US offshore wind warnings pile pressure on 2024 auctions

East Coast offshore wind auctions must reflect a new cost reality to lure back developers still licking their wounds from major write-downs, industry experts said.

Related Articles

The fate of several U.S. offshore wind projects hangs in the balance after soaring costs prompted developers to cancel offtake contracts and write down billions of dollars.

High inflation and interest rates combined with supply chain bottlenecks to push up the cost of installing the large arrays off the U.S. East Coast. State regulators rejected requests to increase the price of agreed electricity contracts, squeezing the margins of developers.

Orsted, the world's largest offshore wind developer, ceased the development of its 2.2 GW Ocean Wind 1 and 2 projects in New Jersey. The Danish group warned impairments could reach $5.6 billion because of higher costs and supply chain delays, particularly a shortage of vessels.

Orsted CEO Mads Nipper said the company regretted early-stage investments in Ocean Wind 1 and called for a "reset" of offshore wind prices to reflect rising costs.

Oil and gas groups BP and Equinor wrote down the value of their Beacon and Empire offshore wind projects in New York after the state regulator refused their request to increase electricity prices saying it was not in the interest of ratepayers.

BP wrote down the value of the projects by $540 million on October 31 citing “inflationary pressures and permitting delays." The projects have a combined capacity of 3.3 GW and Equinor had already announced a $300 million impairment.

In total, at least ten East Coast projects tried to renegotiate offtake prices and the contract cancellations and wider project uncertainty deal an early blow to U.S. offshore wind hopes.

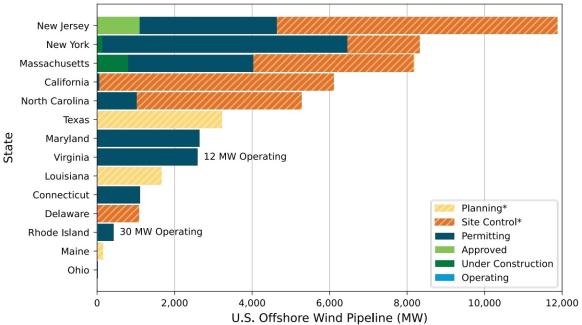

US offshore wind pipeline by state

(Click image to enlarge)

Source: Department of Energy's Offshore Wind Market Report, August 2023.

The Biden administration's Inflation Reduction Act has boosted the economics of manufacturing and installing clean technology in the U.S. but suppliers need a clear pipeline of projects to invest in factories and vessels.

Developers have committed to more advanced projects that are less impacted by rising costs and inflation is now retreating in most major nations. Meanwhile, several states have committed to adapt bid mechanisms to protect developers against future price rises.

Developers are considering how to re-bid, rather than fully exiting the market, Fred Zalcman, Director of the New York Offshore Wind Alliance, told Reuters Events.

In one example, BP said it would reconsider its Beacon and Empire Wind projects after New York State announced plans to simplify bid processes and index future electricity contracts to inflation.

As power authorities prepare new auctions, rising prices will test the commitment of East Coast states to offshore wind.

Even if projects are rebid and approved by state authorities, the delays will have knock-on effects along the supply chain and look set to derail President Biden's plan to install 30 GW offshore wind by 2030.

Industry rethink

Other developers which terminated offshore wind power purchase agreements (PPAs) include Iberdrola subsidiary Avangrid and a consortium between oil group Shell and Ocean Winds, a joint venture by Portugal's EDP Renewables and France's Engie.

Avangrid cancelled agreements on its 804 MW Park City project and its 1,232 MW Commonwealth Wind project in Connecticut while Shell and Ocean Winds have terminated the PPAs for their 1.2 GW SouthCoast Wind project in Massachusetts.

Some offshore wind projects have been less impacted by surging costs and interest rates and timing played a key role in this.

Last month, Orsted and Eversource took the final investment decision on their 704 MW Revolution Wind project off the coast of Rhode Island and Connecticut. Onshore construction has already begun and offshore construction will start in 2024 with project completion expected in 2025.

