Cost crunch prompts mass rethink of US offshore wind contracts

Squeezed by rising global supply costs, offshore wind developers are seeking new power contract terms on at least ten East Coast projects in a further blow to President Biden's climate targets.

Related Articles

Last month, Orsted said it may report U.S. impairments of 16 billion Danish crowns ($2.3 billion) due to supply chain problems, soaring interest rates and a lack of additional tax credits impacting several offshore wind projects.

Orsted, the world's largest offshore wind developer by capacity, had already warned of potential delays to U.S. offshore wind projects as it reconfigures projects to mitigate rising global costs and adapt to grid connection reforms.

The company may delay its 1.1 GW Ocean Wind 2 project in New Jersey and its 1 GW Skipjack project in Maryland.

“We’re working through external challenges, including comprehensive reforms to the interconnection review process and unprecedented macroeconomic challenges, which may cause a shift in timing. We are reconfiguring these projects to minimize the impact," a company spokesperson told Reuters Events in July.

Offshore wind developers have faced rising costs and interest rates since the COVID-19 pandemic that have sliced profit margins in agreed power contracts. Delivery delays are hampering some projects and a lack of transmission investment along with reforms by grid operator PJM to clear a bottleneck in the country’s largest power network are slowing grid approvals.

Tax incentives in the Biden administration's Inflation Reduction Act will help the nascent U.S. offshore wind sector build out a domestic supply chain but developers of the first projects are exposed to global supply risks and offshore wind activity is on the rise in Europe.

Last month, Orsted said two suppliers are experiencing “challenges” that are delaying the delivery of foundations for three of its projects on the U.S. East Coast.

Orsted is in talks with federal officials to qualify for additional investment tax credits (ITCs) above the 30% baseline provided in the inflation act but the company conceded that the discussions “are not progressing as we previously expected.”

The group is seeking to gain additional 10% tax credits available for domestic content and for projects that benefit former fossil fuel communities. Orsted aims to “qualify for at least 40% ITCs on all projects” and will continue to develop its three “near-term” U.S. offshore wind projects (Sunrise Wind, Revolution Wind 1 and Ocean Wind 1) and make a final investment decision on these in late 2023 or early 2024, it said.

Orsted has already sought to control costs and increase the profitability of other U.S. projects.

The state of New Jersey recently approved Orsted's request to secure tax credits from the inflation act for its 1.1 GW Ocean Wind 1 project and the Danish group has also asked the New York State Public Service Commission to amend the power purchase agreement (PPA) for its 880 MW Sunrise Wind project. The company cited “unanticipated, extraordinary economic events” including rampant inflation and disruptions in the wind supply chain exacerbated by the COVID-19 pandemic and Russia’s invasion of Ukraine. It expects a reply by October or November.

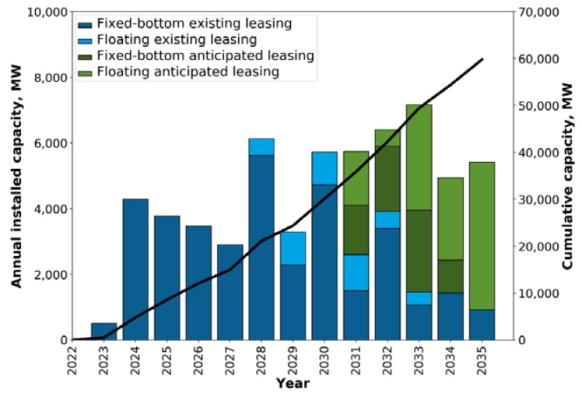

Forecast U.S. offshore wind installations

(Click image to enlarge)

Source: Department of Energy report on U.S. offshore wind supply chain, June 2022

In July, Rhode Island Energy said it had decided not to negotiate a PPA with Orsted and Eversource for the 884 MW Revolution Wind 2 offshore project, saying that the prices sought by the companies were too high.

“Higher interest rates, increased costs of capital and supply chain expenses, as well as the uncertainty of federal tax credits, all likely contributed to higher proposed contract costs,” Rhode Island Energy said in a statement.

Several other developers including Equinor, Shell, EDPR, Engie and Iberdrola's Avangrid have asked for new contract terms on East Coast offshore wind projects.

