Rising curtailments in Texas magnify grid, storage shortfalls

As curtailments slice revenues in the U.S.' largest clean energy market, energy storage will be key to maximising revenues.

Related Articles

Curtailment of U.S. wind and solar farms are set to rise in the coming years, denting the revenues of generators, as renewable energy deployment outpaces the buildout of transmission capacity and energy storage.

In Texas, wind power curtailments are forecast to rise to 13% of total available generation by 2035, up from 5% in 2022, if there are no upgrades to the state power grid, the U.S. Energy Information Administration (EIA) said in a research note. Solar curtailments are forecast to hike from 9% to 19% under the same grid scenario, it said.

Texas is the fastest-growing U.S. solar market and operates the largest wind power fleet, accounting for 26% of national wind generation last year. EIA projects wind and solar capacity will double to over 100 GW by 2035 and battery storage is also on the rise, spurred by a growing need for dispatchable power and new tax credits in the 2022 Inflation Reduction Act.

Grid operators curtail wind and solar when supply exceeds demand and the power cannot be transported to other regions, curbing operators’ revenues from generation and federal production tax credits (PTCs) that are based on output.

Curtailment is more prevalent in western Texas, where most wind and solar farms have been installed to date and where older wind assets are less able to adapt to market conditions, Mark Noyes, CEO of renewable energy operator RWE Clean Energy, told Reuters Events.

Many of the wind farms in West Texas were installed more than 10 years ago and therefore no longer receive PTCs, deterring them from offering output at low prices in the wholesale market, Noyes said. Under the inflation act, developers of new wind projects can choose between PTCs or investment tax credits (ITCs) that are based on project costs. A large number of RWE's wind farms are located in central and southern areas, helping it minimise curtailment issues.

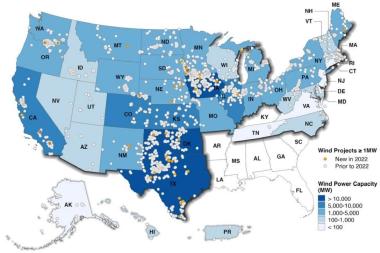

US installed wind capacity (end of 2022)

(Click image to enlarge)

Source: Department of Energy's 'Land-based Wind Market Report,' August 2023.

Amid rising curtailments and a lack of transmission capacity towards large cities like Houston and San Antonio, many wind and solar developers are spreading east and investing in utility-scale energy storage.

Grid barriers

Large investments in wind and solar capacity helped Texas meet power demand this summer as high temperatures propelled consumption to record levels.

High power prices during these periods boost the revenues of wind and solar operators but at many other times curtailments are a significant project risk.

Curtailments are most likely in the evenings when wind is more common and demand is moderate, and the "ERCOT price map turns blue," says Ed Hirs, an Energy Fellow at the University of Houston, referring to periods of low prices in the Texas power market.

Texas has no significant transmission capacity with other networks, leading to shortages or curtailments when supply and demand differs between parts of Texas and there is insufficient transmission capacity within the state. The intermittency of wind and solar generation creates surpluses or deficits at different times of the day and year.

“One solution to the issues presented by intermittency is balancing resources and load across a larger footprint,” Cristin Lyons, partner and energy practice leader at ScottMadden, told Reuters Events. New power lines from West to East would be one way to ease the congestion but these would take many years to be completed.

Texas must prioritise the expansion and upgrade of transmission infrastructure, Hirs and Lyons both said. Across the U.S., a lack of long-distance transmission capacity is restricting deployment of wind and solar farms while slow approval processes for grid connections are delaying projects.

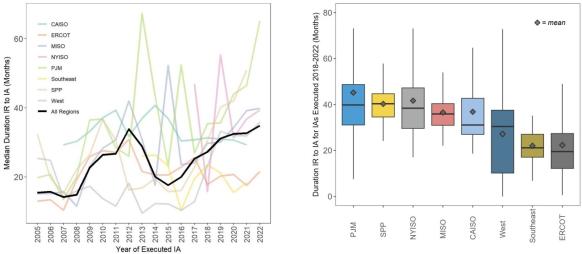

US grid connection approval times, by market

(Click image to enlarge)

IR = Interconnection Request

IA = Interconnection Approval

Source: Berkeley Lab, April 2023

Developers in Texas have benefited from a faster approval process than in many other U.S. markets but rising activity is increasing the pressure on power authorities.

“ERCOT and the [Texas] Public Utility Commission say that they are being very responsive with connection requests but for those who are waiting, it is costing money and holding them back,” Hirs said.

Balancing supply

A rapid rise in energy storage capacity in Texas in the coming years will help to temper curtailment risks, allowing operators to charge batteries during low demand or excess supply and dispatch power during peak demand.

Developers plan to install 7.9 GW of battery storage in Texas by 2025, twenty times the 400 MW currently installed, EIA said in a research note in December 2022. Nationwide, 20.8 GW of battery capacity is planned, it said.

A surge in solar installations has reduced revenue potential during peak solar hours and most developers are pairing new facilities with battery storage capacity to increase revenues at other times. The inflation act introduced tax credits for stand-alone energy storage, further boosting battery deployment.

Batteries are often a better fit for solar profiles than wind farms. Only one new hybrid wind-storage facility was commissioned in the U.S. in 2022 while there were 59 PV plus storage plants brought online, the Department of Energy (DOE) said in its annual 'Land-based wind market report' published last month.

As electricity demand rises in the coming years, some curtailments could be avoided by locating new power-intensive facilities closer to wind and solar farms, Chris Vlahoplus, an Independent Energy Consultant, said.

In addition, some wind and solar developers may look to divert excess production towards other energy forms such as clean hydrogen production, he said.

The inflation act provides tax credits for green hydrogen projects and Texas is seen as an early market for clean hydrogen due to strong solar and wind resources and significant hydrogen infrastructure on the Gulf Coast.

Going forward, financial incentives could be used to incentivise power consumption during lower demand periods, Vlahoplus said.

"Workplace charging of electric vehicles is an example to soak up the overproduction of solar midday. Bitcoin mining also can be used to shift load and curtail load to meet grid demands,” he said.

Reporting by Mark Shenk

Editing by Robin Sayles