Orsted recorded an impairment of 3.3 billion Danish krone ($485 million) on the project in Q3 but said it has "an attractive forward-looking value creation with a forward-looking spread to [weighted average cost of capital] above Orsted’s guided range."

Earlier construction dates for the 800 MW Vineyard Wind 1 and 132 MW South Fork Wind projects minimised the impact of inflation and construction on the projects continues. Vineyard Wind 1 is a joint venture of Avangrid and Copenhagen Infrastructure Partners (CIP) and reached financial closure in September 2021. Orsted and U.S. utility Eversource reached financial closure on their South Fork project in February 2022.

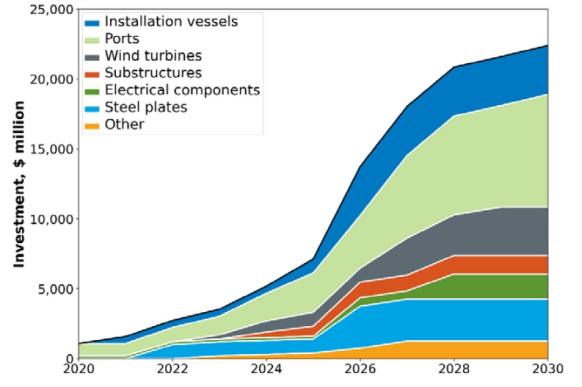

Investments needed to build a US offshore wind supply chain

(Click image to enlarge)

Source: NREL's Offshore wind Supply Chain Road Map, January 2023.

Meanwhile, U.S. utility Dominion Energy is moving forward on its 2.6 GW Coastal Virginia Offshore Wind project as it benefits from regulated utility price mechanisms rather than PPAs with state authorities. U.S. regulators approved the construction of the project earlier this month and the array is scheduled to start producing power in 2026. The project is the fifth and largest offshore wind project authorized by the Biden administration and Dominion has commissioned the country’s first wind turbine installation vessel (WTIV).

In 2021, Dominion Energy raised its cost estimate for the project by $2 billion to $9.8 billion, citing rising commodity costs and revisions to onshore transmission designs.

By November 2021, the utility had secured agreements for material and services, giving both sides confidence in project completion, Jeremy Slayton, spokesperson for operator Dominion Energy, told Reuters Events.

A pilot offshore wind project helped the company gain permitting knowledge and reduce risks, Slayton noted.

Safer bids

Keen to reignite deployment, New York, Connecticut, Massachusetts and New Jersey have committed to include adjustments to electricity prices in future bid processes to reflect changes in interest rates, inflation and supply chain costs between the submittal of bids and the final approval of projects. The states all plan to allocate new contracts over the next 12 months.

“This should help insulate these long duration development projects from the vagaries of global macroeconomic effects," said Zalcman.

The multi-state procurement of wind power could help minimise costs. Connecticut, Massachusetts and Rhode Island recently agreed to jointly procure offshore wind.

This could, in theory, “allow for a greater economy of scale for developers that could alleviate some of the recent higher costs," Timothy Fox, Vice President of energy consultants Clearview Energy, told Reuters Events.

Avangrid and the Shell-Ocean Winds partnership have said they plan to rebid their projects in New England.

The permitting and supply chain progress made by developers of resubmitted projects would give them an advantage over newly proposed projects as they would be closer to construction, Fox said.

Some project requirements may have changed since original bids were submitted and new requirements must not deter developers from rebidding, Zalcman noted.

Rising prices also test the clean energy commitments of East Coast states as they look to minimise the impact on consumers.

An "underappreciated risk" is that high bid prices prompt states to award less offshore wind capacity, Fox said.

State regulators could determine the bids are unreasonable and "approve less capacity than the full solicitation implied," or even determine all bid prices are too high to justify, he said.

Reporting by Neil Ford

Editing by Robin Sayles