Louisiana poised to spearhead offshore wind in Gulf of Mexico

Developers are in negotiations with the state of Louisiana over nearshore projects that could be completed faster than projects in federal Gulf of Mexico waters.

Related Articles

In May, the U.S. Bureau of Ocean Energy Management (BOEM) found no significant environmental impact from offshore wind leasing in the Gulf of Mexico, paving the way for development in Louisiana and Texas.

The BOEM's environmental assessment applies to a 30 million-acre call area and in February the bureau identified three zones for the first lease sales. BOEM identified a 102,480-acre area offshore Lake Charles, Louisiana and two potential areas offshore Galveston, Texas, one comprising 102,480 acres and the other comprising 96,786 acres.

The first lease sale could come later this year but the first turbines could in fact be installed in Louisiana state waters.

Louisiana aims to install 5 GW of offshore wind by 2035 and the state's Department of Natural Resources (DNR) is in talks with two offshore wind developers for projects in state waters, DNR confirmed to Reuters Events.

Diamond Offshore Wind, a subsidiary of Mitsubishi Corporation, is in power agreement talks for a project off the coast of Jefferson and Lafourche parishes while Kontiki Winds, owned by Norwegian developer Havram, is negotiating a project offshore Cameron and Vermillion parishes. Other developers have also expressed an interest, according to media reports.

The governor's office says there is less opposition to wind turbines in Louisiana waters than in other states as the nearshore is already occupied by oil and gas installations.

Turbines will need to be adapted for local conditions but the state water projects could progress faster than in federal zones as they face less regulations and their proximity to shore would help minimise transmission costs.

The Louisiana projects would be the first wind arrays in state waters since Orsted installed the Block Island pilot project in Rhode Island in 2016.

Platform for growth

The large area assessed in BOEM's environmental report suggests more areas will be designated in the Gulf of Mexico. Developers and suppliers will be keen to establish a pipeline of projects that generates revenues for years to come.

“Based on the interest we’re seeing and input from stakeholders and meetings we’ve had, we’ve even considered maybe we should start talking about a second bidding sale,” James Kendall, director of the BOEM Gulf of Mexico Regional Office, told Reuters Events.

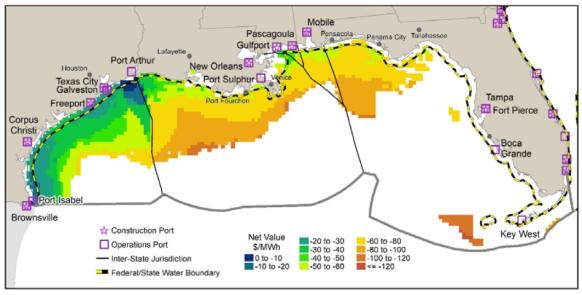

Forecast net value of offshore wind in Gulf of Mexico in 2030

(Click image to enlarge)

Note: net value refers to estimated revenue minus the levelised cost.

Source: NREL report 'Offshore Wind in the US Gulf of Mexico: Regional Economic Modeling and Site Specific Analyses,' May 2020.

Developers in the Gulf of Mexico can benefit from the infrastructure and expertise of the region's oil and gas industry. Access to vessels, ports and assembly facilities is key to minimising costs.

Gulf of Mexico assets, such as shipbuilding capabilities, are already being used to launch offshore wind on the East Coast, says Hayes Framme, head of New Markets and Supply Chain at Orsted. The Danish group is the world's largest offshore wind developer by capacity and has identified the U.S. as a key growth market.

“The opportunity is there, the historic expertise that [the Gulf of Mexico] has with oil and gas is valuable," Framme said.

"When you think about the things that we need in order to effectively and cost-effectively and efficiently deploy projects in the Northeast and Mid-Atlantic, we've already brought to bear some of that [Gulf of Mexico] experience," he said.

Louisiana is seeking to build out its supply chain and play a key role in national offshore wind deployment, Harry Vorhoff, deputy director of the Louisiana Governor’s Office of Coastal Activities, told Reuters Events.

“We see really a kind of two-pronged strategy being deployed, playing a big role in the supply chain around the country but also looking to develop in the Gulf of Mexico as well,” Vorhoff said.

"The Gulf of Mexico is well positioned to be a leader in renewable energy, with all the talent, expertise, and infrastructure that’s available,” Kendall said.

Adapted turbines

Developers will however face particular challenges in the Gulf of Mexico that impact financing, installation and insurance.

Lower wind speeds than on the East Coast will require the development of new turbine specifications, potentially of capacities 18 MW or 20 MW, double the capacity of most turbines in operation and more powerful than the towering 15 MW models that will be deployed in the next few years. Turbines must also be able to withstand hurricanes while foundations and structures must be adapted to the softer soils found in the Gulf of Mexico. Projects must also take into account dense bird migration paths.

Hurricane debris could pose challenges near the shore and abandoned oil and gas infrastructure and pipelines could complicate installation.

“There’s a lot of destructive power in the water near the shore…So the developers will need to be extremely careful to assess where objects are in the seabed before they go out and start doing construction and cable installation,” said Cheryl Stahl, principal project manager at consultancy DNV.

Most of the challenges can be overcome “with money and will,” she noted.

The technological innovation needed in the region will “create new market opportunities,” Framme said.

Work is already underway to optimise technology. In one example, New Orleans company Gulf Wind Technology (GWT) was created to develop turbines resilient to local conditions and has recently partnered with oil and gas group Shell to create a research and technology hub in Jefferson parish.

East Coast learnings

Developers in the Gulf of Mexico could benefit from cost savings and learnings from installing East Coast offshore wind projects in the coming years.

Varhoff predicts a "second mover advantage where some of the supply chains are firmed up as projects get underway and completed on the East Coast.”

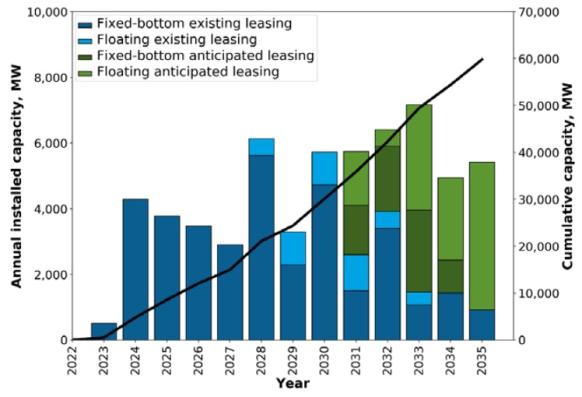

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

Rampant global inflation has been a significant challenge for East Coast developers, prompting project revaluations and delays. In June, several offshore wind farm developers in New York requested contract adjustments to address escalating costs. These costs were driven by inflation, pandemic-induced supply chain disruptions, and increased renewable energy demand after Russia's invasion of Ukraine.

Access to local companies and infrastructure may provide some protection for Gulf of Mexico projects, but they will still need to access global markets. Developers and state legislators will have to find a solution that minimises cost risks.

To prevent a bidding war, BOEM has proposed bid credits for supply chain development in its Gulf of Mexico lease sale.

“There's not many ways that we can actually have an active role in business decisions with the developer, but by introducing bid credits to help develop the supply chain...That’s a way we're trying to help them with costs,” said Laura Robbins, BOEM’s deputy regional director for the Gulf of Mexico.

Reporting by Juliana Ennes

Editing by Robin Sayles