Offshore wind price hike set to revive UK decarbonisation goal

A higher UK price cap is expected to spur competitive bidding in next month’s crucial offshore wind auction and some corporate customers are pivoting to offshore wind contracts in a further boost for the sector.

Related Articles

The UK's round 6 renewable energy auction next month offers a price cap of 73 pounds/MWh for offshore wind developers after the government increased the price by 66% following no eligible bids in last year's auction.

The contracts for difference (CfDs) allocated in the auctions provide operators with guaranteed electricity prices for 15 years. As global costs soared and interest rates climbed, the price cap of 44 pounds per MWh ($53.9/MWh) in round 5 was unrealistic, developers said.

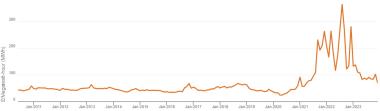

UK average day-ahead wholesale power prices

(Click image to enlarge)

Source: UK energy regulator Ofgem, February 2024.

Across Europe and the U.S., the rising cost of materials and components has hit offshore wind developers hard, prompting some to shelve projects and adapt global offshore wind strategies.

Swedish utility Vattenfall halted work on its 1.4 GW Norfolk Boreas wind farm off the east coast of England, citing a 40% increase in industry costs. In December, the company sold its entire 4.2 GW Norfolk Zone containing the Boreas, Vanguard West and Vanguard East projects, to German utility RWE for 963 million pounds, saying other renewable energy projects would "better fit its overall portfolio and risk appetite."

The higher price cap in round 6 has been welcomed by the offshore wind industry and experts predict fervent interest from developers. Offshore wind has also been allocated its own revenue pot in the auction, avoiding competition from other renewable energy sources.

The UK must accelerate offshore wind deployment to meet its goal of a decarbonised power sector by 2035. The government aims to install 50 GW by 2030, up from a current level of 15 GW.

Industry group WindEurope predicts 10 GW of contracts could be delivered in the auction, based on industry demand and the funds allocated by the government.

Meanwhile, low auction prices last year have spurred interest in corporate power purchase agreements (PPAs), offering developers further revenue options going forward.

Bidders return

Winners in the UK auction are allocated the same bid price as the highest successful bid, under a pay as clear basis. The contracts are awarded in 2012 prices and are increased annually by the UK consumer price index (CPI) over the course of the contract.

UK power generation by source - last 12 months

Source: National Grid, February 2024.

Orsted, the world’s largest offshore wind developer, took the final investment decision on its giant 2.9 GW Hornsea 3 project in December after it was allowed to rebid part of the capacity into round 6.

Due online by 2027, the project was awarded a CfD in 2022 at a strike price of 37.35 pounds/MWh but was granted permission to submit up to 700 MW of the project's capacity in future bidding rounds.

“Orsted will use this flexibility to submit a share of Hornsea 3’s capacity into the UK’s upcoming allocation round 6,” the company said in a statement.

For auction round 7, scheduled in March 2025, the government has proposed indexing prices to international costs during the construction phase, then reverting to the CPI for the operations phase. A market consultation on the proposal runs until March 7.

Competing technologies

The large dimensions and high capital outlay of offshore wind projects mean they are particularly sensitive to rises in materials costs and interest rates.

For round 6, the price cap for offshore wind moves above the price cap for onshore wind which was set at 64 pounds/MWh at 2012 prices.

At 73 pounds/MWh, the offshore wind price cap is about 100 pounds/MWh after indexation to CPI and this remains lower than current wholesale power prices.

Analysts at Cornwall Insight forecast average UK wholesale electricity prices will be 113 pounds/MWh in 2024 and decline gradually to 83 pounds/MWh in 2029.

High gas prices are driving high wholesale power prices and this is set to continue until there is more renewable energy capacity in the system, a spokesperson for Siemens Gamesa said.

Corporate customers

Low price caps in round 5 combined with volatile wholesale prices have spurred interest in corporate Power Purchase Agreements (PPAs) that developers can use to supplement CfD income and reduce wholesale price exposure.

Commercial PPAs provide corporations with long-term energy price certainty and help them meet net zero and corporate social responsibility requirements.

PPAs have been more commonplace in onshore wind and solar, where the technologies are more mature and projects are less capital intensive.

The first offshore wind corporate PPA was concluded in February 2019 between Northumbrian Water and Orsted, for the purchase of 100 GWh per year from Orsted’s Race Bank project over ten years. Race Bank was accredited on the Renewable Obligation (RO) scheme in place before the government introduced CfDs.

In December 2022, Google signed a 12-year PPA for 100 MW from the 882 MW Moray West offshore wind farm in Scotland. Last month, Amazon signed a 473 MW PPA with the same project, which is being developed by Ocean Winds, a joint venture of Engie and EDPR Renewables.

Utility deals include an agreement by Shell to buy 20% of the output from the 1.2 GW Dogger Bank wind farm in England. The project is expected to be completed by 2026 and Shell agreed to sell up to 2.4 terawatt hours per year to Octopus Energy when the project is completed.

Supply incentives

Industry participants want the UK to further reform the auction process for round 7.

The government is considering providing extra financial incentives to developers that reduce emissions from the supply chain and demonstrate positive social impact on communities, echoing support provided to U.S. communities under the Biden administration's 2022 Inflation Reduction Act.

Siemens Gamesa wants the auction process to take into account long-term development pipelines and supply commitments, to help encourage investment in manufacturing. Long-term commitments help to build a sustainable supply chain and allow developers to find economies of series.

This would help to avoid a "late-stage investment choke point" that is precipitated by the auctions allocating contracts to projects late in the development phase after they have met numerous requirements, a Siemens Gamesa spokesperson said.

Reporting by Neil Ford

Editing by Robin Sayles