UK hikes offshore wind price cap by 66%; New York launches tender in cost battle

The wind power news you need to know.

Related Articles

UK raises offshore wind price cap after failed auction

The UK government will hike the price cap for offshore wind in its next renewable energy auction by 66% after developers complained that prices were too low.

Britain's contract-for-difference (CfD) scheme offers renewable energy developers a guaranteed price for electricity.

The last auction received no bids from offshore wind developers after the UK government lowered the price cap to 44 pounds per MWh ($53.9/MWh, 50.7 euros/MWh) despite rising component costs.

In the next auction in March, the price cap for fixed-bottom offshore wind projects will increase to 73 pounds/MWh while the price for floating wind projects will rise by 52% to 176 pounds/MWh. Competitive bidding could result in lower prices.

Day-ahead wholesale power prices in UK, Ireland

(Click image to enlarge)

Source: European Commission's quarterly electricity market report.

Developers have urged the government to raise prices to account for high inflation, interest rate hikes and supply chain delays since the coronavirus pandemic.

Offshore wind will be given a separate funding pot in March due to high demand and the government has introduced an additional reward mechanism for sustainable supply chains.

The UK government aims to quadruple offshore wind capacity to 50 GW by 2030 and has earmarked 960 million pounds for a Green Industries Growth Accelerator to support clean energy manufacturing, it said.

This scheme “will help us to scale up the UK’s offshore wind supply chain faster,” the Offshore Wind Industry Council industry association said in a statement.

Soaring costs have disrupted offshore wind projects in Europe and the United States.

In September, Vattenfall halted the development of the 1.4 GW Norfolk Boreas offshore wind project off the east coast of England due to rising costs and supply chain delays. The Swedish company said that the entire wind industry has seen costs increase by 40% while contract terms have remained the same, which is making some projects unsustainable.

Northern European countries collaborate on onshore wind tenders

Nine countries in northern Europe have issued a tender plan to secure 15 GW of offshore wind energy a year by 2030 in a joint effort to address cost risks and licensing challenges.

The members of the North Seas Energy Cooperation (NSEC) (Belgium, Denmark, France, Germany, Ireland, Luxembourg, the Netherlands, Norway, and Sweden) published a schedule to award contracts for 100 GW of new offshore wind energy by the end of the decade.

NSEC members already planned to procure this capacity but the new collaboration aims to address challenges such as “increased resource prices, limited availability of labor, and complex licensing systems,” the European Commission (EC) said.

The collaboration aims to “translate national ambitions to European actions” and support efforts to create a more resilient supply chain for the industry, the commission said.

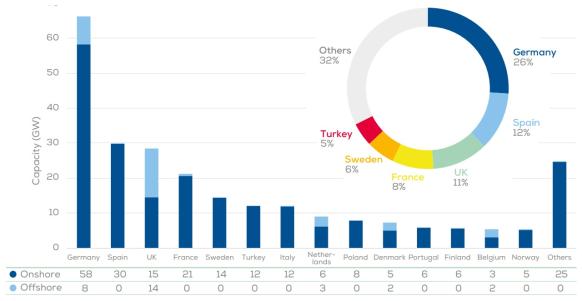

Installed wind capacity in Europe at end of 2022

(Click image to enlarge)

Source: WindEurope

The countries will also coordinate the construction of North Sea port infrastructure, which has been identified as a substantial bottleneck for offshore wind development.

Their plans will be guided by the EU's European Network of Transmission System Operators for Electricity (ENTSO-E) which is due to publish a shared plan for North Sea infrastructure in January.

The collaboration is part of efforts by the EC to create an integrated energy system by 2050. The agreement will allow the North Seas to become the largest source of renewable energy in Europe, the commission said.

UK to remove projects blocking grid queues

The UK National Grid system operator will remove stalled power generation projects from grid connection queues under a new process launched on November 27.

National Grid ESO will terminate stalled projects that are blocking connection queues for high-voltage transmission lines so that projects that are ready to go can be fast-tracked, energy regulator Ofgem said in a statement.

