U.S. grid plans set to slice offshore wind connection costs

Coordinated onshore grid upgrades are set to lower U.S. offshore wind costs but deeper network studies could reveal larger savings, industry experts said.

Related Articles

As the U.S. drives towards a zero carbon power sector, new transmission planning processes are set to impact offshore wind connection risks. The Biden administration aims to install 30 GW offshore wind capacity by 2030 and East Coast states are planning more efficient onshore grid upgrades.

There is a "critical need" for onshore grid upgrades to avoid congestion and send power to the large load centres, Seth Kaplan, Director of Government and Regulatory Affairs at Ocean Winds, a wind power developer jointly owned by EDP Renewables and Engie, told Reuters Events.

Ocean Winds is developing 2 GW of offshore wind capacity in Massachusetts with partner Shell and 1.7 GW of capacity in the New York Bight.

The first offshore wind farms are being developed with radial links that connect directly to shore and developers must enter the onshore grid interconnection queue and take responsibility for grid upgrades. For future projects, grid operators and power authorities are planning coordinated grid work.

Developers have looked to minimise the length of radial offshore lines in their project bids but this "farm-by-farm" approach can hamper efficient scaling of offshore wind, Theodore Paradise, Executive Vice President, Transmission Strategy & Counsel, at transmission developer Anbaric, said.

Radial lines result in more onshore substations, longer cable distances and greater onshore land needs for multiple projects.

Paradise gave the example of the Narrows tidal strait between Staten Island and Brooklyn in New York City, where land availability is limited. Four grid cables of 2 GW each could be connected, but two spaces are already occupied by 800 MW radial links, he said.

“Well-designed offshore transmission projects can materially reduce the need for onshore transmission upgrades," Paradise said.

This "de-risks offshore wind generation build-outs because [onshore grid] siting can run into significant delays," he said.

Major savings

Kaplan highlighted efforts by New Jersey, Connecticut and New York to better integrate offshore wind into the onshore grid. New Jersey is trialling a new holistic grid planning process created by grid operator PJM that reduces costs and transfers responsibility to power authorities. Connecticut recently launched a regional grid planning strategy that uses offshore wind integration to achieve its carbon reduction targets while New York is implementing several grid initiatives that prioritise its offshore wind targets.

More comprehensive studies by regional transmission organisations (RTOs) could reduce costs further, Johannes Pfeifenberger, Principal at consultants the Brattle Group, told Reuters Events.

PJM is making the most progress in this area, conducting an offshore wind transmission study last year and rolling out a new State Agreement Approach to plan transmission based on state renewable energy objectives such as offshore wind targets. The PJM network is the largest in the country, spanning 13 states across eastern U.S.

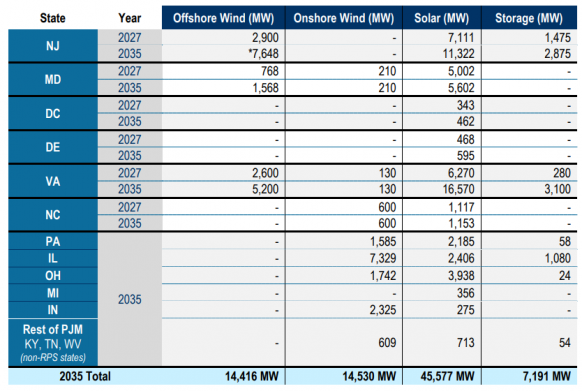

Renewable energy installs in PJM model to achieve state targets

(Click image to enlarge)

Source: PJM's Offshore Wind Transmission Study, October 2021

PJM's studies show how proactive grid planning for larger volumes of capacity additions dramatically reduces the cost per project.

Interconnection studies for 15.5 GW of individual offshore wind farms identified $6.4 billion in onshore transmission upgrades, an average cost of $400/kW. PJM's offshore wind transmission study estimated the cost of coordinated onshore upgrades for 75 GW of renewables, including up to 17 GW of offshore wind, at $3.2 billion, an average cost of just $40/kW.

Grid operators are best placed to find the most ideal locations for grid connection and large-scale work across the grid can offer economies of scale and require less resources than individual interconnection requests.

Transmission operators could further aid developers by analysing how much headroom exists at various possible points of interconnection and the lowest cost options for additional connection capacity, said Pfeifenberger. Grid capacity could be shared with off-line fossil fuel plants located near the coast, he added.

"Right now generators have to guess where the lowest-cost interconnection points to PJM’s grid may be. That’s very hard to figure out for generators," he said.

Sharing risk

Offshore wind developers are also set to benefit from a transfer of interconnection responsibility in PJM that is currently being trialled by New Jersey.

Under PJM's new State Agreement Approach, states propose transmission upgrades that support public policy objectives. PJM analyses the most cost-efficient solution and the state authorities decide whether to pay the costs associated with the upfront planning and build out of transmission. States would then be able to assign interconnection rights to generators, saving developers from making time-consuming interconnection applications on a project-by-project basis.

East Coast power authorities must also take advantage of federal initiatives to improve regional transmission planning and cost allocation, Kaplan said.

The Department of Energy (DOE) is allocating funds to grid upgrades from Biden's $1 trillion Bipartisan Infrastructure bill and last year the Federal Energy Regulatory Commission (FERC) launched market consultations on improvements to regulation on transmission planning and generator connection that will take into account rising renewable energy capacity and future generation needs. The FERC invited comments on grid connection challenges and costs and will study whether transmission planning should be proactive. The commission is yet to say when it will publish its final ruling.

The consultation shows FERC is “hopefully stepping away from the narrow allocation of costs to [project] developers," Kaplan said.

Reporting by Neil Ford

Editing by Robin Sayles