Oil groups dominate German offshore wind auction; Texas curtailment forecast piles pressure on grid

The wind power news you need to know.

Related Articles

BP, Total dominate 13-billion-euro German offshore auction

Oil and gas groups BP and TotalEnergies were the only winners of a 7 GW offshore wind auction in Germany.

BP was awarded two North Sea sites with a total generating capacity of 4 GW, bringing the company’s offshore wind pipeline to 9.2 GW.

Some of the power will be used to supply BP's electric vehicle stations in Germany and decarbonise its hydrogen, biofuels, and refinery projects in the country, the company said in a statement.

TotalEnergies was awarded a site in the North Sea with a generating capacity of 2 GW and another in the Baltic Sea with a capacity of 1GW. The power generated by these projects will be sold directly in the electricity market or through Power Purchase Agreements (PPAs), the company said.

The auctions are part of Germany’s efforts to quadruple offshore wind capacity to 30 GW by 2030.

BP and TotalEnergies will initially pay 10% of the bid amount – 678 million euros ($761.6 million) and 582 million euros, respectively – and the remaining 90% will be paid over a 20-year period after the projects start operations.

Both companies aim to start delivering power from these sites by 2030.

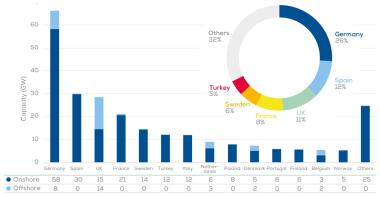

Installed wind capacity in Europe at end of 2022

(Click image to enlarge)

Source: WindEurope

The contracts do not include any government subsidies and the winners were chosen following a second round of uncapped negative bidding on the basis of price only.

“Negative bidding creates additional costs for offshore wind developers,” industry association WindEurope warned in a statement.

“These costs must be passed on. Either to the supply chain which is already struggling with inflation and surging input costs. Or to the consumers who already face higher electricity prices and costs of living.”

Germany plans to tender a further 1.8 GW of offshore wind this summer under a different bidding process that would include qualitative criteria, WindEurope said.

Texas curtailment outlook highlights need for grid upgrades

Wind power curtailments in Texas are forecast to rise to 13% of total available generation by 2035, up from 5% in 2022, if there are no upgrades to the Texas power grid, the U.S. Energy Information Administration (EIA) said in a research note.

Solar curtailments are forecast to hike from 9% to 19% under the same grid scenario, EIA said.

Texas is the fastest growing solar market in the U.S. and operates the largest wind power fleet, accounting for 26% of total U.S. wind generation last year. EIA projects wind and solar capacity will double to over 100 GW by 2035 and battery storage is also on the rise, spurred by a growing need for dispatchable power and new tax credits in the 2022 Inflation Reduction Act.

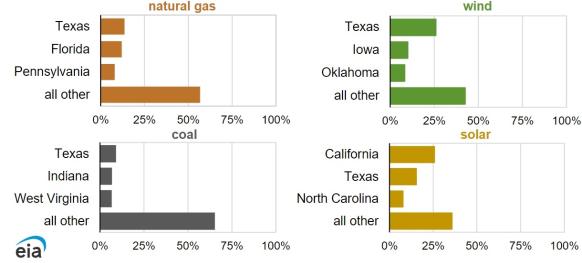

Share of US power generation - top three states

(Click image to enlarge)

Some 64% of the curtailments in 2035 would occur during times of high wind and solar resources and low electricity demand, while 36% would be due to limited transmission capacity during periods of high wind and solar and high power demand, EIA said in its forecast.

Greater power demand from battery charging could potentially reduce curtailments during lower demand periods, EIA noted.

Texas is due to hit record high power demand this week as soaring temperatures drive up air-conditioning demand.

US approves construction of third commercial-scale offshore wind farm

The federal Bureau of Ocean Energy Management (BOEM) has approved the construction plan for Orsted’s 1.1 GW Ocean Wind 1 project off the coast of New Jersey.

The approval allows Ocean Wind 1 to install up to 98 wind turbines and build up to three offshore substations within its lease area. The project is expected online in late 2024 or early 2025.

Ocean Wind 1 is the third commercial-scale offshore wind project to gain federal approval after Vineyard Wind in Massachusetts (Orsted, 800MW) and South Fork Wind in Rhode Island (Avangrid and Copenhagen Infrastructure Partners, 132 MW). Both of these projects started installing monopile foundations in June.

There are seven more offshore wind projects with a combined capacity of 14 GW awaiting final environmental review, according to the Business Network for Offshore Wind. The Biden administration has set a target of 30 GW of offshore wind by 2030 and aims to complete environmental reviews of at least 16 projects by 2025, representing over 20 GW of offshore wind capacity.

Orsted and Eversource’s Revolution Wind project off the coast of Rhode Island received environmental approval on July 17 and is due to receive full BOEM approval within 30 days.

“Alongside this progress, the U.S. supply chain is coming to life as factory workers in Paulsboro, New Jersey, fabricators in Baltimore, Maryland, and construction workers at New Jersey’s wind port are manufacturing Ocean Wind 1’s turbine components and ports,” the business network said.

UK approves Orsted’s Hornsea 4 offshore wind project

The British government has given Orsted the go-ahead to build the 2.6 GW Hornsea 4 offshore wind project.

Located off the Yorkshire coast, Hornsea 4 will feature 180 wind turbines and is the second largest project approved in the UK after Orsted's 2.9 GW Hornsea 3 project.

In March, Orsted warned Hornsea 3 may not go ahead without more government support such as tax breaks. Orsted is expected to announce whether it will continue with Hornsea 3 before the end of the year.

Britain has a target of 50 GW of offshore wind capacity by 2030, up from almost 14 GW currently, and is aiming to fully decarbonise its power sector by 2035.

Reuters Events