New York auction highlights jump in US offshore wind prices

New York used higher power prices, inflation indexes and transmission cost sharing to re-establish offshore wind growth and other East Coast states could soon follow suit.

Related Articles

On February 29, New York reallocated power contracts to Orsted's 924 MW Sunrise Wind and Equinor's 810 MW Empire Wind 1 offshore wind projects through an expedited solicitation which should preserve plans for local supply chains and boost investor sentiment.

New York adapted the terms of the auction after state regulators in October denied requests by developers to renegotiate power purchase agreements (PPAs) for Sunrise Wind and Empire Wind 1, as well as Equinor's Empire Wind 2 and Beacon projects. The PPAs were signed before inflation surged and interest rates hiked, making the projects uneconomical.

Empire Wind 1 and Sunrise Wind will earn $150.15 per megawatt hour under the new 25-year contracts, far higher than the $110.37MW/h price awarded to Sunrise Wind in 2019. The contracts are also indexed to inflation and include measures to share grid connection costs.

Orsted said Sunrise Wind can now move forward because the project was awarded a “bid price level reflecting the current component and financing costs."

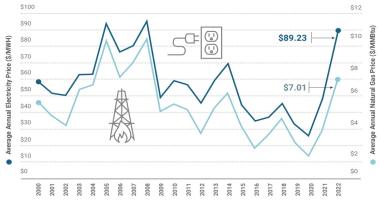

New York average wholesale electricity, gas prices

(Click image to enlarge)

Source: New York ISO

“I promised to make New York a place for the renewable energy industry to do business, and we are delivering on that promise,” New York Governor Kathy Hochul said.

New York aims to install 9 GW of offshore wind by 2035 and the speed with which the state reallocated the contracts following renegotiation requests is a "promising sign" for other projects unable to move ahead based on lower prices, Signe Sorensen, a Senior Research Analyst for the Americas at Aegir Insights, told Reuters Events.

Developers cancelled 8.9 GW of offshore wind power contracts in the U.S. Northeast last year and requested to improve financial terms for an additional 4.3 GW, according to the Oceantic Network industry group.

Many of these projects could be placed firmly back on track this year if New York's auction results are mirrored in upcoming auctions along the East Coast.

Together, the East Coast states of New York, New Jersey, Massachusetts, Connecticut, Rhode Island, and Maryland plan to tender for 16 GW of offshore wind power in 2024.

Iberdrola subsidiary Avangrid and a partnership between EDPR, Engie and oil group Shell, are among companies planning to rebid contracts.

Reality check

East Coast states sought the lowest possible prices in earlier auctions, which put projects in jeopardy when global costs rocketed, Kris Ohleth, Director of the Special Initiative on Offshore Wind, said.

States are now being more "realistic" about prices in order to meet ambitious renewable energy targets, she said.

The prices awarded by New York last month are slightly higher than the $145.07/MWh awarded to projects in a separate auction by the state in October. In January, New Jersey allocated 3.7 GW of projects and market experts said that while the terms of the contracts were different, the prices also reflected the new cost landscape.

New York and New Jersey both indexed prices to inflation in their latest auctions and Fred Zalcman, Director of the New York Offshore Wind Alliance, expects other East Coast states to follow suit.

New York's contracts also include an interconnection cost sharing mechanism under which developers pay a “symmetrical” portion of transmission costs, Zalcman noted.

This mechanism reduces the risks of transmission costs ballooning, as costs that exceed a certain threshold get "shared with ratepayers,” he said.

Offshore wind developers are looking to secure a series of projects to achieve economies of scale and the New York contract awards will “reinvigorate some supply chain investments,” Ohleth noted.

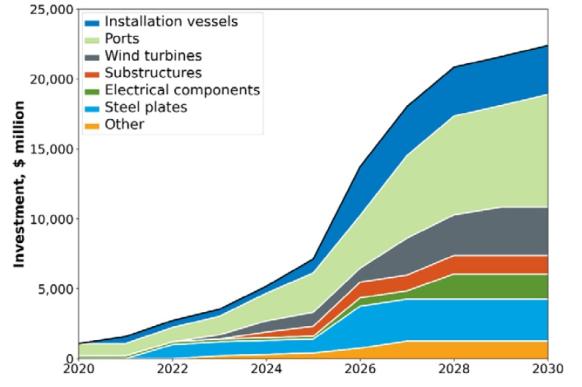

Investments needed to build a US offshore wind supply chain

(Click image to enlarge)

Source: NREL's Offshore wind Supply Chain Road Map, January 2023.

Empire Wind 1 and Sunrise Wind agreed to support the construction of the South Brooklyn Marine Terminal assembly and staging port, and to invest a total of $80 million in a facility that will manufacture components for turbine foundations, as well as $335 million in transmission and grid infrastructure, New York State Energy Research and Development Authority (NYSERDA) said.

“There is a lot at stake because these projects are tied to supply chain, port, and transmission investments. If they're scrapped, many of those developments will also be lost, and that could cause further delays for the industry,” Sorensen said.

Time to build

New York is now on a tight time schedule to bring online its largest offshore wind farms to date.

Orsted plans to make a final investment decision (FID) on Sunrise Wind in the second quarter and Equinor plans its FID for Empire Wind 1 in the third quarter.

Both projects aim to start producing power in 2026 and onshore as well as offshore transmission must be put in place before then.

In December, New York announced plans to build a 17-mile underwater transmission line to connect Empire 1 to the grid, clearing a major hurdle for the project.

The New York City grid can currently only connect up to 4 GW of offshore wind capacity and grid operator NYISO plans to conduct an open solicitation this year for additional transmission infrastructure to accommodate future projects. The transmission expansion will be an “enormous undertaking,” Zalcman warned, but he is hopeful it will be constructed in time.

RWE and National Grid also bid their Community Offshore Wind 2 project into New York’s latest auction but the mechanism was designed to reallocate troubled projects and the project was instead put on a waiting list, meaning it would be considered for “award and contract negotiation at a later date," NYSERDA said.

Community Offshore Wind was awarded a contract for 1.3 GW in New York's previous auction in November and holds a lease area with potential capacity of 3 GW.

The group is committed to developing the lease and “also standing at the ready to support NYSERDA if called upon,” Doug Perkins, President and Project Director of Community Offshore Wind, told Reuters Events.

Reporting by Eduardo Garcia

Editing by Robin Sayles