US grid connection queues jump 27%; California grid invests in floating wind

The wind power news you need to know.

Related Articles

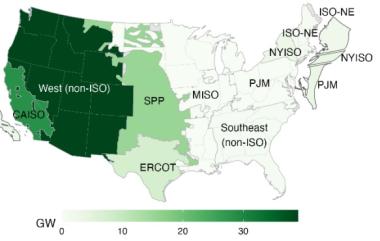

US grid connection queues surge 27% in 2023

Power capacity in U.S. grid connection queues rose by 27% in 2023 to 2,600 GW, the Lawrence Berkeley National Laboratory said in its annual “Queued Up” report.

Solar (1,086 GW) and energy storage (1,028 GW) represent 81% of grid connection applications, followed by wind, which accounts for 14% (366 GW), a third of which is offshore. Natural gas projects represent the remaining 3% (79 GW). Only a fraction of the projects that apply for grid connections are eventually completed, the report notes.

The typical timeframe from connection request to commercial operation hit five years in 2023, up from four years for the 2018-2023 period and two years for projects built in 2000-2007, the report said, based on data from the country’s seven ISOs/RTOs alongside 44 non-ISO utilities.

Capacity joining the interconnection queues is growing rapidly. Last year, projects totaling 908 GW joined the queues, up from 759 GW in 2022 and 561 GW in 2021.

New wind capacity entering grid queues in 2023

(Click image to enlarge)

Source: Berkeley Lab, April 2024

The biggest queues are in the West (706 GW), followed by California’s CAISO (523 GW), MISO (311 GW), PJM (287 GW) and ERCOT (269 GW).

There are currently 571 GW of solar hybrids and 48 GW of wind hybrids in grid connection queues. Hybrid projects are typically coupled with a battery and are seeing particularly strong growth in CAISO and the non-ISO West.

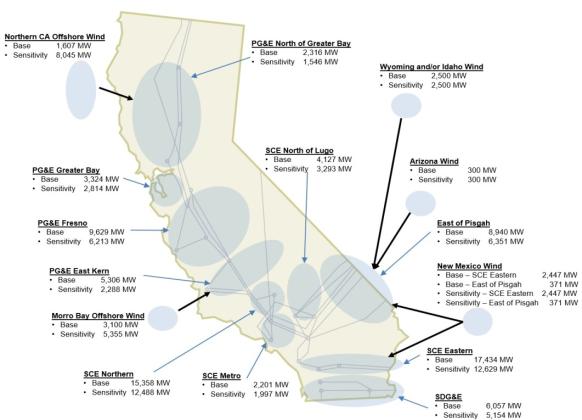

California invests in floating wind transmission

California has proposed $6.1 billion of new grid investments in 2023-2024 and approximately two thirds will be spent on new lines to transport power from floating wind projects as well as smaller lines to deliver the energy into the Bay Area.

The lines will transport up to 4.7 GW of offshore wind, with 3.1 GW in the Central Coast (Morro Bay call area) and 1.6 GW in the North Coast area (Humboldt call area), California grid operator CAISO said in its draft annual investment plan.

“These projects off California’s North Coast area represent the first wave of development for offshore wind to meet the state’s portfolio needs while also being flexible enough to expand in the future to meet any increased requirements,” Neil Millar, the ISO’s vice president for Infrastructure and Operations Planning, said in a statement.

The grid investments will also allow the connection of 38 GW of solar generation, 21 GW of geothermal and 3 GW of in-state wind generation in existing development regions including Tehachapi in Southern California.

Capacity in California enabled by 2023-2024 transmission plan

(Click image to enlarge)

Source: CAISO's 2023-2024 transmission plan, April 2024

The infrastructure will also strengthen south-eastern borders to import over 5.6 GW of out-of-state wind generation from Idaho, Wyoming and New Mexico, and will improve access for battery storage projects co-located with clean power as well as stand-alone batteries closer to major load centers in the LA Basin, greater Bay Area, and San Diego, CAISO said.

California needs to add more than 85 GW of transmission capacity by 2035 to meet its clean power targets.

US approves 2.6 GW offshore wind project in New England

The U.S. has approved New England Wind, the country’s eighth and largest offshore wind project, the Interior Department said on April 2.

The 2.6 GW project is being developed by Iberdrola’s Avangrid and is situated 20 nautical miles south of Martha’s Vineyard, Massachusetts. Avangrid expects to receive approval for its Construction and Operations Plan by July.

The Biden administration has now approved 10 GW of offshore wind projects as it pushes towards its highly ambitious target of installing 30 GW by 2030.

“With the first projects nearing completion, two set to begin major construction this summer, and more following in quick succession, a consistent construction pipeline is fostering the industry’s growth,” Liz Burdock, founder and CEO of Oceantic Network, said in a statement.

Avangrid submitted several proposals to sell offshore wind power in a multi-state procurement process conducted by three New England states last month. The developer expects to hear back in August.

New England Wind will border Vineyard Wind 1 to the south, a 50/50 venture between Avangrid and Copenhagen Infrastructure Partners (CIP) that will be the U.S.' first large-scale offshore wind farm.

The first five turbines of Vineyard Wind 1 started producing power in February, the companies said.

EU launches investigation into Chinese turbine suppliers

The EU has launched an investigation into whether Chinese turbine makers are using anti-competitive practices to undercut their European rivals.

EU authorities will investigate projects in Bulgaria, France, Greece, Romania and Spain to determine if government subsidies give Chinese turbine makers an anti-competitive advantage, EU anti-trust commissioner Margrethe Vestager said on April 9.

European turbine makers including Vestas, Siemens Gamesa and Nordex have a stronghold on the EU market but Chinese companies are making inroads by offering lower prices and better financial terms.

Thanks in part to government subsidies, Chinese solar panel makers now control 97% of the EU market and Beijing is using “the same playbook” in other tech sectors, Vestager said in a speech in the U.S. state of New Jersey.

“We can't afford to see what happened on solar panels, happening again on electric vehicles, wind or essential chips,” she said.

Industry group WindEurope welcomed the investigation, saying that Chinese companies are selling turbines at half the cost of their EU rivals while offering developers three years of deferred payments.

“You can’t do that without unfair public subsidy,” said WindEurope CEO Giles Dickson.

The investigation is the latest EU effort to support domestic wind suppliers as it pursues its goal of 425 GW installed wind capacity by 2030, up from 220 GW currently.

In October, EU policymakers approved a new Wind Power Package aimed at accelerating permitting and boosting supply chain investments going forward.

Alongside this, the Net-Zero Industry Act (NZIA) approved in February urges EU members to include pre-qualification and non-price criteria in future auctions to incentivise the use of domestic components.

Reuters Events