Offshore wind in Europe needs urgent factory aid to hit targets

Europe must urgently expand offshore wind factories to supply larger turbines and EU support mechanisms must go further to minimise cost increases, industry officials said.

Related Articles

Europe's commitment to accelerate renewable energy deployment and strengthen energy security presents significant supply chain challenges in the coming years.

In April, European leaders pledged to install 120 GW of offshore wind capacity in northern sea areas by 2030, more than quadruple current capacity. By 2040, the European Union targets over 215 GW, alongside ambitious UK goals.

Europe hosts just 7 GW per year of offshore wind manufacturing capacity and suppliers will require policy support from governments to meet its objectives, renewable energy companies warned in a joint declaration. U.S. offshore wind developers will also seek European components while domestic supply chains are built up.

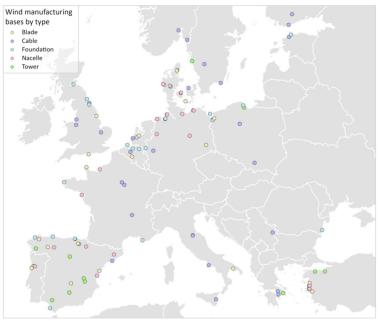

Wind power manufacturing facilities in Europe

(Click image to enlarge)

Source: Rystad Energy

Europe’s supply chains will be misaligned without direct financial support for manufacturing and port capacity, a spokesperson for turbine supplier Siemens Gamesa told Reuters Events.

“Without direct financial support…we risk missing the 2030 targets, the spokesperson said.

The EU has pledged to match the funding offered to U.S. companies under President Biden's Inflation Reduction Act and has proposed a Net Zero Industry Act that targets 36 GW/year of manufacturing capacity by 2030 and 40% of renewable energy components from local factories.

The EU must improve the net zero act or risk importing more components from China, WindEurope said. The act should provide stronger support for developers that commit to European technology and include cyber security and due diligence requirements, the industry group said.

“We can’t be sourcing kit from places with questionable human rights records, or loose standards on labour and environmental protection," it said.

A long period of intense competition has driven down offshore wind prices and seen manufacturers diversify their supply chains.

More sourcing of European components will come at a price, Siemens Gamesa warned.

“More sustainability, innovation and energy sovereignty don't come for free," the spokesperson said.

Size squeeze

Developers are seeking larger turbine capacities to optimise costs, increasing the challenge of building out new manufacturing capacity. Many developers are now planning to install 15 MW turbines with a height of 280 metres and rotor diameter of 240 m.

Without urgent investments, there will be a shortage of turbines larger than 12 MW and the wind turbine installation vessels and monopiles needed to support them, Alex Flotre, Vice President, Offshore Wind at market analysts Rystad Energy, told Reuters Events.

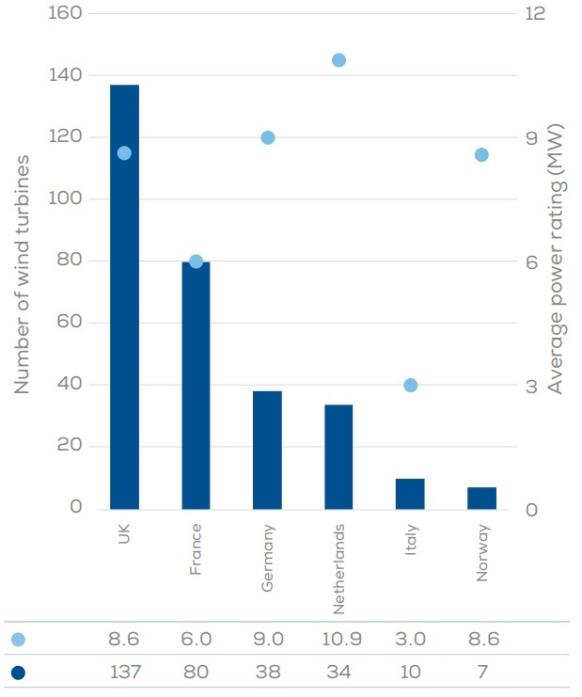

Average power rating of offshore turbines installed in 2022

Source: WindEurope

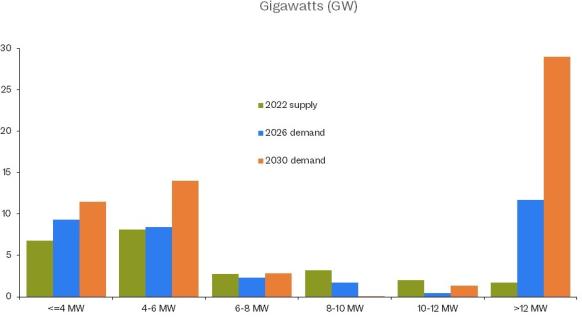

Urgent investments are required across the offshore wind value chain, market analysts at Rystad Energy said in a report in April.

To meet Europe's targets, manufacturing investment decisions for offshore turbines greater than 12 MW must be taken by 2024, alongside decisions on floating wind foundations, Rystad said. Announced expansions include Siemens Gamesa’s Hull extension that is planned to be completed this year and Vestas’ Szczecin nacelle base in Poland due to start up in 2024. In addition, blade supplier TPI Composite aims to build a new factory in Izmir, Turkey that would start producing in 2026, although the project is not definite.

By 2024-2025, investments must also be made in new wind turbine installation vessels and monopile facilities, as well as turbine tower factories, Rystad said.

European wind turbine manufacturing capacity, by size

(Click image to enlarge)

Source: Rystad Energy

Developers will need more port facilities and vessels that can handle the large components as well as greater supplies of cables, HVDC converter stations and substations, a spokesperson for German utility ENBW noted.

There is currently only one shipyard in Europe capable of building the latest generation of HVDC converter stations - Dragados in southern Spain.

Clearer outlook

To mitigate supply risks, project developers are securing supplies at an earlier stage of development by entering preferred supplier agreements prior to reaching financial closure.

The market visibility offered by Europe's targets and support programs should encourage more long-term commitments that support new factories and vessels.

In an early example, developer RWE has signed four to five year agreements with Jan de Nul to secure use of the Voltaire and Les Alizes installation vessels. Voltaire is the world's largest jack-up installation vessel and Les Alizes is a heavy lift vessel.

The agreement, announced on June 12, will help the industry scale up capacity, Flotre said.

"Many of these large-scale investments have lacked the long-term certainty, increasing the risk of these costly [vessel] fleet expansions," he said. Component suppliers face a similar challenge with factory expansions.

National governments could further aid companies by increasing the availability of acreage for offshore wind projects, Flotre said.

High demand for acreage has led to aggressive bidding for lease areas and spurred developers to bid lower for offtake contracts. This “trickles through to the supply chain and leads to low margins across the value chain,” he said.

Another option would be to limit component sizes within the industry to help standardise production and encourage expansions, Flotre said.

This could be done through targeted support for certain component sizes and would enable suppliers to "expand with increased certainty of being relevant for a longer period of time,” he said.

Reporting by Neil Ford

Editing by Robin Sayles