In Europe and the United States, solar and wind projects must wait several years for grid connections as approval authorities work through a high volume of applications.

The new UK rules will apply to existing and future grid connection agreements and the first terminations are "likely to happen as early as 2024," the regulator said.

Earlier this month, National Grid said it will speed up the connection of 10 GW of battery storage on the UK transmission network by around four years and accelerate the connection of 10 GW of wind, solar and storage capacity on the distribution network.

On the transmission network, 19 battery storage projects in England and Wales will be offered connection dates four years earlier than current agreements, on average, by delaying some non-essential engineering works until after connection.

In the Midlands and South West of England and in South Wales, 10 GW of low carbon energy projects will be accelerated with some "shovel ready" projects brought forward by up to five years, National Grid said.

The UK aims to quadruple offshore wind capacity to 50 GW by 2030 and fully decarbonise its power sector by 2035, requiring huge investment in onshore and offshore infrastructure and faster deployment of energy storage.

The announcement by National Grid follows months of engagement with industry, government and Ofgem.

The grid operator has "already been in contact with more than 200 projects interested in fast tracking their distribution connection dates in the first wave of the capacity release, with 16 expressing an interest in connecting in the next 12 months and another 180 looking to connect within two to five years," it said.

A further tranche of clean energy projects, primarily batteries or batteries coupled with wind or solar, will be offered accelerated transmission connections early next year, which could bring forward another 10 GW, National Grid said.

New York to launch new offshore wind solicitation

New York State will open a new offshore wind solicitation on November 30 as part of efforts to support the troubled emerging industry.

Final proposals will be due by January 25 and the winning bids will be announced the following month, the office of Governor Kathy Hochul said.

The tender will be open to all companies, including developers with existing contracts that want to secure better financial terms.

New York officials previously said that this “accelerated renewable energy procurement process” will include inflation indexing and simplified bid requirements.

The new solicitation comes after New York regulators rejected an effort by developers to improve the financial terms of their power purchase agreements (PPAs). The petitioners included Orsted, which had asked for amendments to the PPA for its 880 MW Sunrise Wind project, as well as Equinor and BP, which requested modifications to the contracts for their Empire 1, Empire 2 and Beacon Wind projects with a total capacity of 3.3 GW.

BP and Equinor said the regulators' decision will cost the companies $540 million and $300 million, respectively. Earlier this month, Orsted said it will cancel its offshore wind projects Ocean Wind 1 and 2 in New Jersey, a move that will cost the Danish company $5.6 billion.

Following the regulatory setback, Governor Hochul released an "action plan" to support the renewable energy industry and later awarded provisional contracts to three new offshore wind projects with a combined production capacity of 4 GW.

The projects are the 1.4 GW Attentive Energy One (TotalEnergies, Rise Light & Power, and Corio Generation), the 1.3 GW Community Offshore Wind (RWE Offshore Renewables and National Grid) and the 1.3 GW Excelsior Wind project (Copenhagen Infrastructure Partners).

New York previously approved five other offshore wind projects with a total capacity of 4.3 GW, including the 132 MW South Fork array, which is now under construction.

The state aims to build 9 GW of offshore wind by 2035.

US Treasury extends tax credits to more offshore wind kit

The U.S. Treasury Department has issued new rules that effectively extend tax benefits to components used by the offshore wind industry.

The guidance states the Investment Tax Credit (ITC) included in the 2022 Inflation Reduction Act applies to subsea cables used in offshore wind projects and some of the technology in onshore substations. The rules also set out ITC requirements for standalone battery storage and for grid connections on small clean energy projects.

The guidance provides “long-awaited clarity on which components qualify for the ITC,” the American Clean Power Association (ACP) said.

The update will help offshore wind developers as they navigate inflation, high interest rates, and supply chain delays. In recent months, several developers have terminated electricity contracts and written off hundreds of millions of dollars on offshore projects in Massachusetts, Connecticut, New Jersey and New York.

Reuters Events