permitting roadmap, and identify more areas for development.

EU unveils measures to invigorate wind industry

The European Union has unveiled a European Wind Power package that aims to fast-track permitting, improve auction systems and stimulate the bloc’s supply chain.

Slow permitting is one of the main hurdles preventing the EU from achieving its goal of 480 GW wind capacity by 2030. The EU installed 19 GW of wind power in 2022, well below the 30 GW a year needed to meet the goal.

New rules provisionally approved by EU officials earlier this year set a two-year maximum for permitting new onshore wind projects and one year for repowering projects but member states have some time to implement the rules.

"We will fast-track permitting even more. We will improve the auction systems across the EU. We will focus on skills, access to finance, and stable supply chains," European Commission President Ursula von der Leyen told the European Parliament on September 13.

The package aims to have a broader impact to ensure that clean technology including wind supplies, batteries and electric vehicles are made in Europe, von der Leyen said.

Industry association WindEurope welcomed the announcement, saying the bloc needs to support local manufacturers, which are struggling with rampant inflation, higher interest rates, and unfair competition from Chinese suppliers offering “cheaper turbines, looser standards and unconventional financial terms.”

The trade group urged EU countries to redesign their auction systems so that they include mechanisms that account for inflation and non-price criteria that reward companies for sourcing EU-made technology.

The Net-Zero Industry Act (NZIA) proposed by the EU earlier this year will "help embed these principles in auctions, but it may come too late. It is important that Governments apply this as soon as possible,” WindEurope said.

Reuters Events