EU turbine factory growth hangs on permitting action

Embattled turbine suppliers welcome EU financing aid but await effective measures to accelerate permitting and raise auction volumes before investing in new factories.

Related Articles

The EU Wind Power Action Plan approved in October aims to prop up the European wind supply chain after rising costs and a slowdown in deployment sliced the profits of the region's largest turbine makers.

The EU plans to boost financial support for wind turbine manufacturers and shorten permitting times for wind farms through swifter implementation of new rules. It will also adapt power auction rules to favour local content.

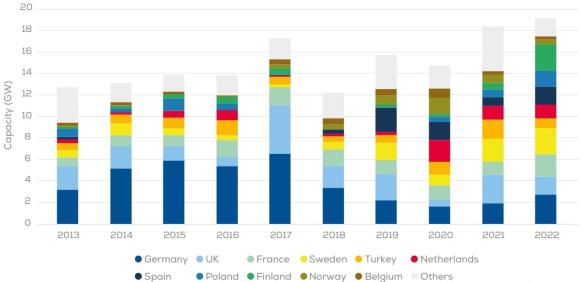

EU wind installations must increase rapidly to meet the bloc's renewable energy objectives but the EU's largest turbine suppliers Vestas, Siemens Gamesa, Nordex, and Enercon are holding back investments in new capacity. The EU installed 16 GW of wind in 2022 and must install 37 GW per year to hit its target of 500 GW by 2030.

The action plan allows turbine suppliers to tap into EU financing that was previously earmarked for innovation and research and calls on the European Investment Bank to offer de-risking guarantees.

These measures "will significantly reduce financing costs for the original equipment manufacturers (OEMs) and would allow the wind industry to allocate financial resources to increase their capacity,” said Jon Lezamiz Cortazar, Head of Advocacy at Siemens Energy, the owner of Siemens Gamesa.

More importantly, turbine suppliers will need a clearer deployment pipeline to commit to new investments. Around 80 GW of EU wind projects are stuck in permitting queues and several wind power auctions have failed to attract developers due to rising costs.

To meet EU wind targets and give turbine suppliers the "possibility to become profitable," governments must solve the permitting delays, Lezamiz said.

Analysts at Rystad Energy expect an 11% drop in EU wind installations this year but may improve their forecast going forward if countries take “concrete steps” to clear up permitting backlogs.

The EU will issue more detailed guidelines early next year and OEMs don’t expect to see substantial financial benefits until 2025 or 2026 and are unlikely to announce infrastructure investments until much of the permitting backlog is cleared.

Manufacturers are expected to invest more in offshore wind turbines than in onshore wind components, to address current supply gaps and respond to growing global demand, industry sources told Reuters Events.

Pathway to growth

Without manufacturing expansions, the EU will face a “moderate bottleneck” for large onshore wind turbines of capacity 4 MW to 6 MW there could be "significant undersupply" of the largest offshore wind turbines of over 12 GW, analysts at Rystad Energy said in a report published in April.

Developers may need to "diversify their demand a bit more toward smaller turbines,” Rystad Energy analyst Victor Signes told Reuters Events.

Faster permitting and more effective capacity auctions will be key to securing new manufacturing capacity. Between 2020 and 2022, the vast majority of the wind tenders in the EU went undersubscribed due to a combination of permitting challenges, inflationary pressures and supply chain disruptions.

Germany saw a sharp fall in annual installations but a recent increase in guaranteed onshore wind prices and measures to reduce permitting challenges have led to an increase in activity this year.

Annual wind installations in Europe by country

(Click image to enlarge)

Source: WindEurope

OEMs are unlikely to invest in new facilities unless they have clear visibility that there will be a market for their turbines, Endri Lico, a Global Wind Technology and Supply Chain analyst at Wood Mackenzie, said.

“The solution will require a massive ramp up in the volume of auctions with significantly elevated strike prices, as well as new manufacturing facilities,” Lico said.

To accelerate the permitting of renewable energy projects, the EU's wind action package aims to accelerate the implementation of rules in the 2022 REPowerEU package that require permits for renewable energy projects to be granted within two years. The EU will help digitalise national permitting processes and financially support the training of national permitting authorities, it said.

Even with the right financing conditions, it will take time for manufacturers to find locations and obtain permits for new factories.

The EC said it is keen to "accelerate permitting for setting up manufacturing facilities" but has not set out specific support in its action plan and member states may opt to accelerate permitting of specific facilities.

Buying local

The EU is planning to support domestic suppliers in new auction rules. The EU has already loosened state aid rules to allow members to provide financing support for clean technology and OEMs want the EU to introduce non-price criteria in future auctions in a bid to fend off Chinese rivals. Western OEMs have a stronghold in Europe but Chinese suppliers have made inroads in adjacent markets, such as Turkey and the Balkans, stakeholders said.

EU OEMs are increasing prices after posting losses last year “and I think that developers are okay with that because they see that they will be able to secure higher bidding prices next year," Signes said.

EU member states have started to index auction prices to inflation following feedback from the industry. Siemens Gamesa wants the EUs' new auction guidelines, expected by the end of March, to also include requirements on cybersecurity and global environmental and labor standards.

Bidders should also be granted “points” if they support the resiliency of the European supply chain, are more sustainable because they use green steel or recyclable blades, or include a storage element that would benefit the grid, Lezamiz said.

The finer details of the EU's auction rules will need to be discussed by the European Parliament, the Council of the European Union and the European Commission and then has to be “absorbed” by member states that will need to turn the plan into concrete legislation, Lico said.

Germany’s ABO Wind only sources EU turbines as "Chinese manufacturers have lacked the acceptance of banks and investors” but the company hopes that domestic producers will remain competitive.

“It would be very unfortunate if wind power were to develop in a similar way to [solar PV]. More than 90% of [solar] module production takes place in China," said Alexander Koffka, a communications manager for ABO Wind.

Reporting by Eduardo Garcia

Editing by Robin Sayles