New York doubles offshore wind pipeline as early projects stumble; UK speeds up grid connections by years

The wind power news you need to know.

Related Articles

New York approves three more offshore wind projects

New York state has given conditional approval to three new offshore wind projects with a combined production capacity of 4 GW.

New York awarded contracts to the 1.4 GW Attentive Energy One (TotalEnergies, Rise Light & Power, and Corio Generation), the 1.3 GW Community Offshore Wind (RWE Offshore Renewables and National Grid) and the 1.3 GW Excelsior Wind project (Copenhagen Infrastructure Partners).

State officials also announced a $300 million investment to support the construction of a nacelle manufacturing and assembly plant by GE Vernova and a blade manufacturing facility by GE subsidiary LM Wind Power.

“By going big and bold, the state secured critical new supply chain investments that will help anchor the entire U.S. market, as well as bring thousands of new jobs to the Empire State,” the Oceantic Network offshore wind industry group said in a statement.

New York previously approved five other offshore wind projects with a total capacity of 4.3 GW, including the 132 MW South Fork array which is now under construction. The future of the other four projects is in question after regulators rejected an effort by developers to improve the financial terms of their power purchase agreements (PPAs). The petitioners included Orsted, which had asked for amendments to the PPA for its 880 MW Sunrise Wind project, as well as Equinor and BP, which requested modifications to the contracts for their Empire 1, Empire 2 and Beacon Wind projects with a total capacity of 3.3 GW.

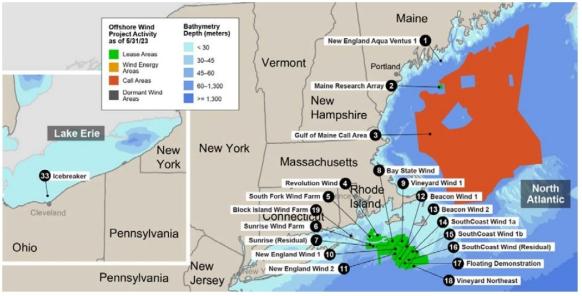

Offshore wind projects in US North Atlantic

(Click image to enlarge)

Source: Department of Energy's 2023 Offshore Wind Market Report, August 2023.

Following the regulators' verdict, New York Governor Kathy Hochul released an "action plan" to support the renewable energy industry. The plan includes an accelerated procurement process for offshore and onshore projects "to backfill any contracted projects which are terminated."

BP and Equinor said the regulators' decision will cost the companies $540 million and $300 million, respectively. But during a call with analysts in late October, Equinor CFO Torgrim Reitan said the company may still move forward with the projects if ongoing negotiations with state officials lead to an agreement that makes the planned wind farms profitable.

Orsted cancels two offshore wind projects in New Jersey

Denmark's Orsted will cease development of its offshore wind projects Ocean Wind 1 and 2 in the U.S. state of New Jersey but is pursuing the Revolution Wind and Sunrise projects in New York state.

The New Jersey projects were cancelled largely due to a shortage of installation vessels, which would have caused a “multiyear delay,” Osrted Chief Executive Mads Nipper said.

Orsted is the world's largest offshore wind developer and had invested significantly in Ocean Wind 1, the most advanced of the two projects, it said.

The cancellations, which could cost the Danish company nearly $5.6 billion, come after several offshore wind developers failed to renegotiate power purchase agreements (PPAs) for their projects following soaring inflation and interest rates.

Orsted plans to pursue Sunrise Wind in New York in part because it has already secured an installation vessel for the project, but also because the company believes it may be able to obtain additional tax credits as well as a more beneficial PPA, Nipper told analysts.

Orsted and Eversource said they would go ahead with the 704 MW Revolution project in a statement on October 31.

Rising costs have already prompted developers to terminate contracts for three offshore projects in Massachusetts and Connecticut with a total production capacity of 3.2 GW.

US approves construction of Virginia offshore wind project

U.S. regulators have approved the construction of Dominion Energy's Coastal Virginia Offshore Wind array, the fifth and largest offshore wind project authorized by the Biden administration.

The 2.6 GW project will feature 176 wind turbines, each with a production capacity of 14.7 MW.

