RWE wins Gulf of Mexico lease as bidders stay away; Offshore wind developers shun UK auction

The wind power news you need to know.

Related Articles

RWE wins Gulf of Mexico offshore wind lease in undersubscribed auction

The U.S. federal government awarded Germany’s RWE a lease area in the Gulf of Mexico that could generate 1.2 GW of offshore wind energy.

RWE’s $5.6 million bid is the lowest winning bid for a federal offshore wind auction since President Joe Biden took office in 2021, while two other lease areas on offer off Texas received no bids. Fifteen companies had qualified for the auction but only two of them placed bids, federal authorities said.

Separately, the Louisiana Department of Natural Resources (DNR) is in talks with two offshore wind developers for projects in state waters and these projects could be completed faster.

“While today’s auction fell short of expectations, it is nonetheless a critical step for the energy transition on the Gulf Coast,” the American Clean Power Association said in a statement.

Developers in the Gulf of Mexico will face several challenges, including lower wind speeds compared to the North Atlantic, soft soils, and hurricane activity. On the plus side, they could benefit from existing oil and gas infrastructure and lower labor costs than Atlantic sites.

RWE’s winning bid in Louisiana represents a cost of $55 per acre, which compares to $10,000 per acre in the New York Bight auction in February 2022, K&L Gates law firm said.

“The strikingly low interest in the Gulf lease areas appears to reflect risk assessments highlighting the lack of certainty surrounding offshore wind in the region,” K&L Gates said in a research note.

Louisiana aims to build 5 GW of offshore wind by 2035 but unlike most North Atlantic states, Texas does not have an offshore wind target, meaning that developers could struggle to secure offtake contracts. The industry faces multiple cost challenges, including volatile component costs, interconnection delays and a shortage of installation vessels.

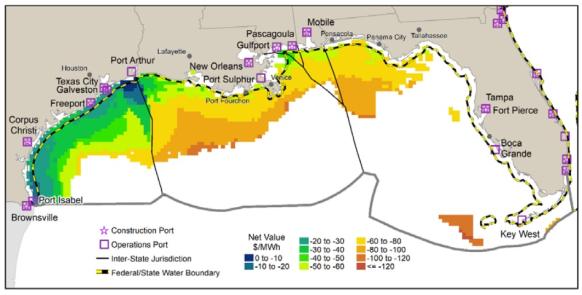

Forecast net value of offshore wind in Gulf of Mexico in 2030

(Click image to enlarge)

Note: net value refers to estimated revenue minus the levelised cost.

Source: NREL report 'Offshore Wind in the US Gulf of Mexico: Regional Economic Modeling and Site Specific Analyses,' May 2020.

RWE qualifies for two bidding credits: 20% for supporting workforce training programs and developing a domestic supply chain, and 10% for contributing to mitigate potential negative impacts on the fishing industry.

RWE’s winning bid cements its position as a leading of offshore wind developer in the U.S. The company is building the 1.3 GW Community Offshore Wind project off the coast of New Jersey, which is expected to come on-stream in 2030, and last year won a lease to develop up to 1.6 GW of floating offshore wind projects off the coast of Northern California.

The Biden administration aims to install 30 GW of offshore wind energy by 2030 and has thus far approved four commercial-scale offshore wind projects. Leases have been allocated along the Northeast coast and federal authorities aim to complete environmental reviews of at least 16 projects by 2025. Leases are also set to be allocated in Oregon, the Gulf of Maine and the Central Atlantic.

Offshore wind developers shun UK auction

The UK received no bids for offshore wind projects in its latest renewable energy auction after developers argued the prices offered by the government were too low.

The auction aimed to award up to 5 GW of offshore wind contracts and the lack of bidders undermines the government's goal of installing 50 GW of offshore wind by 2030, up from around 14 GW currently.

Britain's contract-for-difference (CfD) scheme offers renewable power developers a guaranteed price for electricity. For the latest auction, the price cap was lowered to 44 pounds per MWh, down from 46 pounds/MWh in the previous round, despite rising component costs.

Ahead of the auction, offshore wind developers urged the British government to raise prices to reflect higher costs and interest rates since Russia invaded Ukraine and economies bounced back from the pandemic. Soaring costs have disrupted projects in Europe and the U.S.

