Grid failings threaten US climate goals; Maine approves law for 3 GW floating wind

The wind power news you need to know.

Related Articles

Lack of grid build endangering US climate targets

A lack of transmission build could seriously jeopardise President Joe Biden’s efforts to hike renewable energy capacity and decarbonise the power sector, according to a report by the Princeton University-led REPEAT Project.

The U.S. needs to expand its transmission capacity twice as fast as during the 2004-2016 period to achieve its climate goals, the study found.

Wind and solar projects currently take several years to gain grid connections as transmission operators work through a backlog of projects.

Capacity in US grid connection queues (end of 2022)

(Click image to enlarge)

Source: Berkeley Lab, April 2023

Most of the new transmission will be needed to connect wind farms because urban areas tend to be farther from the best wind resources, the report notes.

“If new transmission capacity cannot be added at a faster pace, growth of wind and solar power will be substantially constrained” and dozens of coal-fired power plants will need to continue operating and hundreds of new natural gas power plants will need to be built, the study said.

The U.S. must also accelerate interregional grid capacity and renewable energy developers have called for more forward planning of bulk transmission build in areas of high wind and solar resources.

The REPEAT team estimates that, under current policies, the average annual rate of onshore wind additions will reach 39 GW to 43 GW per year from 2023-2030, nearly triple the peak of 15 GW in 2020. Solar additions are forecast to reach between 44 GW and 51 GW per year from 2023-2030, more than double the 19 GW installed in 2021.

By 2035, consumption of petroleum-based fuels is forecast to decline by 15%-25% while natural gas consumption is forecast to fall by one-third.

Electricity demand is expected to increase by 38%-49% between 2022 and 2035 due to the increased adoption of electric vehicles, heat pumps, industrial electric boilers, and hydrogen electrolysis, the report says.

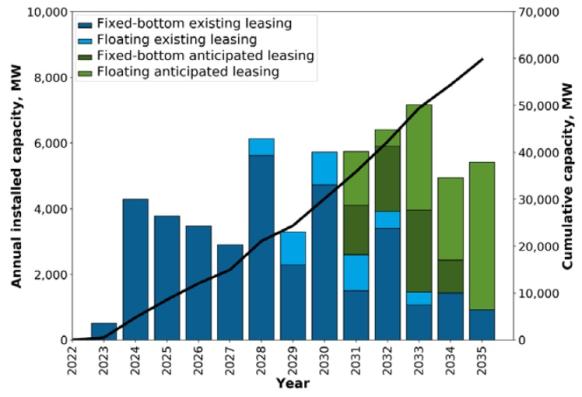

Maine approves law to support 3 GW of floating wind

Maine Governor Janet Mills has enacted legislation to support the procurement of 3 GW of offshore wind energy by 2040 and the construction of a deepwater offshore wind port to assemble turbines.

Mills vetoed an earlier version of the bill in late June, saying it would have put local non-unionised workers at a disadvantage. Following negotiations, the proposed legislation was amended to require offshore wind developers to prioritise workers based in Maine.

“I thank the legislators and stakeholders who, through collaboration and compromise, have positioned Maine to pursue offshore wind in a manner that puts all Maine workers and businesses on a level playing field, invites investments in critical port infrastructure, and importantly, respects those who rely on the ocean for their livelihoods,” Mills said in a statement.

The Gulf of Maine hosts 156 GW of potential offshore wind capacity but most of this is floating wind as the waters are too deep for fixed-bottom technology. The federal Bureau of Ocean Energy Management (BOEM) plans to hold the first commercial lease sale in Maine in 2024.

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

Maine’s legislation requires the state Public Utilities Commission to issue its first request for contract proposals by January 2026 and says that future solicitations will each seek at least 600 MW of offshore wind energy. Maine officials expect to determine a preferred location for the offshore wind port this year.

Aqua Ventus, a partnership between Mitsubishi subsidiary Diamond Offshore Wind and German energy group RWE, plans to start construction of the country’s first floating offshore wind project in a research area off the coast of Maine next year.

The new legislation will allow Maine to advance the development of offshore wind technology in the U.S., the Business Network of Offshore Wind said in a statement.

“We encourage Maine to work closely with neighboring states to develop the robust supply chain and port infrastructure necessary for these projects,” it said.

Vattenfall halts British Norfolk Boreas offshore wind project

Vattenfall has halted the development of its 1.4 GW Norfolk Boreas offshore wind project off the east coast of England due to rising costs and supply chain delays.

A growing number of offshore wind developers are halting projects or looking to renegotiate contracts in response to global inflation and high interest rates since the COVID-19 pandemic and Russia's invasion of Ukraine.

Vattenfall said that the entire wind industry has seen costs increase by 40% while contract terms have remained the same, which is making some projects unsustainable. The utility expects to incur a loss of 5.5 billion Swedish crowns ($537 million) due to the decision.

The UK awarded Vattenfall a contract-for-difference (CfD) for Norfolk Boreas in an auction last year, guaranteeing a minimum price of 37.35 pounds/MWh in 2012 prices for the electricity produced, equivalent to around 45 pounds/MWh today.

The Swedish company will also “examine the best way forward” for its entire Norfolk Zone lease area, on which it is developing the Norfolk Boreas, Vanguard East and West projects for a total planned capacity of 4.2 GW.

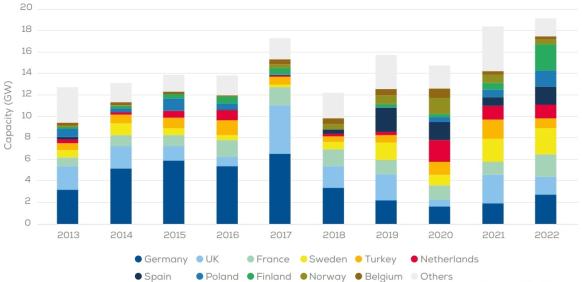

Germany installs 1.8 GW of wind capacity in H1

Germany installed nearly 1.8 GW of wind energy in the first half of 2023, according to figures released by the German Wind Energy Association (BWE).

The new installations include 331 onshore wind turbines with a total capacity of 1.6 GW, which represents approximately 65% of wind capacity added in full-year 2022 and puts the country on track to adding 2.7 GW-3.2 GW this year, the upper range of BWE’s forecast.

Germany’s total installed onshore wind capacity reached 59.4 GW at the end of June, a 4.4% net increase from a year earlier, after accounting for the dismantling and revamps of existing turbines.

Offshore wind developers installed 24 turbines for a capacity of 229 MW in January-June, BWE said, raising total offshore capacity to 8.4 GW.

Annual wind installations in Europe by country

(Click image to enlarge)

Source: WindEurope

Oil and gas groups BP and TotalEnergies were the only winners of a 7 GW offshore wind auction in Germany in early July. The contracts do not include any government subsidies and the winners were chosen following a second round of uncapped negative bidding on the basis of price only.

In a statement, BWE and several other wind industry associations criticised the auction rules, saying that the negative bidding process left “too little scope" for earnings in manufacturing.

Following market feedback, Germany plans to tender a further 1.8 GW of offshore wind this summer under a different bidding process that will include qualitative criteria, as well as two more onshore wind tenders with a capacity of 3.2 GW each, industry association WindEurope noted.

Reuters Events