Eight monopile foundations have already been delivered at the Portsmouth Marine Terminal and construction is scheduled to start in spring 2024, the Bureau of Ocean Energy Management (BOEM) said. Power production is slated to start in 2026.

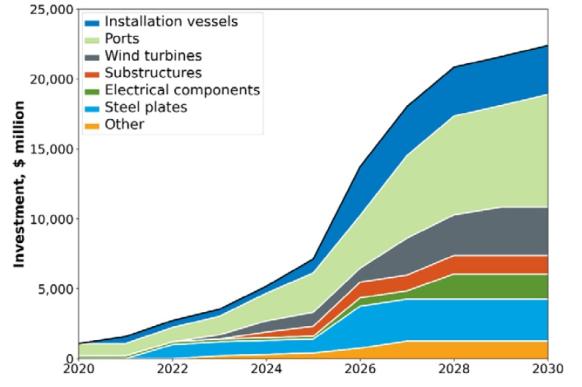

Investments needed to build a US offshore wind supply chain

(Click image to enlarge)

Source: U.S. National Renewable Energy Laboratory's Offshore wind Supply Chain Road Map, January 2023.

The U.S. has already approved four commercial-scale offshore wind projects on the Atlantic Coast as part of efforts to decarbonize electricity generation ― Vineyard Wind (Copenhagen Infrastructure Partners and Avangrid), Ocean Wind 1 (Orsted), as well as South Fork Wind and Revolution Wind (both by Orsted and Eversource).

The Biden administration aims to install 30 GW of offshore wind power by 2030 but volatile global markets have delayed projects.

Persistent inflation along with high interest rates and supply chain challenges have increased construction costs, forcing developers to cancel power purchase agreements (PPAs) for several offshore wind projects in recent months.

UK accelerates grid connections by several years

National Grid is to speed up the connection of 10 GW of battery storage on the UK transmission network by around four years and accelerate the connection of 10 GW of wind, solar and storage capacity on the distribution network, the grid operator announced on November 6.

On the transmission network, 19 battery storage projects in England and Wales will be offered connection dates four years earlier than current agreements, on average, by delaying some non-essential engineering works until after connection.

In the Midlands and South West of England and in South Wales, 10 GW of low carbon energy projects will be accelerated with some "shovel ready" projects brought forward by up to five years, National Grid said.

The UK aims to quadruple offshore wind capacity to 50 GW by 2030 and fully decarbonise its power sector by 2035, requiring huge investment in onshore and offshore infrastructure and faster deployment of energy storage.

The announcement by National Grid follows months of engagement with industry, government and UK regulator Ofgem.

The grid operator has "already been in contact with more than 200 projects interested in fast tracking their distribution connection dates in the first wave of the capacity release, with 16 expressing an interest in connecting in the next 12 months and another 180 looking to connect within two to five years," it said.

A further tranche of clean energy projects, primarily batteries or batteries coupled with wind or solar, will be offered accelerated transmission connections early next year, which could bring forward another 10 GW, National Grid said.

Greece targets 2 GW of offshore wind by 2030

Greece has set out potential areas for offshore wind development and aims to install 2 GW by 2030, Reuters reported.

The draft plan issued by the state-run Hellenic Hydrocarbons and Energy Resources Management Company (HEREMA) lists 25 areas in the Aegean, Ionian and Mediterranean seas.

The zones, which cover a total area of 1,047 square miles (2,711 square km), have an estimated minimum capacity of 12.4 GW, but most of them are only suitable for floating technology. Ten areas with a total production capacity of 4.9 GW will be available between 2025 and 2032. These include potential sites off the islands of Crete and Rhodes, in the central Aegean Sea and in the Ionian Sea. The remaining areas will be available after 2032.

The plan will likely be approved by year-end and the development areas will be demarcated next year, HEREMA said.

"The development of these projects is a national priority not only because it will contribute decisively to our energy independence, but also because it enables us to export green energy in the future," Energy and Environment Minister Theodore Skylakakis said.

More than 6 billion euros ($6.34 billion) in investments will be needed to build 2 GW of offshore wind in Greece, the Hellenic Wind Energy Association (ELETAEN) said.

Reuters Events