Last month, Vattenfall halted the development of the 1.4 GW Norfolk Boreas offshore wind project off the east coast of England due to rising costs and supply chain delays. The Swedish company said that the entire wind industry has seen costs increase by 40% while contract terms have remained the same, which is making some projects unsustainable.

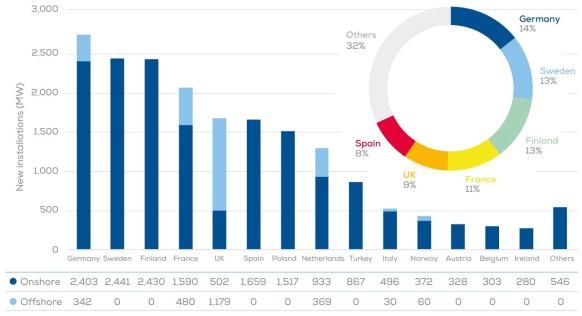

Wind installations in Europe in 2022

(Click image to enlarge)

Source: WindEurope

“There are big lessons here for other Governments in Europe. If your auction prices don’t reflect actual costs, then no one bids and you don’t get the offshore wind farms you want. You miss your climate and energy targets. And you miss out of jobs and growth,” WindEurope CEO Giles Dickson said in a statement.

The UK auction awarded 3.7 GW of renewable energy contracts, including 1.9 GW of solar and 1.8 GW of onshore wind, down from 11 GW of projects in last year's round.

UK implements rules to speed up onshore wind

The British government has introduced changes to speed up the approval of new onshore wind farms, easing a de facto ban on onshore wind in England.

The decision seeks to streamline planning rules for onshore wind projects supported by local communities, accelerate the process of allocating sites, and broaden the ways in which new wind locations can be identified.

"To increase our energy security and develop a cleaner, greener economy, we are introducing new measures to allow local communities to back onshore wind power projects," Michael Gove, minister for Levelling Up, Housing and Communities said in a statement.

Although not formally banned, new onshore wind farms have been effectively ruled out since 2015 by planning rules that allowed a single complaint to block a project. Some members of the Conservative Party objected to these regulations saying that onshore wind projects supported by local communities should be allowed to proceed.

Under the new rules, elected local councilors “should consider the views of the whole community, rather than a small minority, when considering a planning application.”

RenewablesUK said the reforms don’t go far enough and will only lead to a small number of new projects. It urged the government to implement a major overhaul of the planning system to speed up the approval of new onshore wind farms.

The opposition Labour Party is currently on course to win the next general election and wants to decarbonise the entire power sector by 2030, five years earlier than the Conservatives.

In June, Labour said it would look to shorten the timelines for onshore planning approvals from years to months through tough new targets for consenting decisions and require local authorities to proactively identify areas suitable for wind and solar development.

Construction starts on New Mexico-Arizona transmission line

Pattern Energy has started construction of a transmission line with a capacity to transport up to 4.5 GW of mostly clean energy from New Mexico to markets in Arizona and California.

The SunZia project will consist of two 500-kilovolt transmission lines that will transport energy from Pattern’s 3.5 GW SunZia Wind project in New Mexico, which is expected to start operations in 2026. The lines will traverse 520 miles of federal, state, and private lands.

Pattern Energy, which acquired the SunZia transmission project from SouthWestern Power Group in 2022, plans to invest $8 billion in the two projects.

A lack of long-distance transmission capacity is holding back wind and solar growth and developers are calling for the Federal Energy Regulatory Commission (FERC) to mandate grid operators to expand links.

After 16 years in development, the federal Bureau of Land Management (BLM) approved the SunZia transmission project in May. Key changes to the project included a route change to allay concerns over proximity to the White Sands Missile Range.

Sunzia was granted Fast-41 status, a federal initiative launched in 2015 to streamline approvals of critical infrastructure.

"The ability of the Fast-41 team to quickly and efficiently convene cooperating federal agencies to discuss and resolve specific permitting challenges throughout the NEPA [National Energy Policy Act] process proved quite valuable to the successful completion of the SunZia permitting," Pattern Energy CEO Hunter Armistead told Reuters Events last month.

Reuters Events