In all, developers are seeking new terms on at least 10 projects in renegotiations that will further endanger President Biden's goal of 30 GW offshore wind by 2030.

Margin squeeze

For years, wind developers sought lower costs to secure projects in the fast-growing offshore wind market. Even before the pandemic, participants questioned whether offtake prices in Europe could fall much lower.

The rising cost of commodities and components since the pandemic has changed the cost landscape, pushing up the prices of wind and solar PPAs and hiking wholesale power prices to new levels. At the end of 2022, steel prices in North America and Northern Europe remained 52% and 69% above January 2019 prices, American Clean Power (ACP) association said in a report.

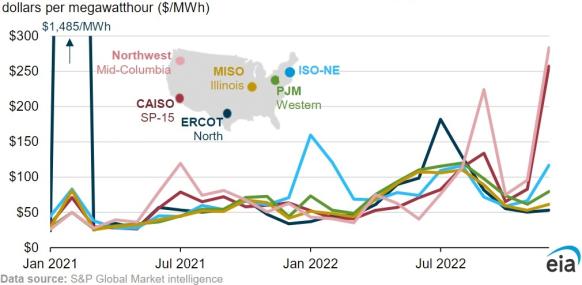

U.S. monthly average wholesale power prices

(Click image to enlarge)

Source: Energy Information Administration (EIA), S&P Global Market intelligence

In July, Avangrid agreed to pay $48 million to terminate PPAs with three Massachusetts utilities that had agreed to buy electricity from the company’s 1.2 GW Commonwealth Wind project. An Avangrid spokesperson told Reuters Events that the company is also involved in negotiations with stakeholders regarding the PPAs for the 800 MW Park City Wind in Connecticut.

Last year, Avangrid warned rising component costs and interest rates had made Commonwealth Wind economically unviable.

Meanwhile, Equinor has asked New York state authorities to make changes to PPAs for its Empire 1, Empire 2, and Beacon Wind projects of total capacity 3.3 GW.

Equinor has asked for a mechanism that adjusts the price according to inflation, an approach

New York authorities took in the most recent offshore wind auction.

In New England, SouthCoast Wind, a 50/50 joint venture between Shell and EDPR and Engie's Ocean Winds North America, terminated its PPAs with Massachusetts.

The project is located in Rhode Island and SouthCoast Wind CEO Francis Slingsby told regulators in June that the PPAs were "low-priced, have no indexation and thus offer no way to overcome the significant and unforeseen economic challenges.”

The company will rebid for those PPAs and continue to advance the 2.4 GW project, it said.

Ongoing contract negotiations between developers, utilities and regulators will lead to project delays and supply chain disruptions, the Business Network for Offshore Wind said in a recent report.

Local factories

The global cost challenges faced by developers increases the importance of a domestic U.S. offshore wind supply chain.

Around 2,100 turbines and foundations, 6,800 miles of cable, 58 crew transfer vessels and four to six turbine installation vessels are required to meet President Biden's 2030 offshore wind target, the National Renewable Energy Laboratory (NREL) said.

The 10% tax credit for domestic content aims to accelerate factory build and many states are requiring developers to make commitments to regional supply chain development in power agreements.

A number of new manufacturing facilities and vessels are now planned but major port expansions will be required to assemble and launch large turbine structures and it will take time to build out a comprehensive regional supply chain.

A lack of wind turbine installation vessels remains a significant issue for developers and NREL has warned some components will require significant efforts to supply domestically, including steel plates to be rolled into monopiles or towers, mooring chains and electrical systems for offshore substations.

The U.S. has laid the foundations for a strong offshore wind industry thanks to federal incentives, efforts to accelerate permitting and strong state demand for offshore wind, Sam Salustro, vice president of communications at the Business Network for Offshore Wind told Reuters Events.

In the short term, states and developers will need to be flexible to ensure projects move forward.

"Weathering this current storm and ensuring future economic turmoil do not roil the industry again requires smart policies and procurements out of states and a robust, domestic supply chain to help keep our projects on track,” Salustro said.

Reporting by Eduardo Garcia

Editing by Robin Sayles